You are here

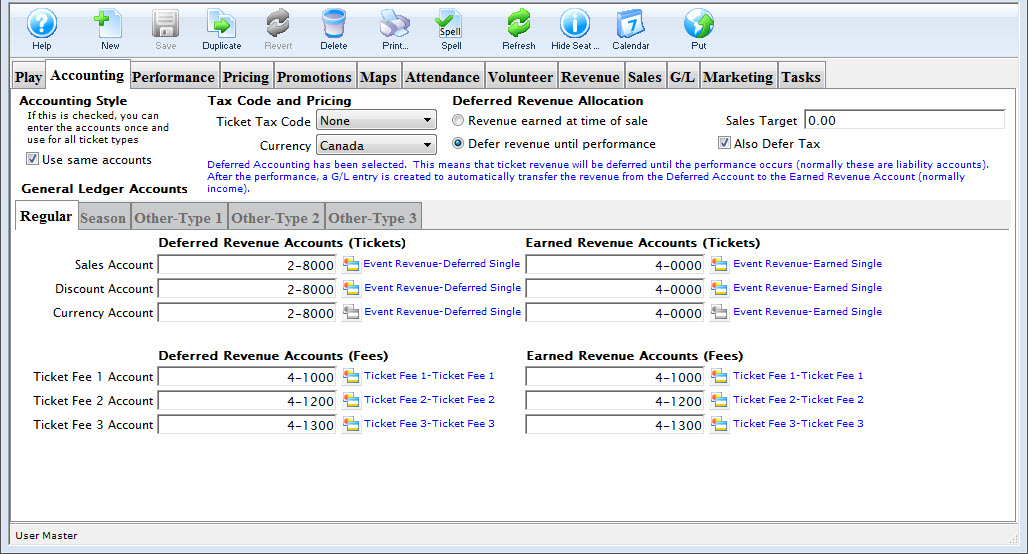

Accounting Tab

Taxes to Apply to Tickets

Select the tax rate to apply to the BASE PRICE OF THE TICKET ONLY. This will apply up to three taxes to the event. If there are taxes on the various fees in the promotion, then they are set in the sales promotion Calculation Tab.

Deferred Revenue

In general, deferred revenue results when payment for goods and services (tickets to an event) is received in advance of the goods (the event). Deferred Revenue is a Liability until the event has passed. Theatre Manager then transfers the revenue from the liability account to the earned revenue accounts. Checking the box beside Use Deferred Revenue will define this event as a deferred revenue event. You will be required to insert the necessary set of General Ledger Liability Accounts for recording the deferred revenue. Refer to the section, General Ledger Setting Up the Chart of Accounts for more information on determining a Chart of Accounts.

|

If the event is set for deferred revenue accounting and the company preferences is set to roll over all events at year end; Theatre Manager will change the deferred revenue setting to earned revenue for all events that were rolled over.

The reason is so that any new performances or extended runs for rolled over events will take on the earned revenue setting. |

Posting Accounts

There are six different types of accounts used in combination with Events. They are:

- a Sales Account

- an Exchange Account

- a Refund Account

- a Discount Account

- a Markup Account

- three levels of Ticket Fee Accounts.

- Regular

- Season

- Other-Type 1

- Other-Type 2

- Other-Type 3.

As well, there are five different ticket categories for each type of ticket. They are:

Depending on how your accounting system is designed, you may want to set up all account types with the same general ledger account. For example, the same general ledger account can be entered for all revenue accounts -- the general ledger will record all revenue for the event into one account. Separate general ledger accounts can be entered for all revenue accounts -- the general ledger will record each type of revenue for the event in a separate account. Refer to the section, General Ledger Setting Up the Chart of Accounts for more information on determining whether to use a detailed versus a simplified general ledger number setup.

| Sales Account | Designates the general ledger account number used to record revenue received through new ticket sales for the event. |

| Exchange Account | Designates the general ledger account number used to record revenue gain or revenue loss through ticket exchanges for the event. |

| Refund Account | Designates the general ledger account number used to record revenue loss through ticket refunds for the event. |

| Discount Account | Designates the general ledger account number used to record the net value of ticket discounts through ticket sales, ticket exchanges, and ticket refunds for the event. |

| Markup Account | Designates the general ledger account number used to record the net value of ticket markups through to ticket sales, ticket exchanges, and ticket refunds for the event. |

| Ticket Fee Accounts | Designates the general ledger account number used to record the net value of per ticket service charges applied to ticket sales, ticket exchanges, and ticket refunds for the event. |

Ticket Types

Theatre Manager can also breakdown your ticket sales for an event into five separate sections.

This allows you to keep track of how your tickets are being sold. The "Other Type" Tabs can be renamed in Default Data: Appearance. Under each of these tabs are independent deferred revenue and earned revenue accounts for each type. Thus allowing you to designate separate accounts for each revenue for all types.