You are here

Accounting Tab in Courses

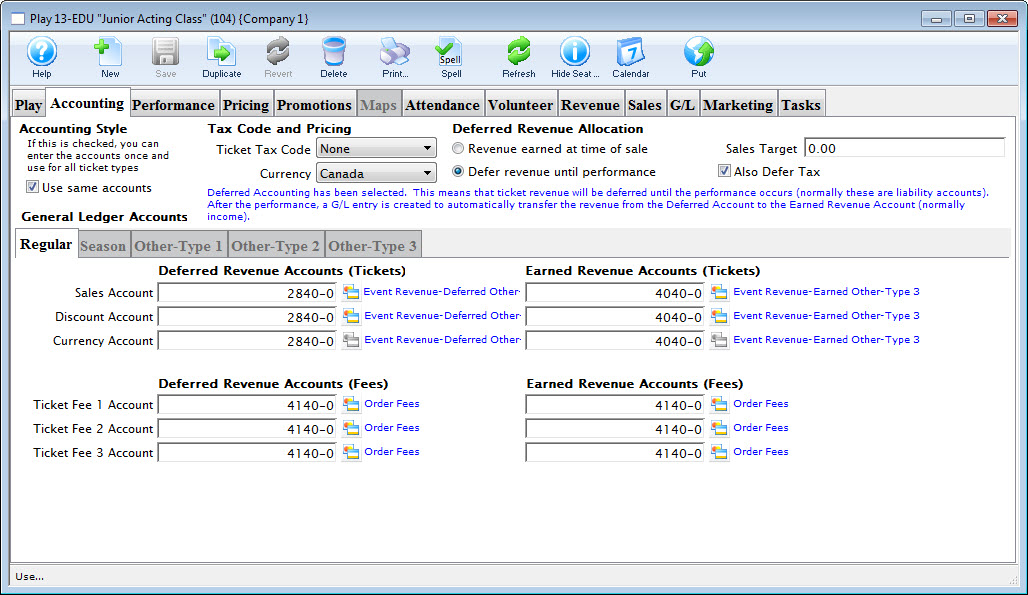

The Accounting Tab displays the accounting information for a course. It shows the general ledger accounts set for the event and the applicable taxes applied. As well, when the revenue will be received into the general ledger can be determined.

Parts of the Accounting Tab

Accounting Stype |

Use same accounts - When checked, you can enter the accounts once and use for all ticket types. |

Tax Code and Pricing |

|

| Ticket Tax Code | Select the tax rate to apply to the BASE PRICE ONLY. If there are taxes on the various fees in the promotion, then they are set in the sales promotion Calculation Tab. |

| Currency | The Currency the event is priced in |

Deferred Revenue Allocation |

|

| Revenue earned at time of sale | When selected, All sales go directly to the revenue account without deferral |

| Defer revenue until performance | The revenue will be deferred until the performance occurs (normally

these are liability accounts) After the performance a G/L entry is created

to automatically transfer the revenue drom the deferred account to the Earned Revenue Account (normally income).

Refer to the section, General Ledger Setting Up the Chart of Accounts for more information on determining a Chart of Accounts. |

| Sales Target | Target income |

| Also Defer Tax | Deferring taxes requires deffered tax accounts be set up in the G/L |

General Ledger Accounts |

|

| Regular | Accounts to use when posting tickets sold using a sales promotion marked as 'Regular' |

| Season | Accounts to use when posting tickets sold using a sales promotion marked as 'Season' |

| Other-Type 1 | Accounts to use when posting tickets sold using a sales promotion marked as 'Other-Type 1' |

| Other-Type 2 | Accounts to use when posting tickets sold using a sales promotion marked as 'Other-Type 2' |

| Other-Type 3 | Accounts to use when posting tickets sold using a sales promotion marked as 'Other-Type 3' |

Depending on how your accounting system is designed, you may want to set up all account types with the same general ledger account. For example, the same general ledger account can be entered for all revenue accounts -- the general ledger will record all revenue for the event into one account. Separate general ledger accounts can be entered for all revenue accounts -- the general ledger will record each type of revenue for the event in a separate account. Refer to the section, General Ledger Setting Up the Chart of Accounts for more information on determining whether to use a detailed versus a simplified general ledger number setup.

| Sales Account | Designates the general ledger account number used to record revenue received through new ticket sales for the event. |

| Exchange Account | Designates the general ledger account number used to record revenue gain or revenue loss through ticket exchanges for the event. |

| Refund Account | Designates the general ledger account number used to record revenue loss through ticket refunds for the event. |

| Discount Account | Designates the general ledger account number used to record the net value of ticket discounts through ticket sales, ticket exchanges, and ticket refunds for the event. |

| Markup Account | Designates the general ledger account number used to record the net value of ticket markups through to ticket sales, ticket exchanges, and ticket refunds for the event. |

| Ticket Fee Accounts | Designates the general ledger account number used to record the net value of per ticket service charges applied to ticket sales, ticket exchanges, and ticket refunds for the event. |