You are here

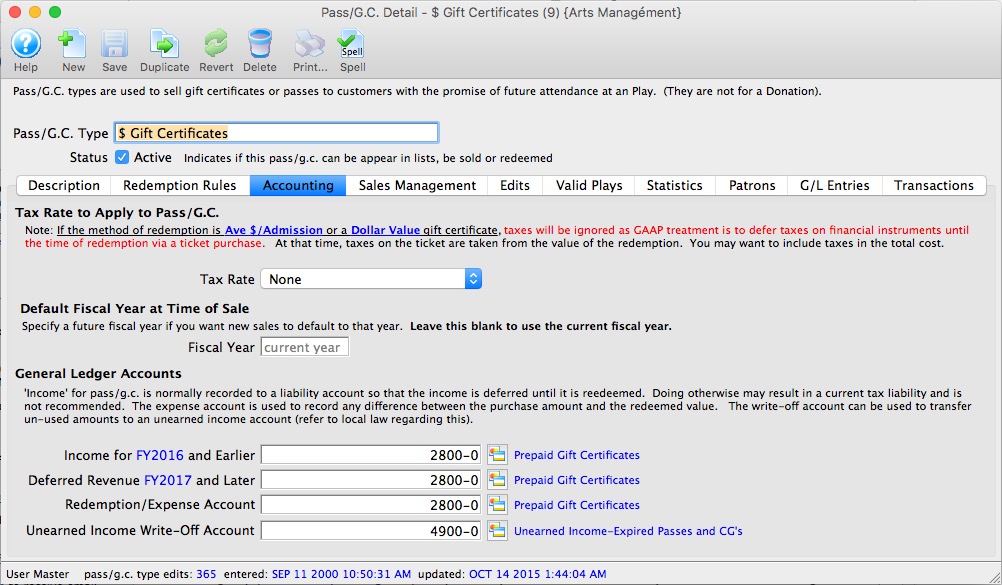

Accounting Tab

The Accounting tab determines where the funds go to during a sale, and are drawn from during the redemption.

|

If the method of redemption is Average $/Admission or Dollar Value Gift Certificate. taxes will be ignored as GAAP treatment is to defer taxes on financial instruments until the time of redemption via a ticket purchase. At that time, taxes on the ticket are taken from the value of the redemption. You may want to include taxes in the total cost. |

Parts of the Accounting Tab

Tax Rate to Apply |

|

| Tax Rate | A drop down to select the tax rate applied to this membership. If there is no tax rate for this membership, then select "None." |

Default Fiscal Year |

|

| Fiscal Year | Normally, passes and gift certificates are sold for the fiscal year that you are currently in. If this is the case, leave this field blank.

However, sometimes there is a time where you are selling passes now for a future fiscal year. If that is true, enter the future fiscal year that the pass is for (normally the next year). When selling the pass, TM will use the default fiscal year for the pass, or the current fiscal year of the venue, whichever is greater. This prevents defaulting to a prior fiscal year. |

General Ledger Accounts |

|

| Income for FY20xx and Earlier | For many membership types (Free Admission, Dollar Value, Average Dollar Per Admission), the income account is normally a liability account. As the membership is sold, the liability goes up. As the membership is redeemed, the liability goes down. |

| Deferred Revenue FY20xx and Later | If the usable redemption period of a membership or gift certificate falls within the upcoming year, rather than the current fiscal period, you may want to consider deferring the revenue in a liability account. During data entry of the pas/G.C., you will need to specify the future fiscal year. If you do this, then revenue will be rolled over into the current year during year end rollover. |

| Benefit Expense Account | If there is a difference between:

For example, if you have a holiday Gift Certificate promotion where if you buy a Gift Certificate for $100, but receive a redeemable value of $110, you will want to attribute the $10 expense to the marketing GL line. Use of this membership benefit amount ties back to the Redeemable Amount on the Type tab. |

| Unearned Income Write-Off Account | If the membership expires (as set in the Edits tab), then any unearned income will be moved to the GL account indicated here when the pass is manually written off. |