You are here

Donation Tax Receipt Options

|

Please read carefully about Revenue Canada's Policies on issuing tax receipts. The CRA web site mentions:

Theatre Manager modelled the contents of receipts after the requirements/samples on Revenue Canada's Web Site.. The US has fewer, although somewhat similar requirements as mentioned in publication 1771 |

|

Read how to batch print receipts that have not been printed. |

|

Please note: receipts are issued for each payment made towards the donation. Receipts are not issued for the donation.

The reason is that donations are only an indication of what the patron intends to give and payments are what they actually gave. A receipt cannot be issued until the payment is made and each payment is given its own receipt number and date. |

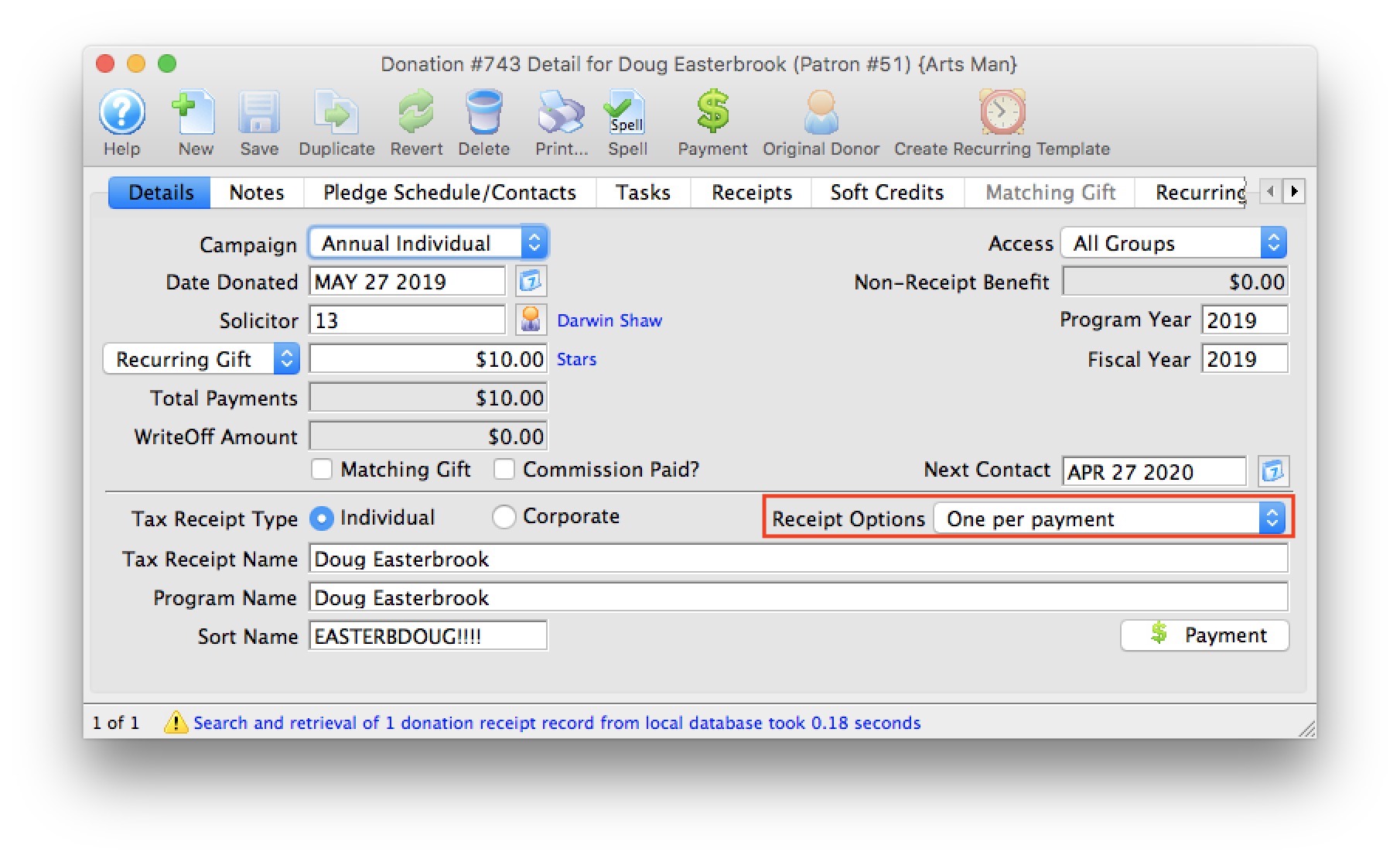

Tax Receipt Options

Theatre Manager has a number of tax receipt options that you can set for each donation. In addition there is a setting for each campaign on the edits tab that can be used to only print donations above a certain amount.

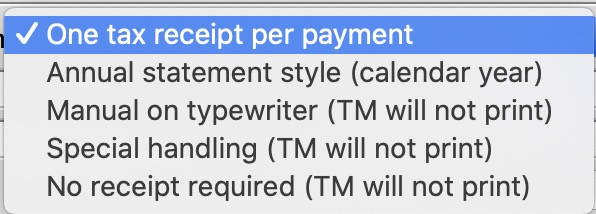

Receipt Options Types Printed by Theatre Manager

- One tax receipt per Payment - is the default. Each payment is issued a separate tax receipt when the payment is received. If there are 10 payments, you will create 10 receipts at when each payment is entered.

- Annual Statement Style (calendar Year) - will print a one page tax receipt for the patron listing all donations in the calendar year marked as using this style of receipt. If a receipt was previously printed, it is so indicated on the statement.

Receipt Options to be handled Manually

- Manual On typewriter - are used when the donation and payments are complex enough and the only way to observe various government regulations is to simply type one up in a word document or on an old fashioned typewriter. Theatre Manager ill not print any receipts for this donation. Once finished the donation receipt, you may want to import a PDF of the document into a task to record what was sent.

- Special Handling - are also used for complex receipting requirements. We suggesting that this be used if you create a form letter for this purpose

- No Receipt Required - there are cases when you should not print a receipt for a donation even if a receipt is normally created for the campaign. Use this option when the true donor cannot be identified, or if the entire donation receives benefit.

If you cannot ascertain the true donor of a gift, select No Receipt Required to comply with Revenue Canada regulations.

Which receipt type to use?

-

One per payment receipts are best suited for:

- Larger donations paid with one or two payments

- When the customer wants a receipt after a payment

- if you want to strictly follow Canada's governmental reporting requirements and use facsimile signatures and/or are using preprinted forms

-

Annual Style receipts are best suited for:

- Donations with many payments or post dated payments

- recurring donations that never end.

- If the client wants for one receipt for all donations in the year

-

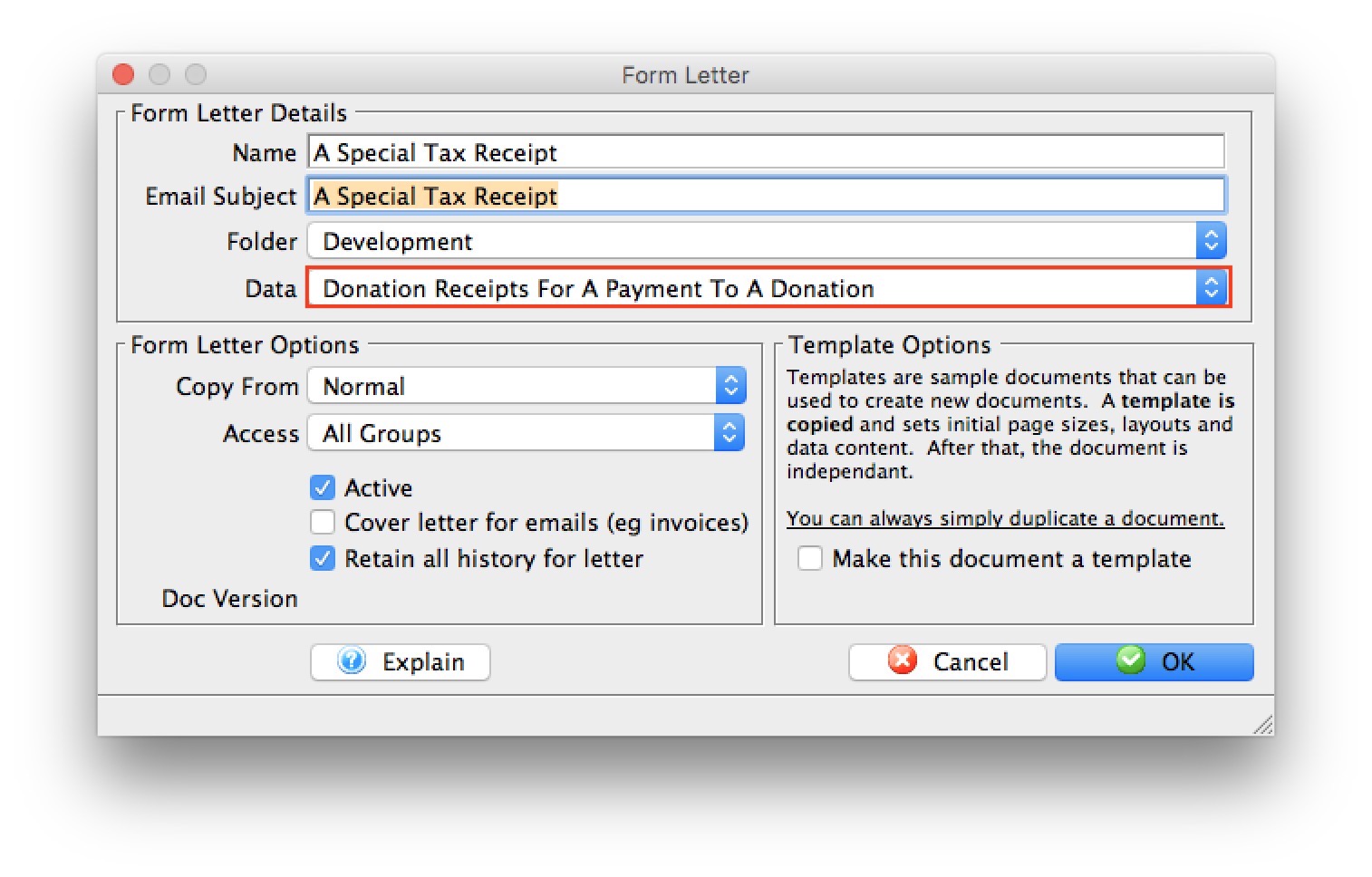

Form letters can be used to print receipts if the options provided or the situation warrants something custom to be created.

To use form letter receipts:

To use form letter receipts:

- Mark the receipt type as Special Handling so that TM will not attempt to print one for each payment

- Make sure to mark your receipts printed manually on the receipt tab - which will generate a receipt number in Theatre Manager

- Create a standard form letter (based on donation receipts file as per the image to the right) and place a table in the form letter containing the receipt data you want to show that also includes the receipt number.

Diataxis: