You are here

Edits Tab

Parts of the Edits Tab

Print Controls On Receipts |

|||

| Print receipts for this Campaign | Allows receipts to be printed for this campaign and you may (optionally) set a minimum donation mount if desired for receipt printing.

You can choose the conditions under which you want to print tax receipts in Canada. |

||

| Email Receipt for Online Donor |

If checked and the patron donates online, a single one receipt per payment style donation receipt will be created and attached to the patron's web confirmation.

You will be warned if your company preference setup contains no: The above images should be in place to so that the tax receipt looks complete (and in Canada, contains all the required information for tax receipts).This option is not available:

|

||

| If Over A certain Amount | If an amount is entered, then any single donation that is under the specified amount will never get a tax receipt printed in the batch printing or automatic emailing of receipts.

Note: Receipts are generated for each payment towards a donation. As long as the donation is over the threshold for receipting, each payment gets a receipt. If you are expecting multiple payments, you may want to consider selecting Annual Statement Style receipts when entering the donation - to minimize any administrative burden. For example: A donation might be $100 (and entitled to a receipt). if the patron pays with post dated payments for $10.00 each, monthly, each payment will get a receipt (i.e. 10 receipts, regardless if the receipt is under the threshold). Printing the Annual Statement Receipt might be one way to reduce receipting effort if the payments are small and donations are large. |

||

| Default Tax Receipt Options |

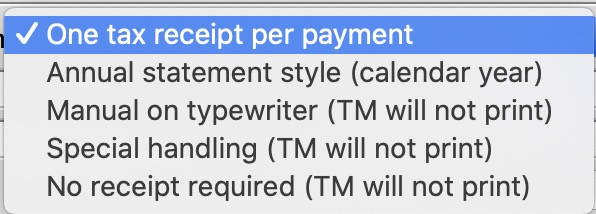

Theatre Manager has a number of tax receipt options that you can set for each donation.

Theatre Manager has a number of tax receipt options that you can set for each donation.

You can set the default for the campaign, which will be copied to each new donation when the donation is created. |

||

Suggested Donations Online |

|

| Suggested Amounts | You can enter a list of suggested donation amounts - and if you do, then the online donation module will have buttons that let the patron quickly pick that amount as a donation - without having to enter information. The patron will always have the ability to enter a custom amount.

If you have no suggested amounts, then the patron will be required to type in a value for the donation. If you drag some of the giving levels to this list, Theatre Manager will take the minimum value in the range for that giving level and add it to the list. You might want to take most popular ranges and drag onto this field for quick entry. |

Giving Level Matrix |

|

| Giving Level | The giving level matrix that will be used for the campaign. For information on setting up a Giving Level Matrix for use here, click here. |

|

Opens the Giving Level (inserting) window, allowing you to add more levels to the campaign. Click here for more information on adding levels. |

|

Opens the Giving Level window, allowing you to edit the selected Giving Level. Click here for more information on editing levels. |

|

Allows you to delete the selected Giving Level. Click here for more information on deleting a level. |