You are here

Determine the Chart of Accounts

Creating the Chart of Accounts requires understanding how the General Ledger will be used to generate information. For more information, refer to the sample Chart of Accounts by clicking here.

Minimum General Ledger Accounts

The suggested minimum number of General Ledger Account numbers are outlined in this table. The organization may choose to operate with fewer or more accounts.

|

Minimum General Ledger Accounts |

Type of Account |

|

Cash |

Asset |

|

Check |

Asset |

|

Accepted Credit Cards |

Asset |

|

Vouchers Received |

Asset |

|

Other Payments |

Asset |

|

Accounts Receivable |

Asset |

|

Accounts Receivable - Future Payment |

Asset |

|

Accounts Receivable - Outlet |

Asset |

|

Accounts Payable |

Liability |

|

City/Municipal Tax Payable - If this tax is collected |

Liability |

|

Provincial/State Tax Payable - If this tax is collected |

Liability |

|

Federal Tax Payable - If this tax is collected |

Liability |

|

Prepaid Gift Certificates |

Liability |

|

Deferred Donation |

Liability |

|

Commissions Payable |

Liability |

|

Order Fees |

Revenue |

|

Exchange Fees |

Revenue |

|

Reprint Fees |

Revenue |

|

Mail Fees |

Revenue |

|

Sales Account for Each Event |

Revenue |

|

Cash Over/Under |

Expense |

|

Donation Bank Transfer |

Expense |

|

Bank Service Charges |

Expense |

|

Donations |

Other Income |

Required General Ledger Accounts

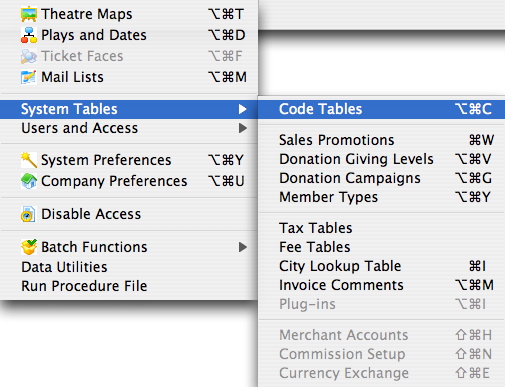

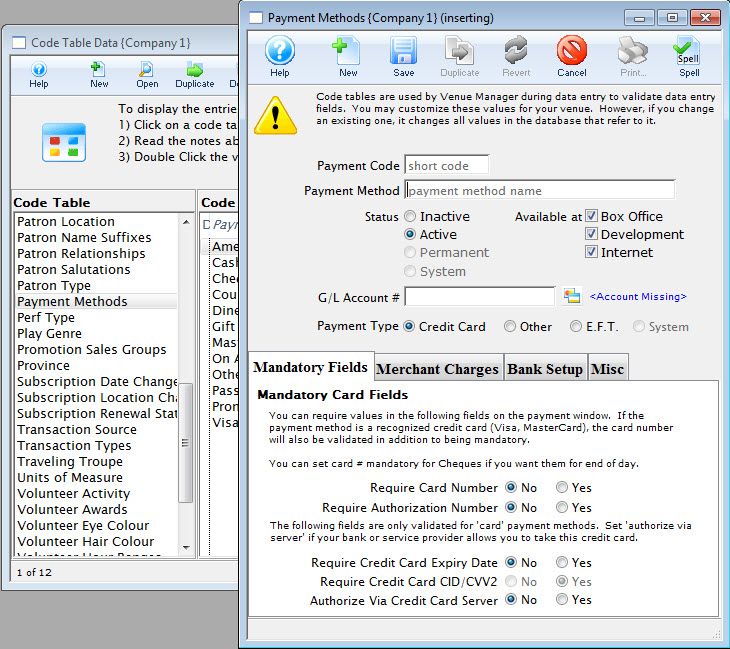

- Open the Code Table Window via the Setup >> System Tables >> Code Tables menu.

- Select Payments.

A list of required general ledger accounts is displayed.

- Select Default Posting Accounts.

The account names that appear in the list are the minimum number of accounts required for the General Ledger to operate and, except the credit card types, are determined by Theatre Manager. The credit card types that appear are determined by the credit card types entered in the Credit Card Category of the Code Table. All additional credit card types to the Code Table requires that Accounting Default Data be updated with a corresponding account number.

The actual general ledger account numbers used depends on the accounts set up in the General Ledger.

All required accounts must have a corresponding account number otherwise Theatre Manager we be unable to create deposits and revenue allocations.