| Single donation PAID at time of entry with one payment |

A single donation is one that is entered, paid for and receipted at one time. You would:

- Insert a new donation (providing amount, campaign, tax receipt name, tax receipt option etc)

- Apply a payment

- (optionally) add a letter/email acknowledging the gift

- Print the tax receipt now (or later)

|

| Single donation with PAID with multiple post dated payments |

A single donation is one that is entered, with a payment plan for and receipted later. You would:

- Insert a new donation (providing amount, campaign, tax receipt name, selecting annual statement tax receipt option etc)

- Begin applying a payment and click on post dated tab

- Enter the post dated payments options which can be credit card, EFT or checks (if they give you all the checks in hand)

- Add a letter/email acknowledging the gift

- Print the tax receipt now, or later when each payment arrives, or once in an annual receipt at end of year.

|

| Single donation where patron PLEDGED to send checks in later on |

A single donation is one that is entered but there is no payment plan. The customer would be sending the checks later in response to as reminder to pay an instalment. You would:

- Insert a new donation (providing amount, campaign, tax receipt name, selecting annual statement tax receipt option etc)

- Click on the correspondence tab and setup up PLEDGE REMINDER letter/emails for the appropriate frequency

- Add a letter/email acknowledging the gift

- When each payment comes in, look up the donation it is for and apply the payment.

- Print the tax receipt when each payment arrives, or once in an annual receipt at end of year.

- Use the report Patrons Behind in Pledge Payments to manage who has received a reminder and hasn't sent in their payment

|

| Recurring Donation that repeats forever |

A donation that repeats forever needs to be entered once and then set up to recur. The next donation is automatically generated on the appropriate date. Any existing donation can be turned into recurring. The suggested steps are:

- Enter a donation like the simple donation with one payment. In general, select Annual Statement receipt for the ta receipt type

- When done, create a recurring donation from the individual donation and

- set a frequency of occurrence (eg, weekly, monthly ,quarterly, etc.)

- pick a payment method that is a credit card, EFT, or On account (meaning you will call them)

- Post dated payments and pledge payments are not appropriate for recurring donations

- Run you end of day each day. On the appropriate date, a new donation and payment will be created.

- If it is credit card, you will authorize it. if it is EFT, you will generate an EFT file

|

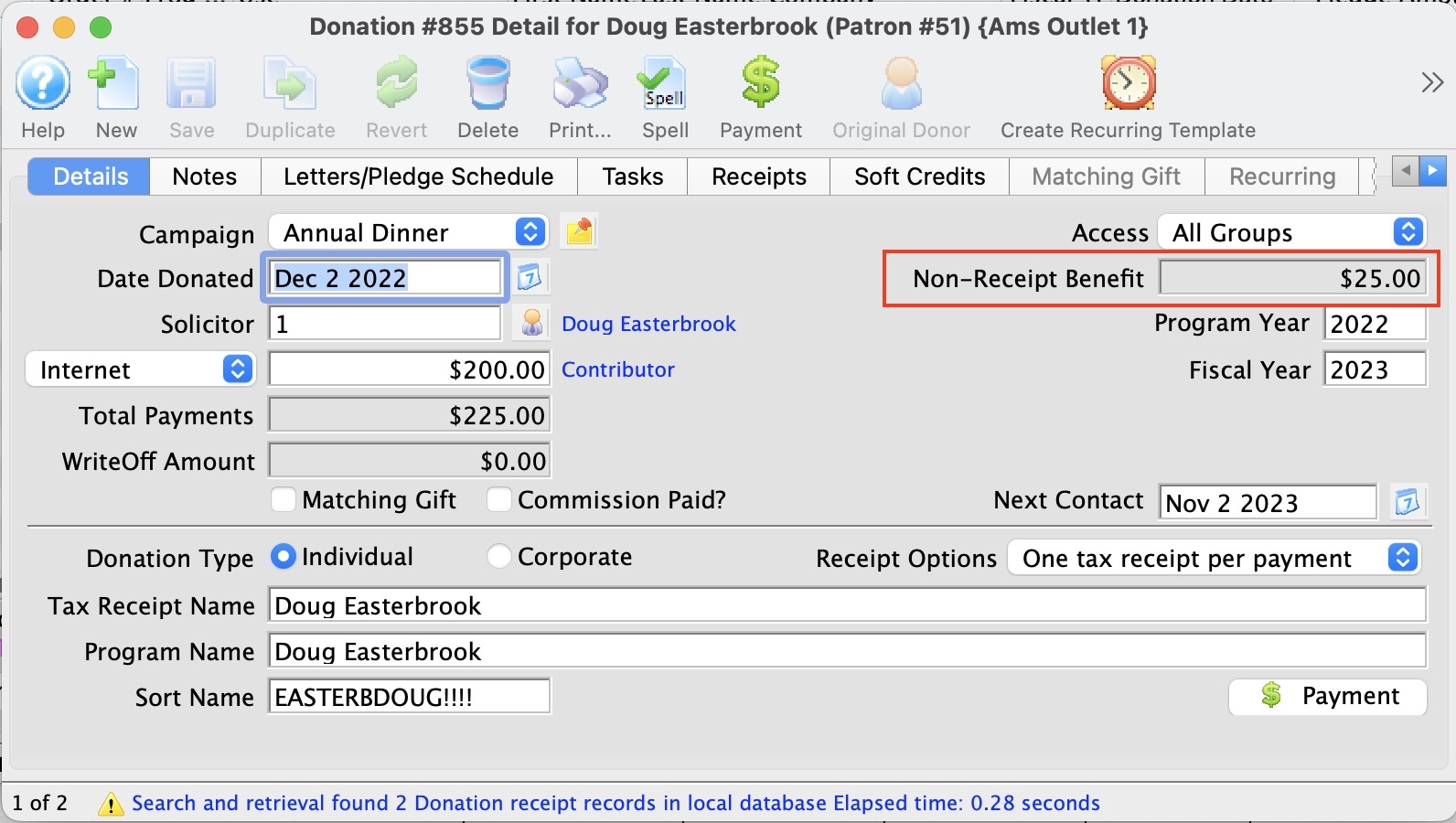

| Donation with a non receiptable benefit amount |

A donation with a benefit amount is entered and paid for like any other donation. The only difference is that the campaign allocated to the donation

A donation with a benefit amount is entered and paid for like any other donation. The only difference is that the campaign allocated to the donation

- Has a benefit amount assigned to the giving level (since each giving level could have a different benefit like 2 tickets, 4 tickets and a mug, etc.

- You can allow the benefit amount to be optional, meaning that the patron does not have to take the benefit

- Enter the donation

- Optionally, modify the benefit amount

- Follow any of the previous examples for post dated, pledge, or single payment.

Donations with a benefit will show that on the tax receipts for IRS or CRA purposes, while allowing the donation to be recognized within the venue at full value. The tax receipt will effectively indicate: Thanks for your donation of $xxx.xx of which $y.yy is a non receipt-able benefit.

It is most often used for special events with dinners, or where there are material benefits conferred or costs incurred by the venue as part of receiving the donation.

|

| Prospects, Grants and Foundations |

A government grant or foundation gift is the same as a single donation. Simply enter it. You may want to do the following:

- (Optional) Enter the donations as a prospect when you start applying or it

- Create a task for the donation and on the 'documents' tab of the task, drag in any PDF's spreadsheets, word documents, etc that are pertinent to the application process. This saves them in the database permanently and make a great reference for the following year.

- When the grant is approved:

- Change the donations amount to the amount actually approved by the granting agency or foundation.

- Change the donation from a prospect to a regular gift

- Apply payments when they come in - which is often first payment, middle payment and final payment.

- If there are interim reports, save those as a PDF and add them to the task as well

|

| Restricted Donations, Capital Campaigns and Gaming Revenue |

Generally, restricted donations are those that can only be used for a specific purpose or are required to be put into a separate bank account (or tracked appropriately in the GL).

In some locations, funds MUST be placed into a separate account (eg gaming revenue). These are handled as follows

- Set up a campaign that uses a restricted account.

- Enter the donation as normal

- Take Payments as normal. These can be one time payments, post dated, EFT, pledges, etc as described above

- When end of day is done, Theatre Manager will create clearing entries telling you to move funds from your operating account to the appropriate restricted bank account. Use your online banking portal to move the appropriate amount

|

| Gifts to multiple campaigns |

Some donations are split amongst two or more campaigns. To do this:

- Enter a donation to the one campaign along with the amount

- Use the duplciate button to create an new donation in the same order. it will be created as a prospect

- Change the campaign that is donation is to go to

- Change the amount, if the allocation is not equal

- Change the donation from a prospect to a gift to make it real -or-

- Delete it if you do not want it.

- Proceed and pay for it as you would any other donations.

Alternatively, if you don't want the donations in the same order, just enter a second one and pay each of them separately.

|

| Gifts to multiple years |

Some donations are pledged and split amongst multiple years for ongoing large donations. Eg, a patron might pledge $3000 a year to the virtuoso fund for a 5 year period. If you want the recognition for the total amount of $15,000 for all 5 years, you would handle this as follows:

|

| Pledges Over Multiple Years |

Scenario: a patron that would like to give a total of $10,000.00

over 5 years ($2,000.00 each year). We don't want to record the $10,000

pledge upfront into our General Ledger, creating a large Accounts Payable entry. However we would like to keep

track of the total amount and the progress of the $10,000.00 as it decreases with future payments. What is the best practice in this scenario?

|

| Buy a Seat |

If you are doing a seat naming campaign, the best way to handle it is:

- Create a specific performance for the buy a seat campaign.

- Create two prices: One for the box office of $0.00 and one for online at the donation for the seat of $xxx.xx

- At the box office:

- Sell the required number of seats to this performance at $0.00

- Add a donation, set the amount and assign to the buy a seat campaign

- enter any custom inscription notes into the donation note field

- Take your payment (check, card, EFT or post dated payments)

- Print receipts as required (annually, or per payment)

- For online sales:

- People buy online to get the seat they want to sponsor, pay the appropriate price and checkout.

- Later, go to the attendance tab in the event window

- Select the number of tickets sold online - they will have the sponsorship price associated with it, instead of $0.00

- Right click and change the price on the tickets to zero

- add a donation to the order equivalent to the former ticket price

- Print receipts as required (annually, or per payment)

At the end of the 'buy a seat' sale, you now have:

- A seat map showing the seats that patrons sponsored which you can refer to later on

- A campaign with the total of the seat sold

- The ability to export the engraving notes from the donations

|