Donation Management

|

Please refer to Donation Features or see how to deal with various data entry scenarios |

Please note that are required to have some system table settings in place before using the donation module. To learn more about Donation System Tables click here.

Accessing Donations

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

You can download the Quick Reference Guides (less than 20 pages), Cheatsheets (1-2 pages) and Screencasts (online video demonstrations of the functions with narration) by clicking on the icon.

|

Topic |

Reference Guide |

Cheatsheet |

Flash ScreenCast |

MP4 ScreenCast |

Donations |

||||

| Donations Overview | ||||

| Add a Donation thru the Order Window | ||||

| Refund a Ticket to a Donation |

|

| ||

| Create a Campaign | ||||

| Pledged Donations | ||||

| How to Toggle Between Individual & Corporate Donations | ||||

| How to Make a Donation Anonymous | ||||

| Soft Credits | ||||

| Matching Gifts Part 1 - Setting up the Gifter | ||||

| Matching Gifts Part 2 - Adding Gift to a Donation, Running a Report | ||||

| Gift In Kind | ||||

| Deleting and Refunding Donations | ||||

Donation Module Features

Theatre Manager can be used to enter and manage donations for your:

- Annual Fund

- Capital Campaign

- Recurring donations

- Donations on a payment plan, or

- Simple Ticket Round-up donation online

- Campaigns with progress bars and suggested donations online

- Special fundraising events, silent and live auctions including raffles, cash advances and checkouts

- Aggregating donations for recognition across campaigns

- Gifts in kind, matching gifts, soft credits

- and almost any scenario

|

For more information on the features of the donation module, you may wish to refer to a number of cheatsheet and videos or the sample data entry scenarios. |

Features Overview

|

For more information on the features of the donation module, you may wish to refer to a number of cheatsheet and videos or the sample data entry scenarios. |

The Development/ Fundraising/ Donation module of Theatre Manager has long been a major portion of the system with a long list of extensive features such as:

- Prospect tracking, including all correspondence and meetings as part of the CRM

- Pledge Schedules & Sending of Payment Reminders (as letters or Emails).

- To-Do's and Contact Notes specific to each donation.

- Allowing multiple Soft Credits per donation.

- Matching Gifts & automatic setup of Matching Gift receivables.

- Modification of the Donation Receipt fields.

- Program Years versus Fiscal Year versus Calendar Year.

- Choice of allowing each donation receipt preference.

- Automatic maintaining of Financial Year for past, current, and future years.

- Maintaining Solicitors, and if they received a commission for getting the donation.

- Allowing Program Giving Levels to be calculated on donations, soft credits, and/or matching gifts or a combination of them all.

- Customized donation specific Marketing Fields.

- Defaults and customization of Program Names.

- Printing of tax receipts based on 7 different printing options.

- Maintains the next contact date for this patron so the patron can become an annual donor.

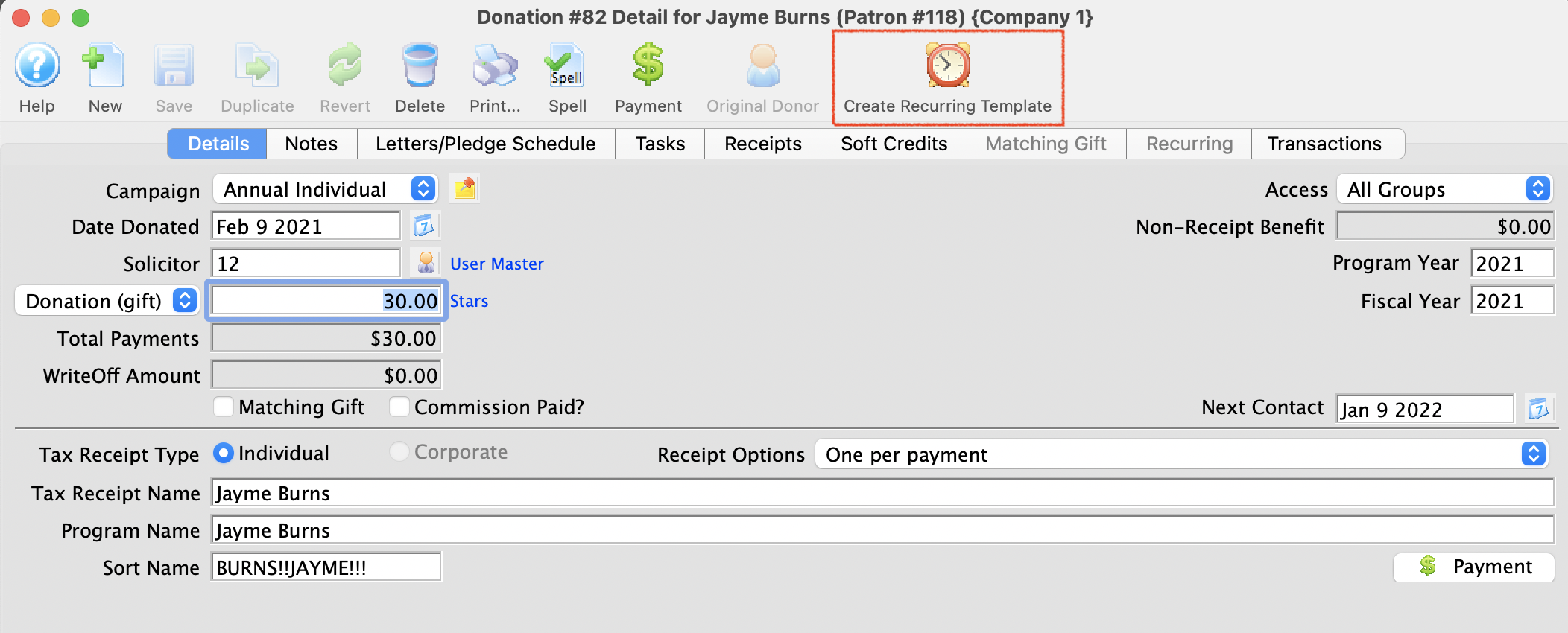

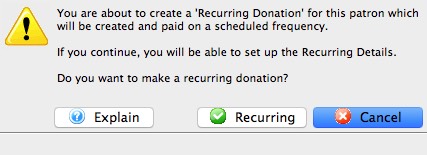

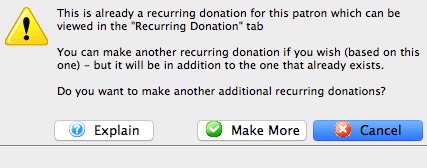

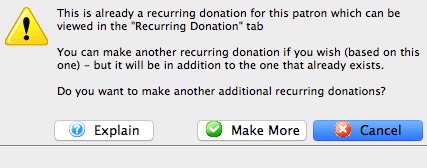

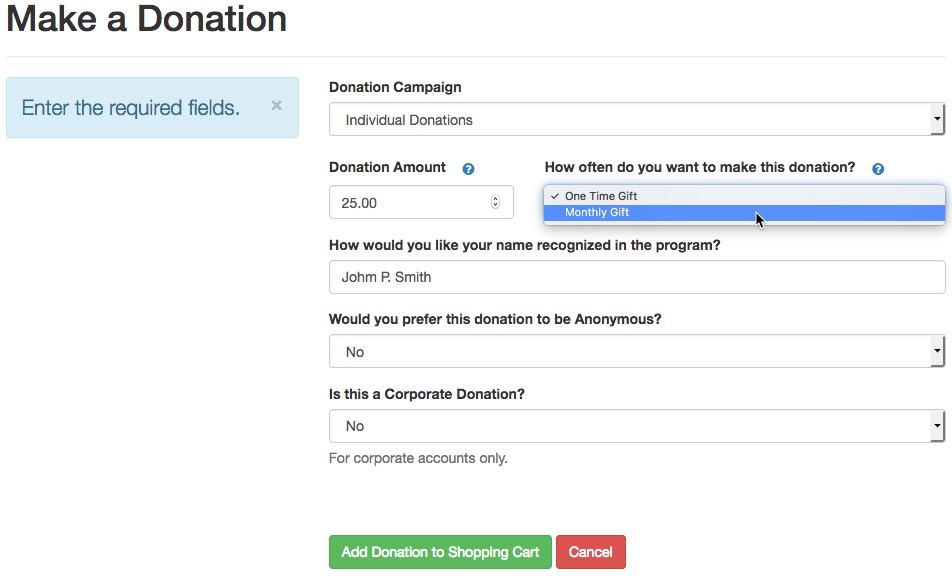

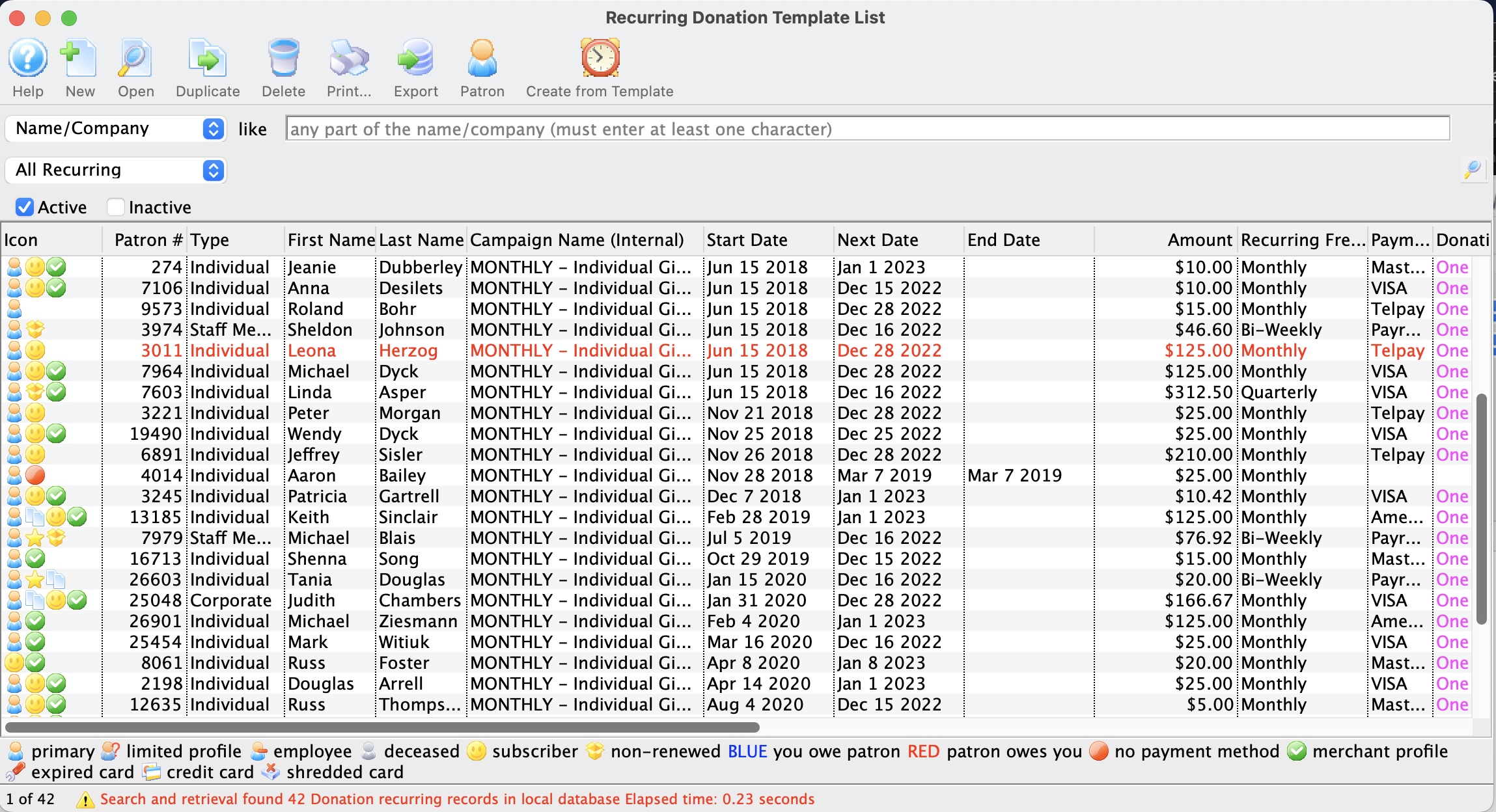

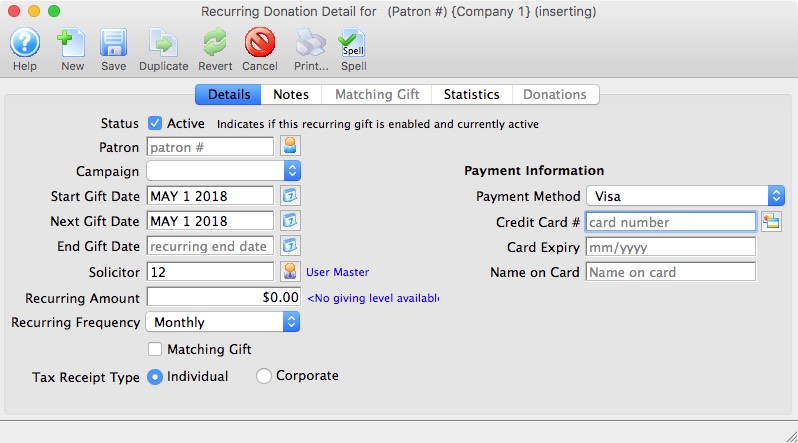

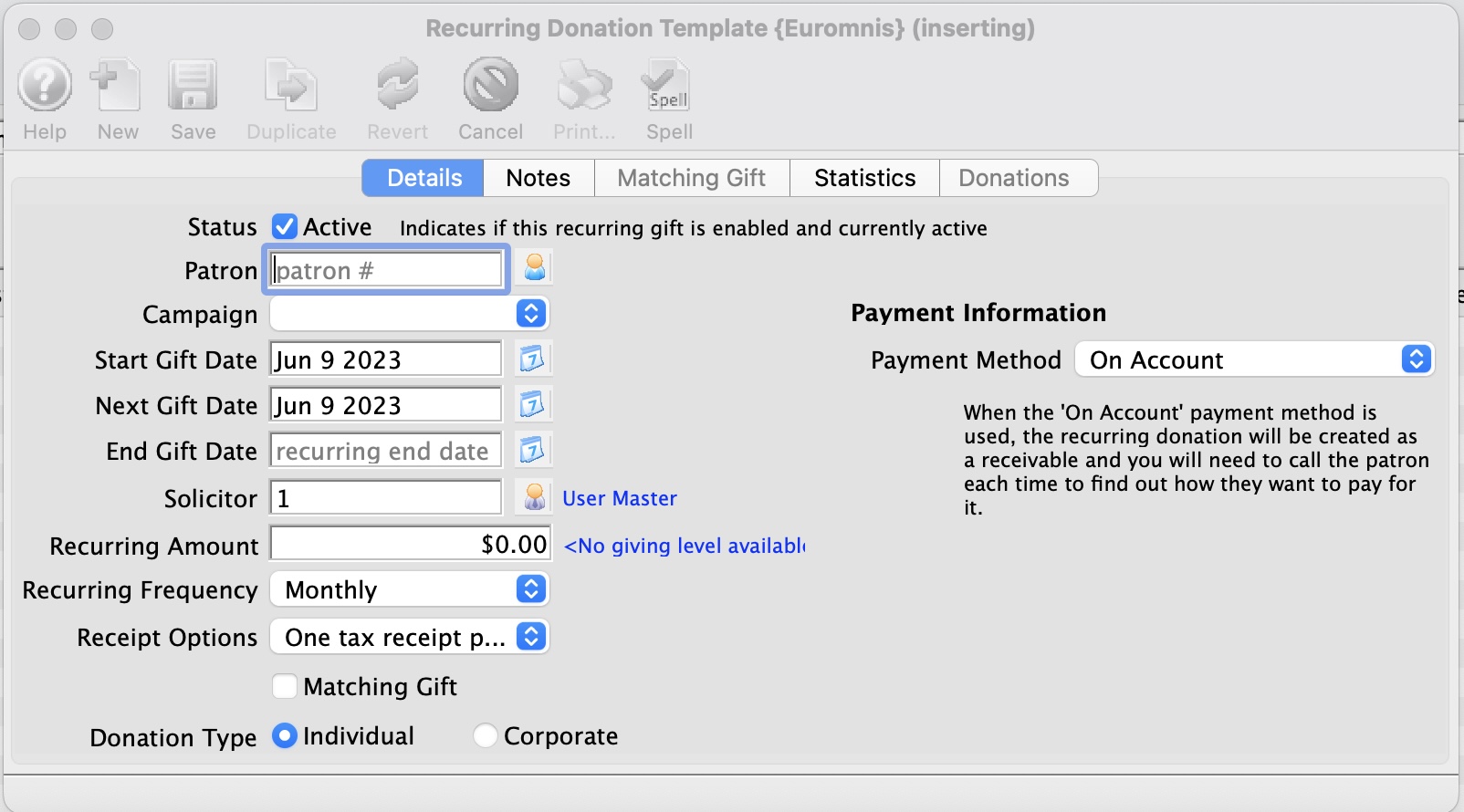

- Easy creation of Recurring Donations for a donors either in the box office or via online web sales.

- Easy setting of Relationships between the donors, ticket buyers, and volunteers.

- Easy maintenance of who your Matching Gift companies are.

- Specific donor contact marketing flags.

- At a glance overview of donors giving history for the past 8 years, averages, maximums and minimums.

- History tracking of each pledge letter, donation thank you, contact note, and donation tax receipt sent to this patron.

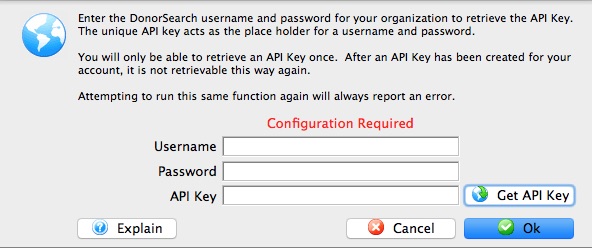

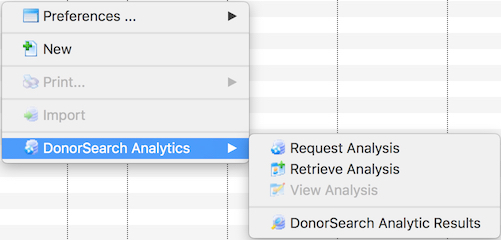

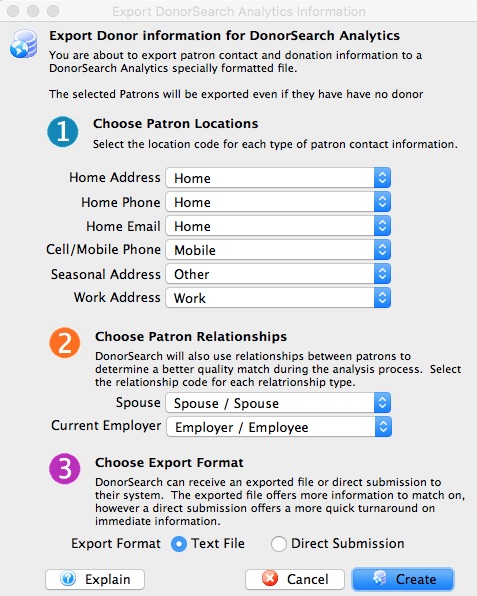

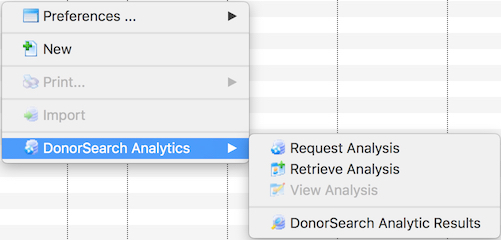

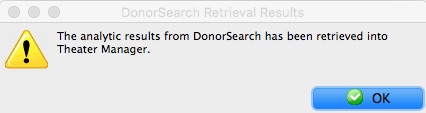

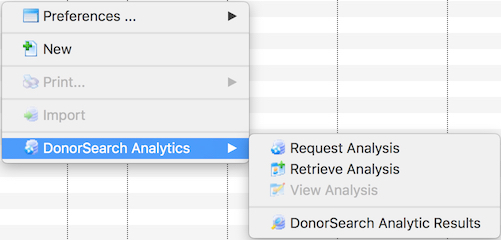

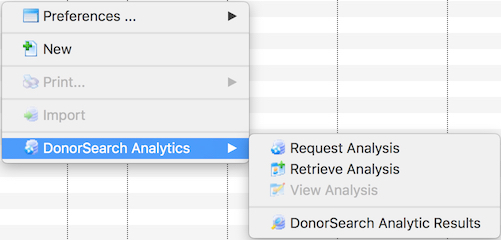

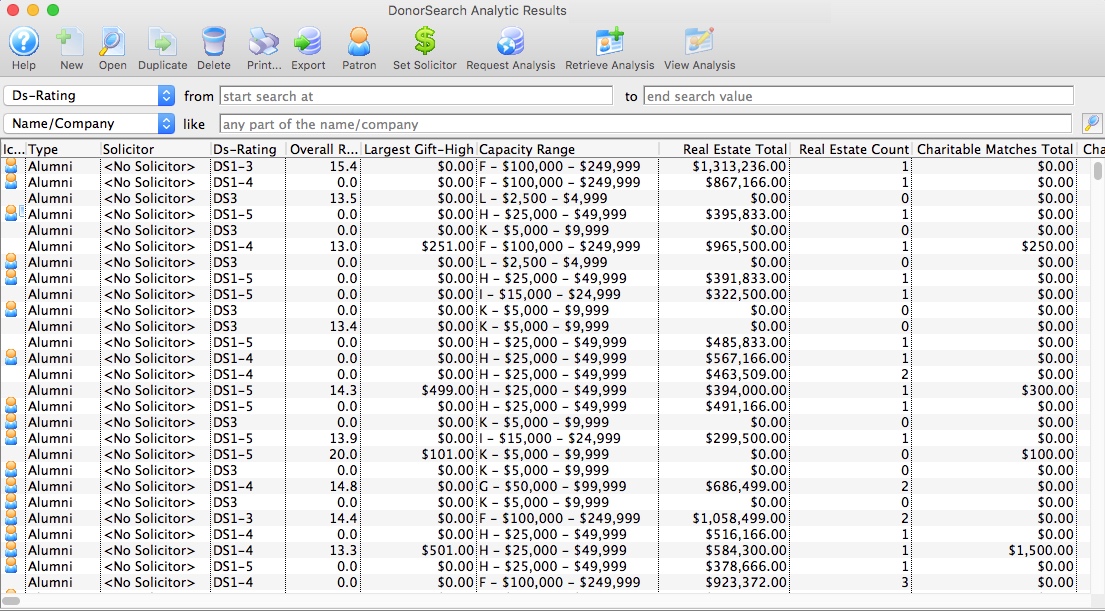

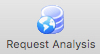

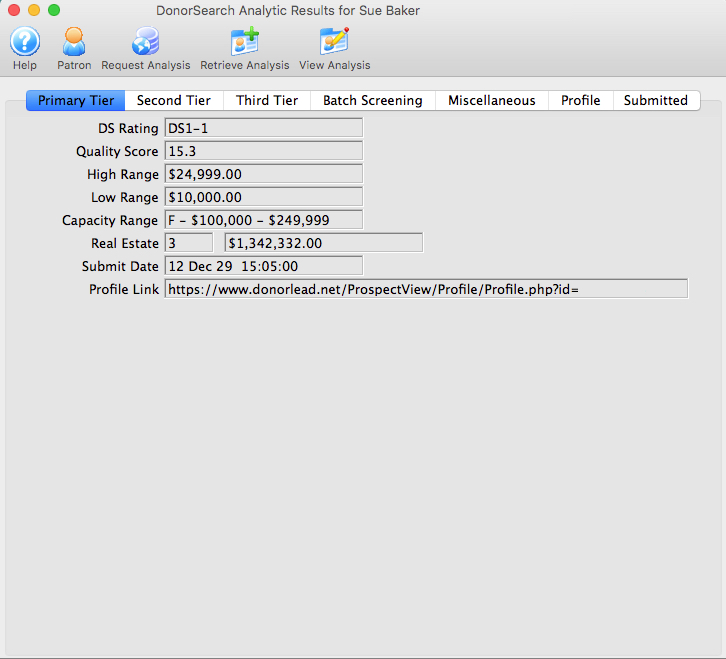

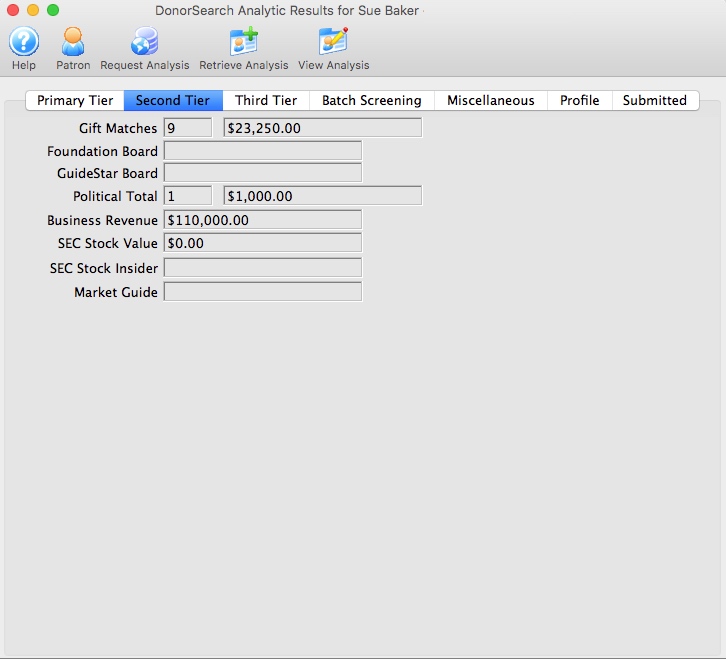

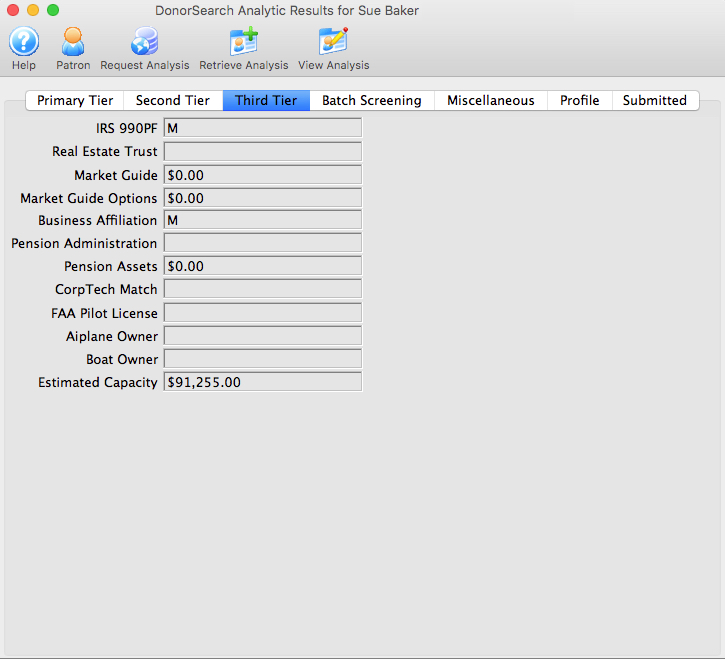

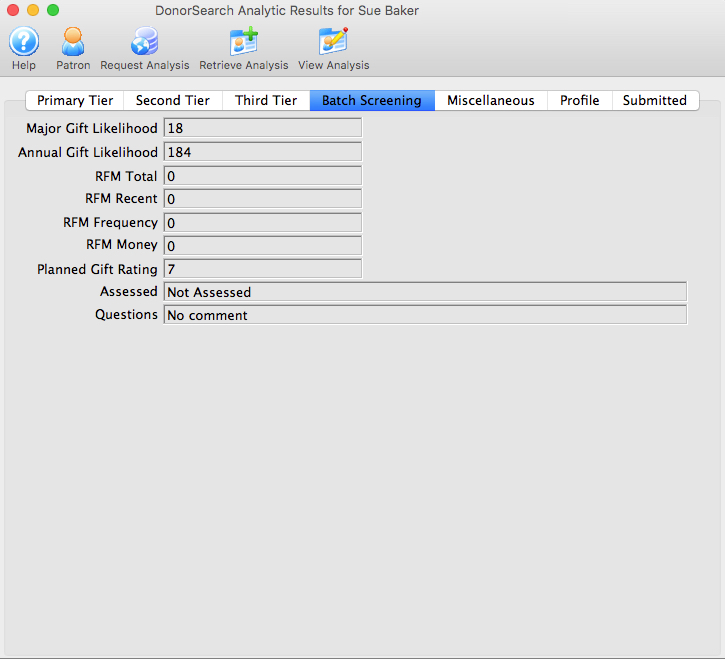

- Direct access to DonorSearch Analytics to immediately access the important and critical information on your existing and potential donors.

- Vast security access and options available that can be defined for each employee determining what they can and cannot do.

Plus the numerous donation detail, summary, giving trends, giving level, reports geared towards telemarketers, board members, development staff, and management.

Sample Donation Scenarios and how to enter them

|

For more information on the features of the donation module, you may wish to refer to a number of cheatsheet and videos. |

What are some sample Donation Scenarios?

| Single donation PAID at time of entry with one payment |

A single donation is one that is entered, paid for and receipted at one time. You would:

|

| Single donation with PAID with multiple post dated payments |

A single donation is one that is entered, with a payment plan for and receipted later. You would:

|

| Single donation where patron PLEDGED to send checks in later on |

A single donation is one that is entered but there is no payment plan. The customer would be sending the checks later in response to as reminder to pay an instalment. You would:

|

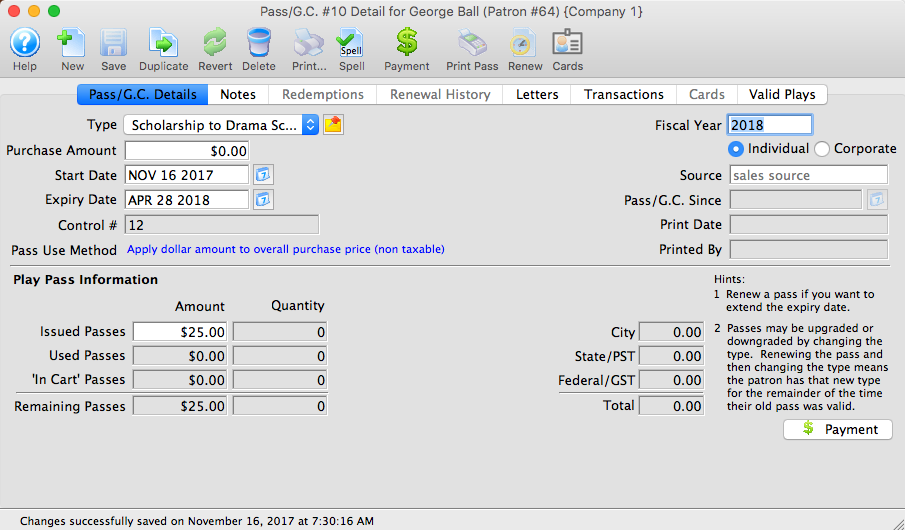

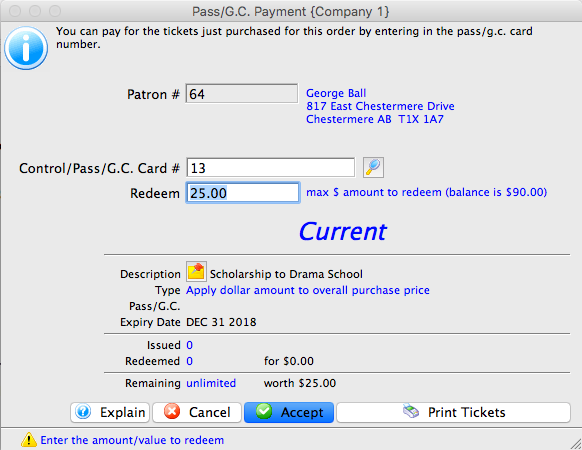

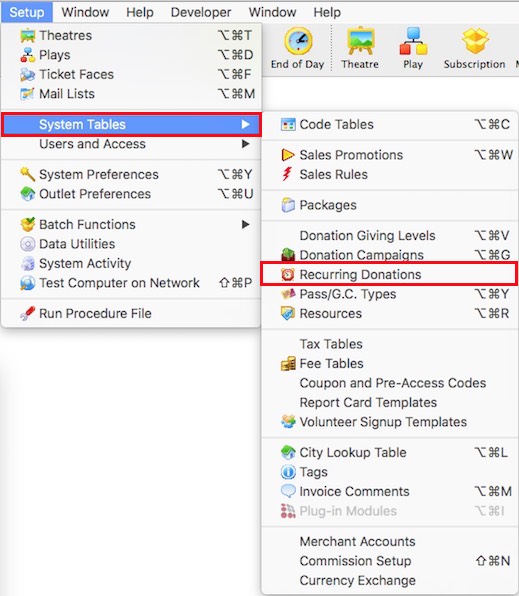

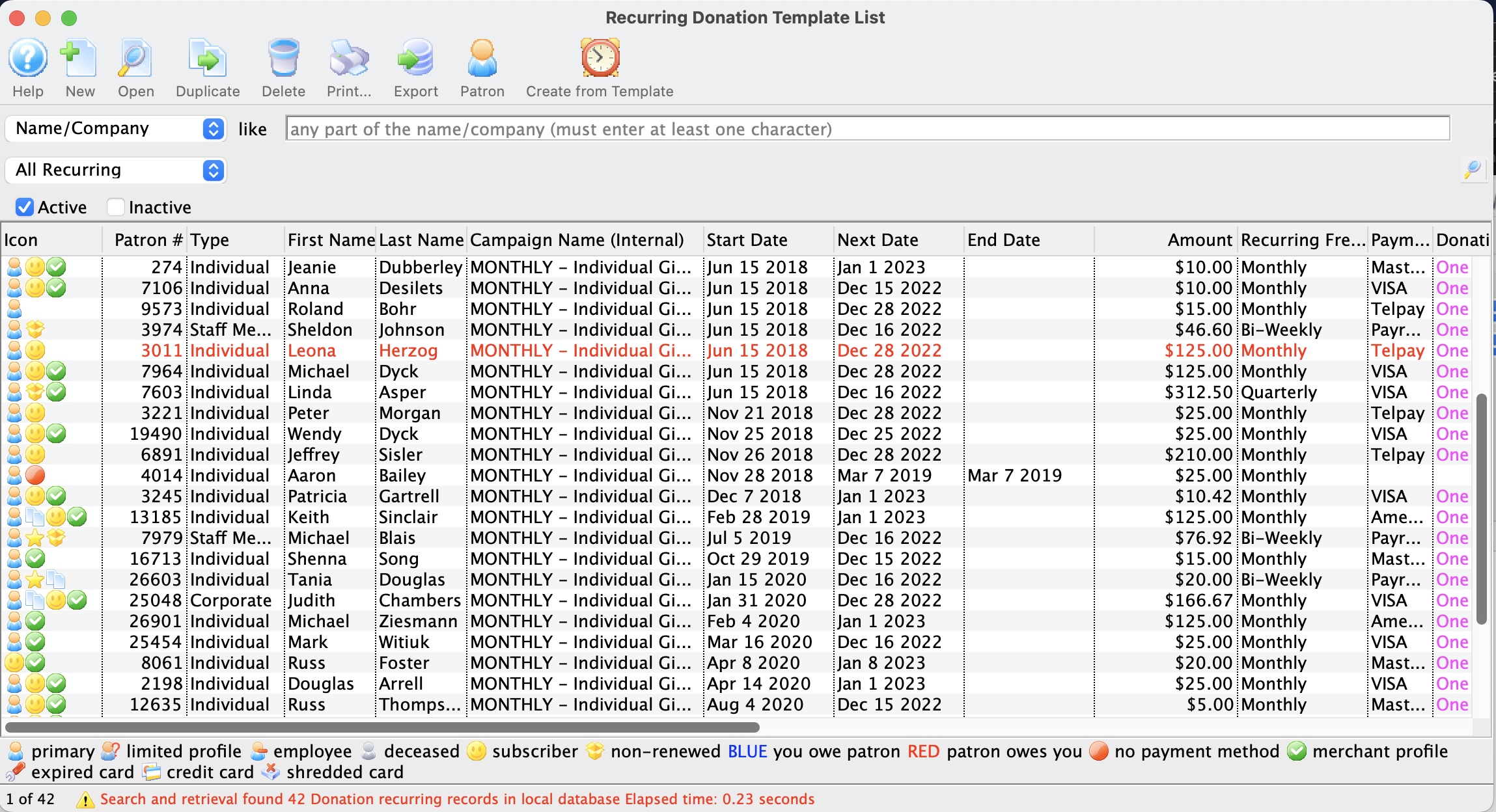

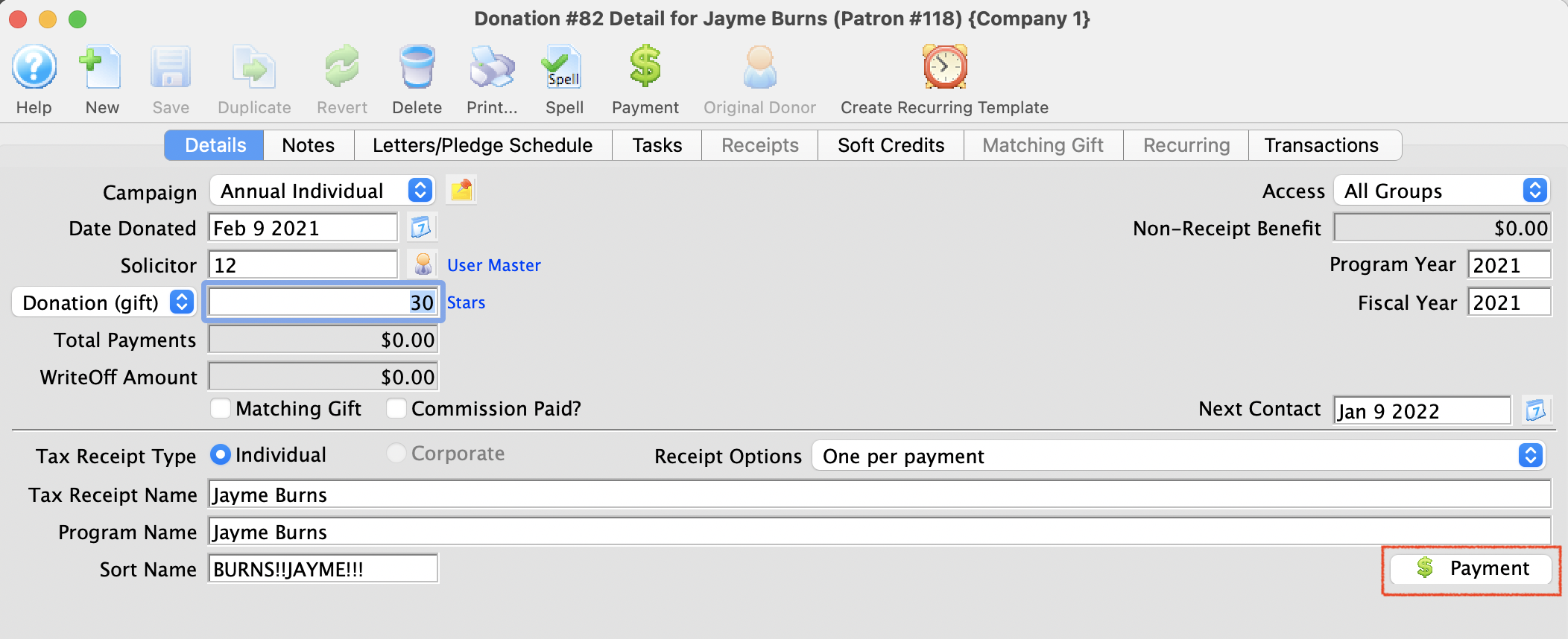

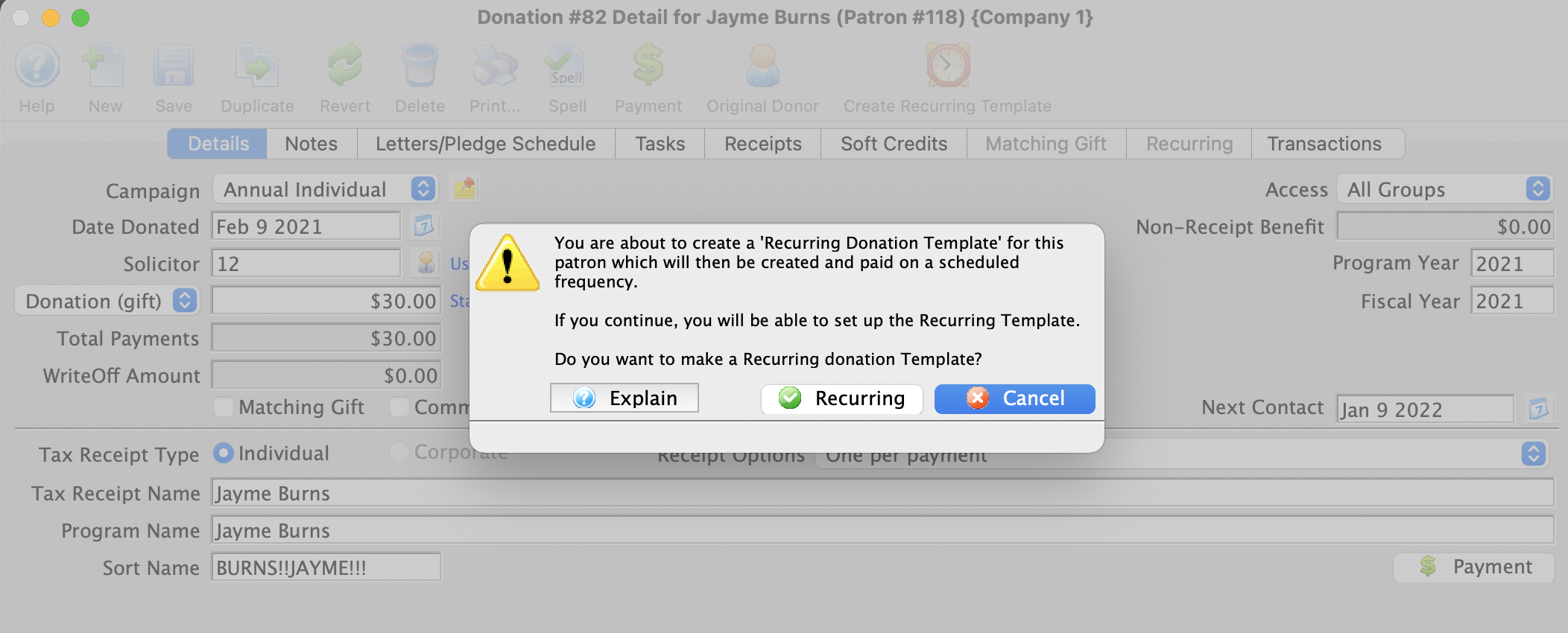

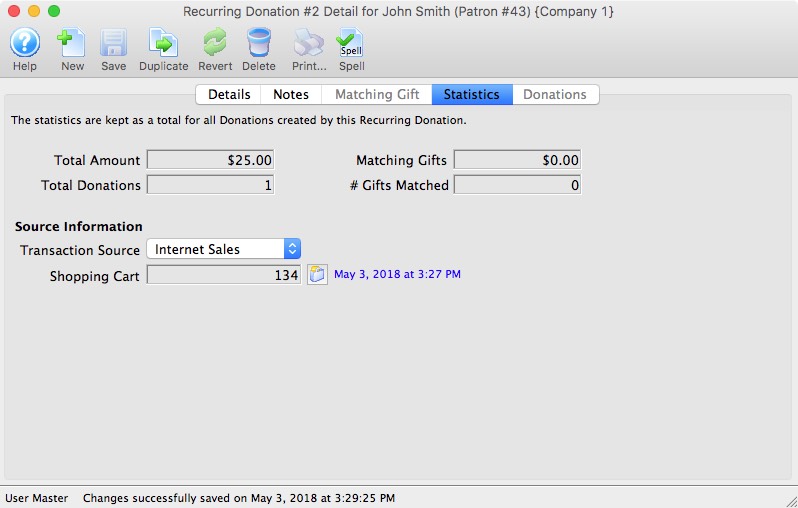

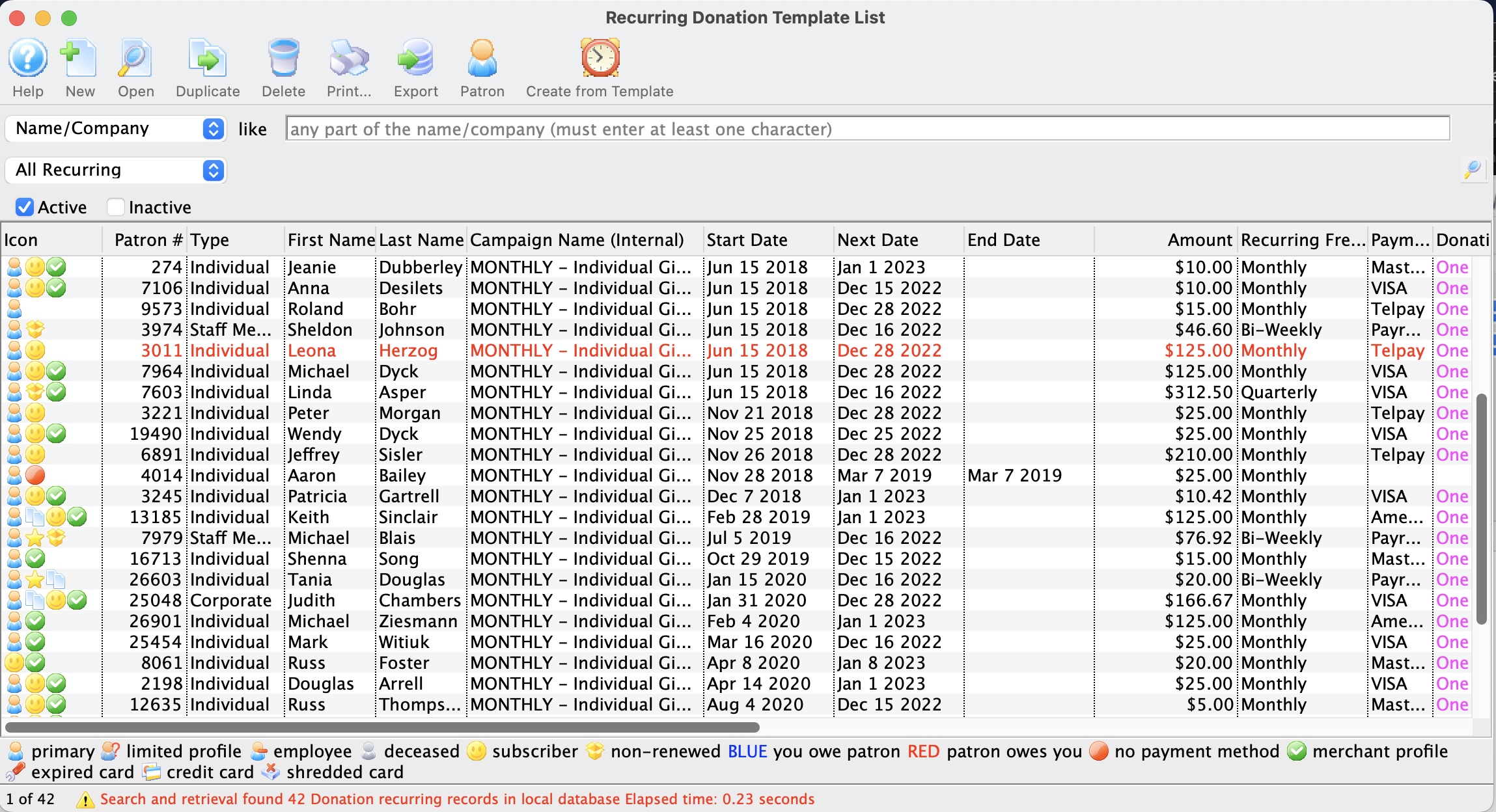

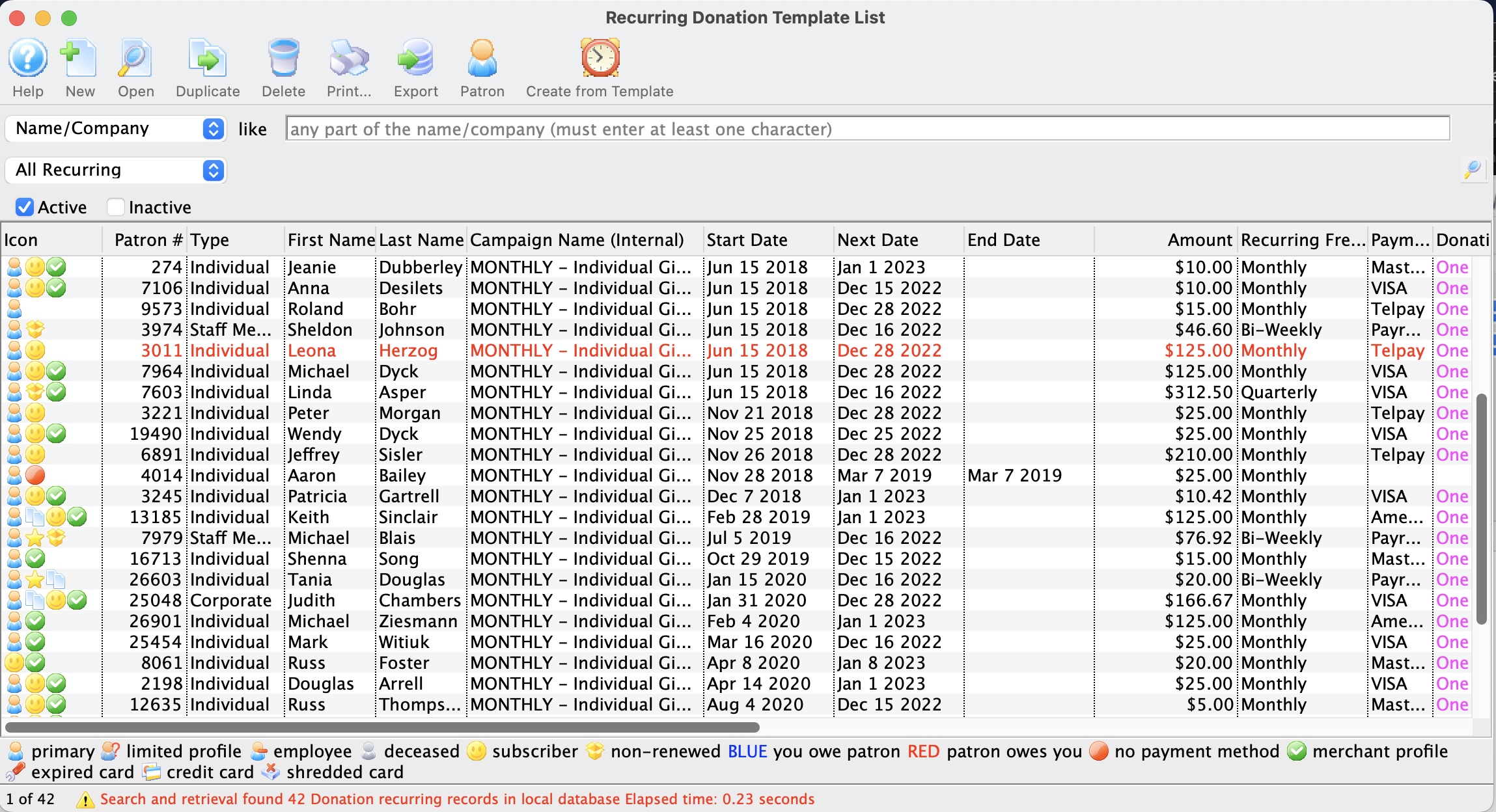

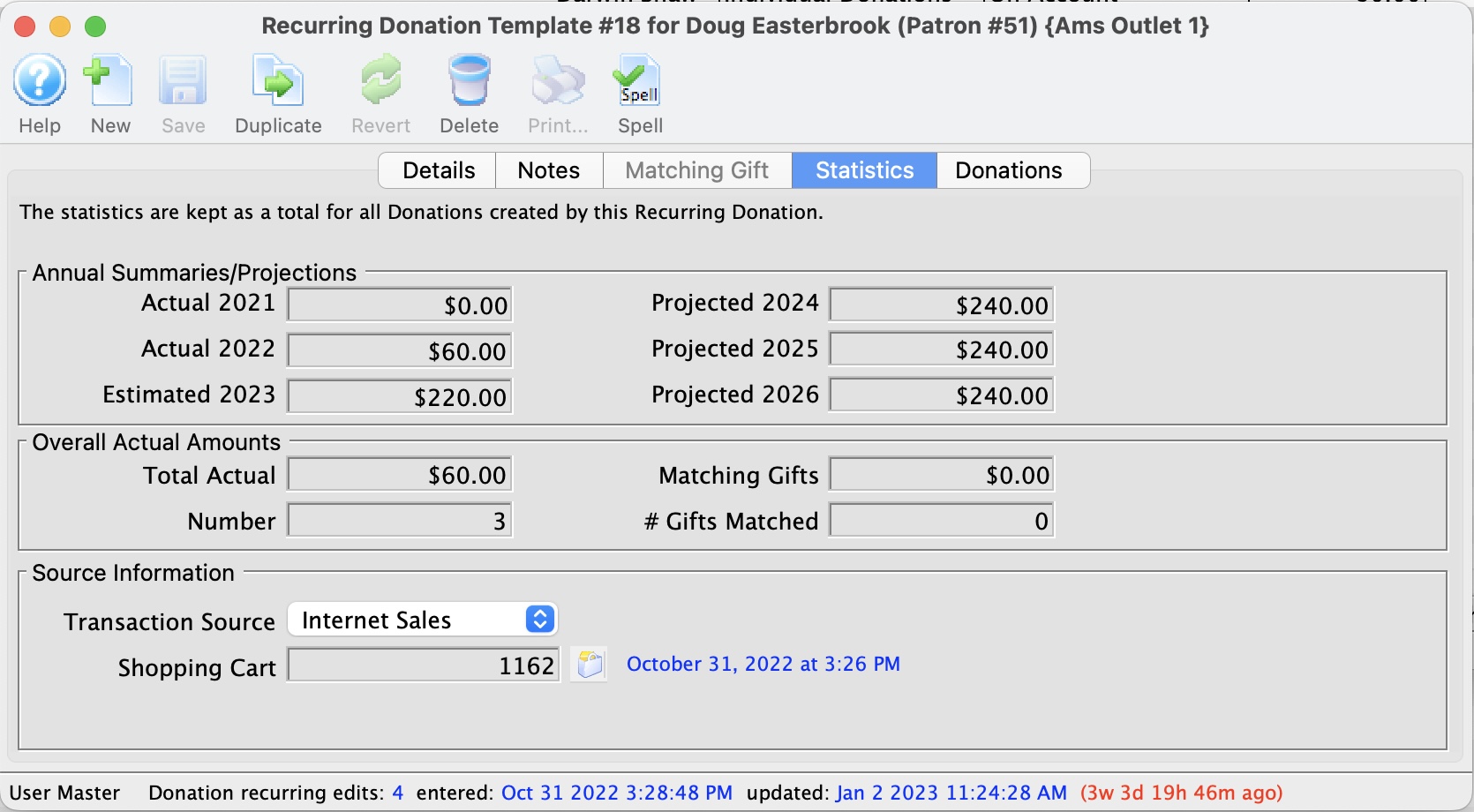

| Recurring Donation that repeats forever |

A donation that repeats forever needs to be entered once and then set up to recur. The next donation is automatically generated on the appropriate date. Any existing donation can be turned into recurring. The suggested steps are:

|

| Donation with a non receiptable benefit amount |

Donations with a benefit will show that on the tax receipts for IRS or CRA purposes, while allowing the donation to be recognized within the venue at full value. The tax receipt will effectively indicate: Thanks for your donation of $xxx.xx of which $y.yy is a non receipt-able benefit. It is most often used for special events with dinners, or where there are material benefits conferred or costs incurred by the venue as part of receiving the donation. |

| Prospects, Grants and Foundations |

A government grant or foundation gift is the same as a single donation. Simply enter it. You may want to do the following:

|

| Restricted Donations, Capital Campaigns and Gaming Revenue |

Generally, restricted donations are those that can only be used for a specific purpose or are required to be put into a separate bank account (or tracked appropriately in the GL).

In some locations, funds MUST be placed into a separate account (eg gaming revenue). These are handled as follows

|

| Gifts to multiple campaigns |

Some donations are split amongst two or more campaigns. To do this:

|

| Gifts to multiple years |

Some donations are pledged and split amongst multiple years for ongoing large donations. Eg, a patron might pledge $3000 a year to the virtuoso fund for a 5 year period. If you want the recognition for the total amount of $15,000 for all 5 years, you would handle this as follows:

|

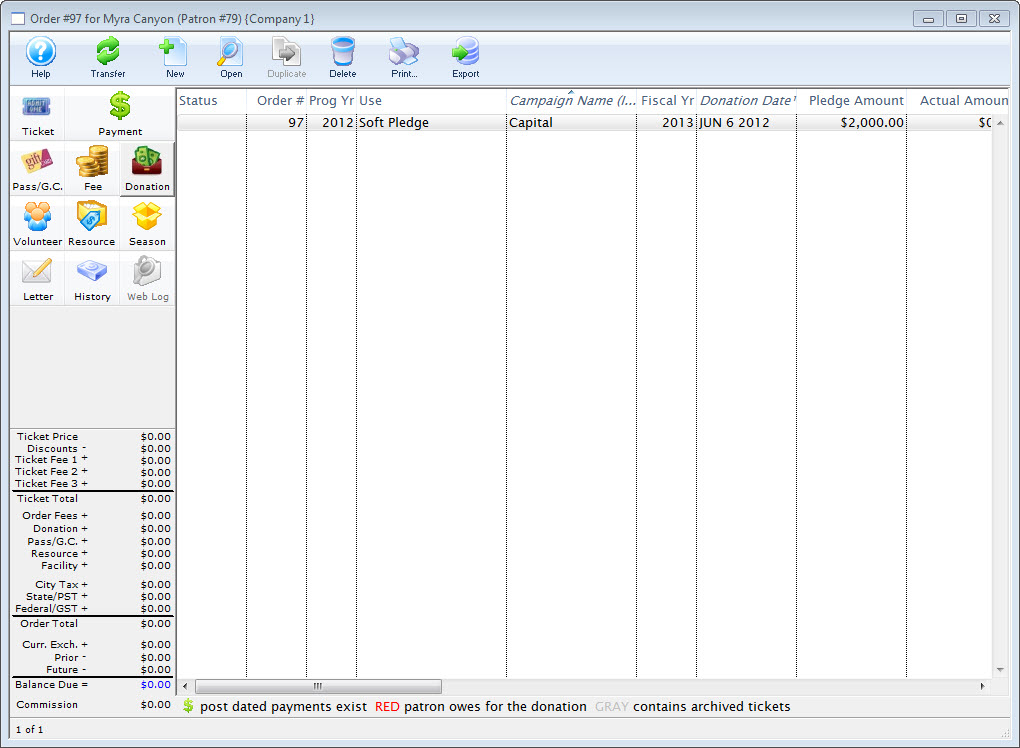

| Pledges Over Multiple Years |

Scenario: a patron that would like to give a total of $10,000.00

over 5 years ($2,000.00 each year). We don't want to record the $10,000

pledge upfront into our General Ledger, creating a large Accounts Payable entry. However we would like to keep

track of the total amount and the progress of the $10,000.00 as it decreases with future payments. What is the best practice in this scenario?

|

| Buy a Seat |

If you are doing a seat naming campaign, the best way to handle it is:

|

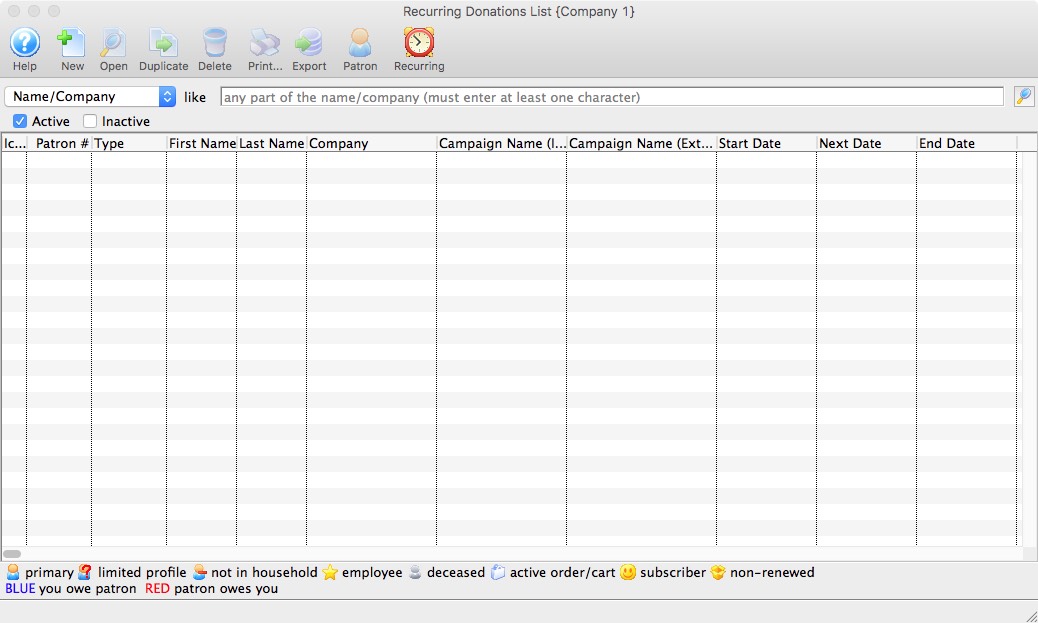

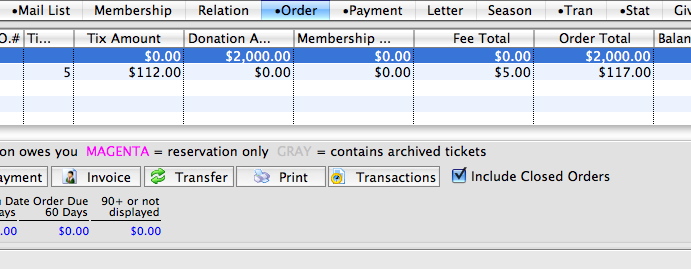

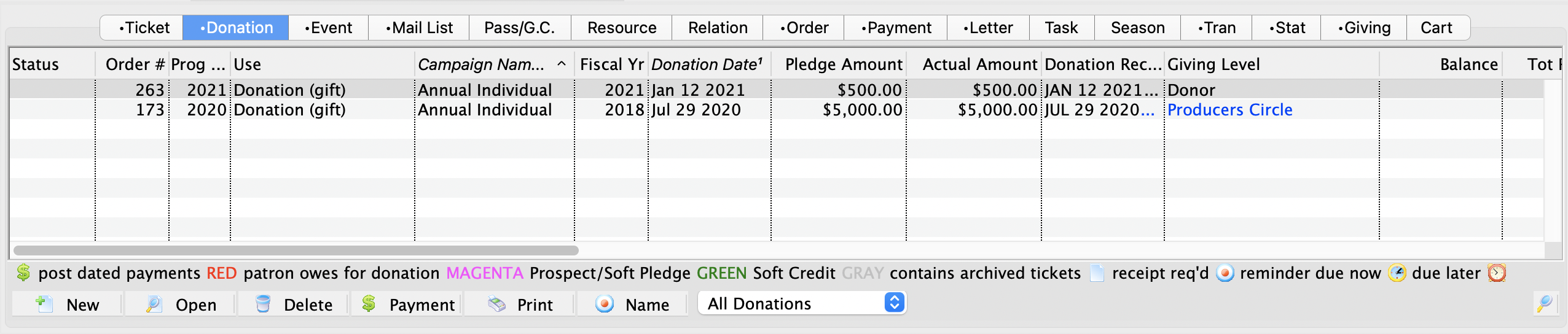

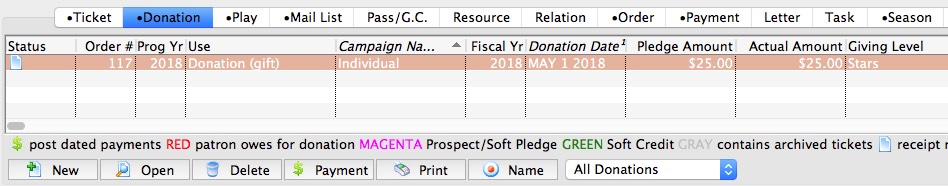

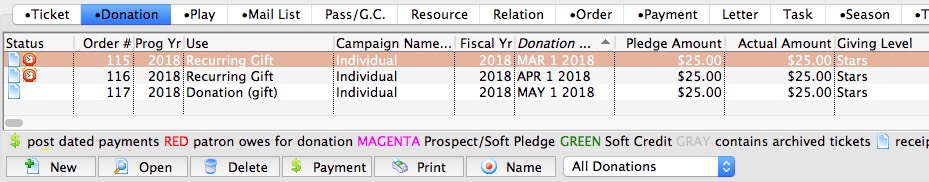

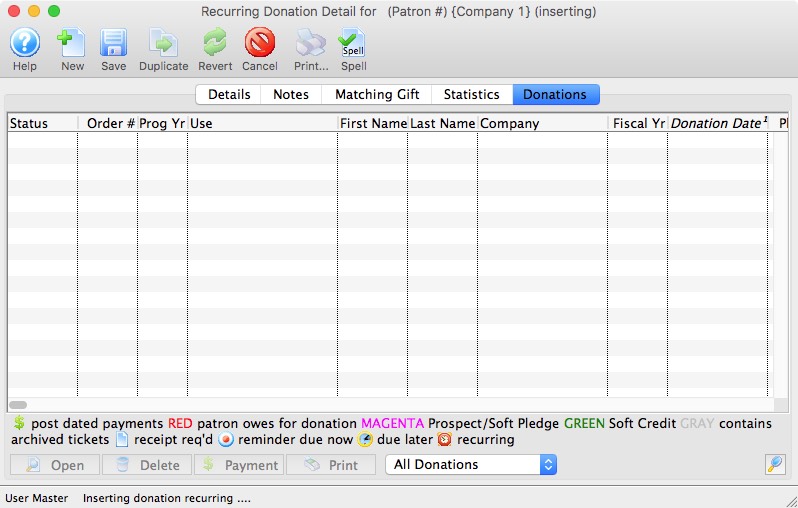

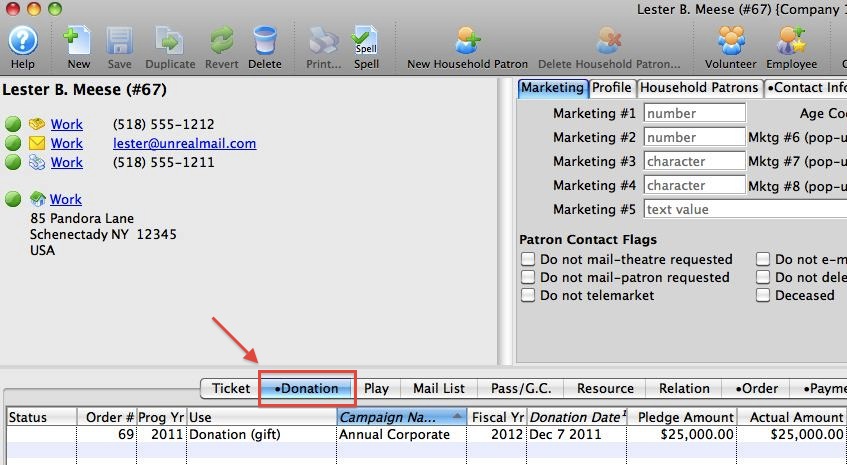

List Window

There are two ways to access the donation list window. The Donation Tab window will let you access other functions of the Donation Module. For instance you can Insert a New Donation from this window or you may access the Donation Detail window from here.

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

Parts of the Donation Tab

| Order # | Unique number assigned to the order for tracking within Theatre Manager. |

|

Program Year |

The Program Year defines the time frame the donation will be recognized in published material. Use it in reports to print a list of Program Names within the Program Year. |

| Use | The type of donation received. |

| Campaign | Campaign the donation was assigned to. |

| Fiscal Year | The financial year the donation was made within. | Donation Date | Date the donation was recorded in Theatre Manager for. |

| Pledge | The amount the donation was originally entered as. |

| Actual | Amount of money received for the donation. A donation may be made in the form of a Stock and the payment amount may be more of less then the donation amount. For information on Stock gifts click here. |

| Donation Balance | The unpaid difference between the Donation and the Total Payment |

| Donation Amount of Receipt | The amount of the donation that receipts have been issued for. |

|

Inserts a new donation. For more information on inserting donations click here. |

|

Opens the selected donation for editing. For more information on editing donations click here. |

|

Deletes a donation when the tax receipt and prior payments have been removed. For more information on deleting donations click here. |

|

Opens the donation payment window. For more information on making payments Click here. |

|

Prints the donation on a ticket if a default ticket face has been associated with the donation. For information on setting up donation campaigns click here. |

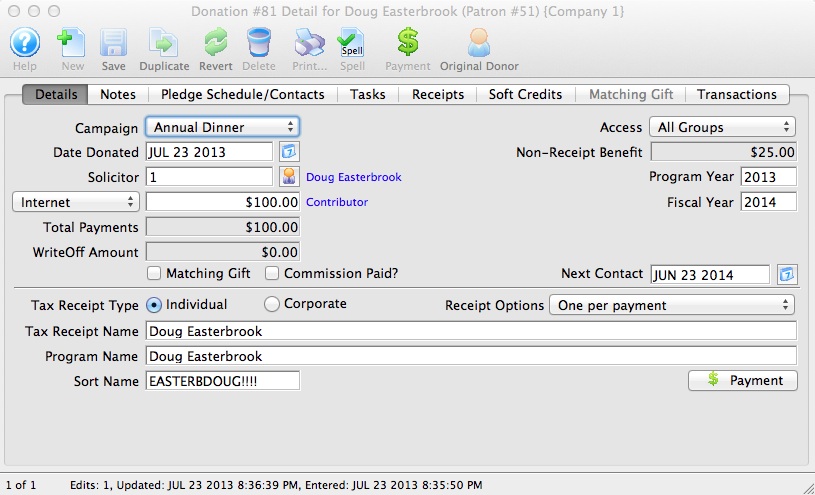

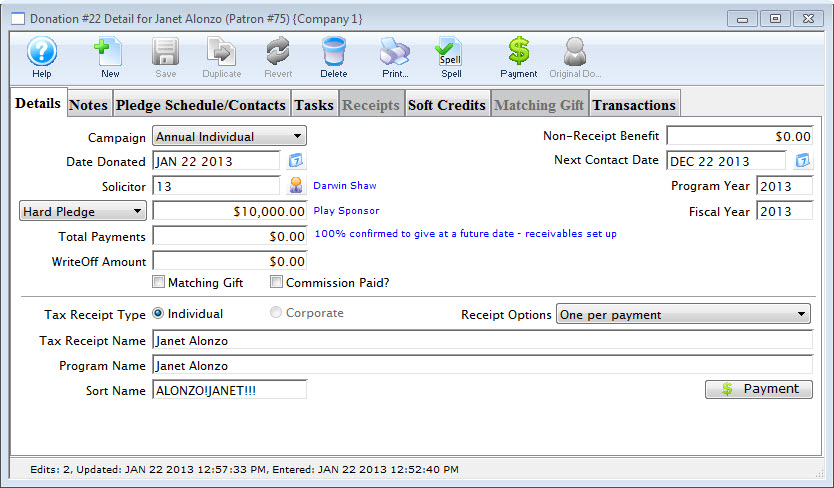

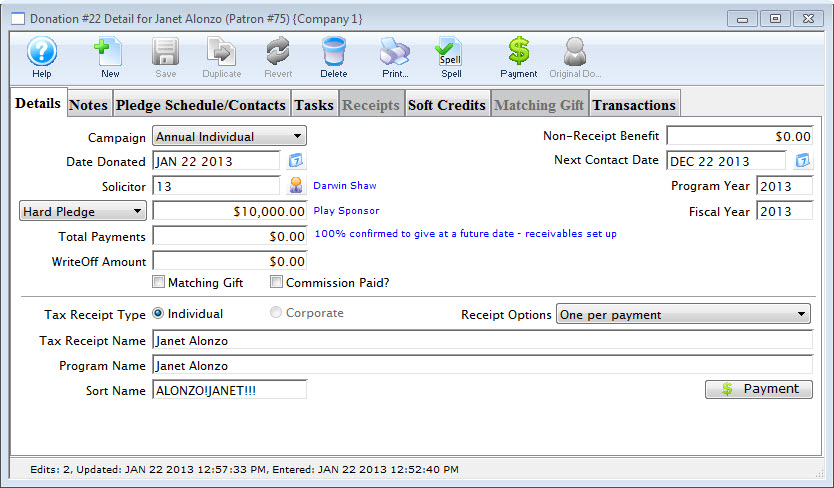

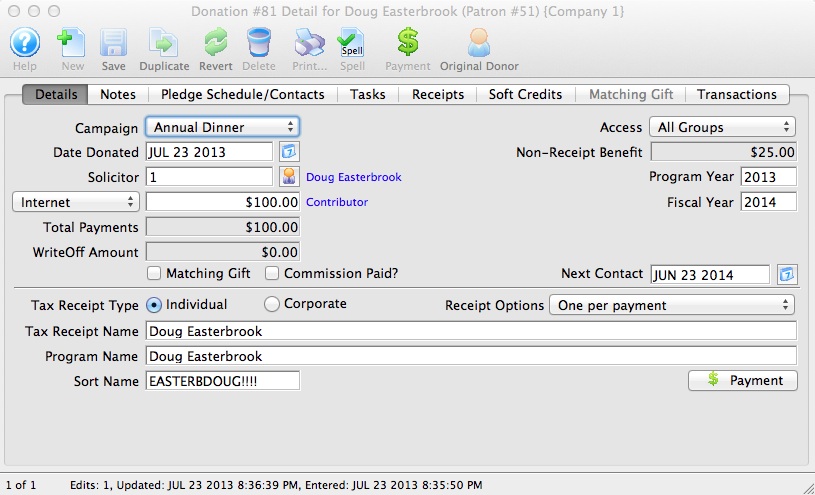

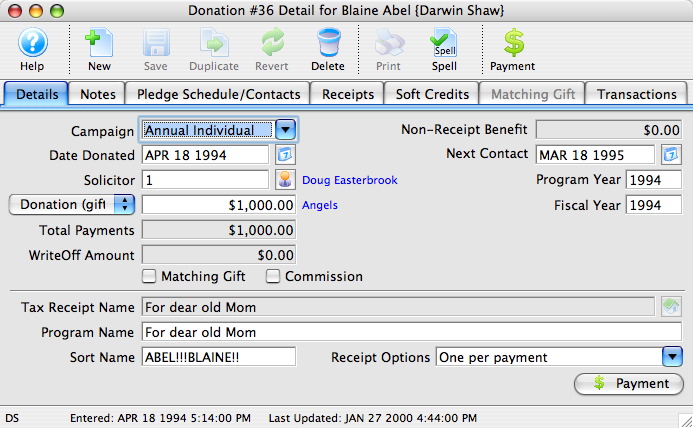

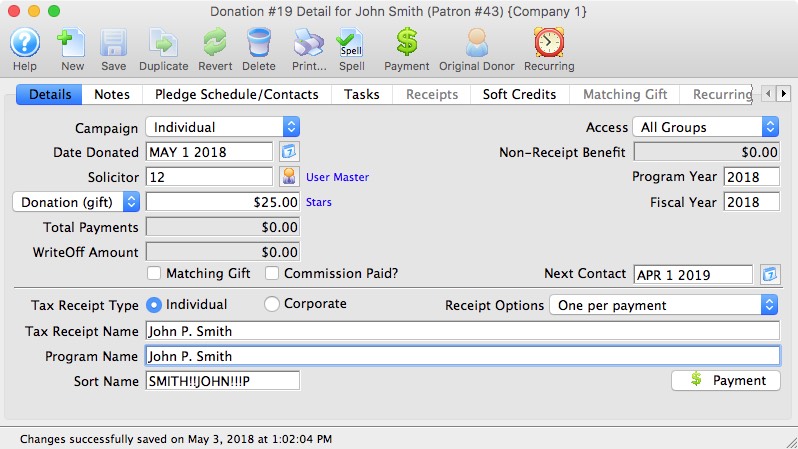

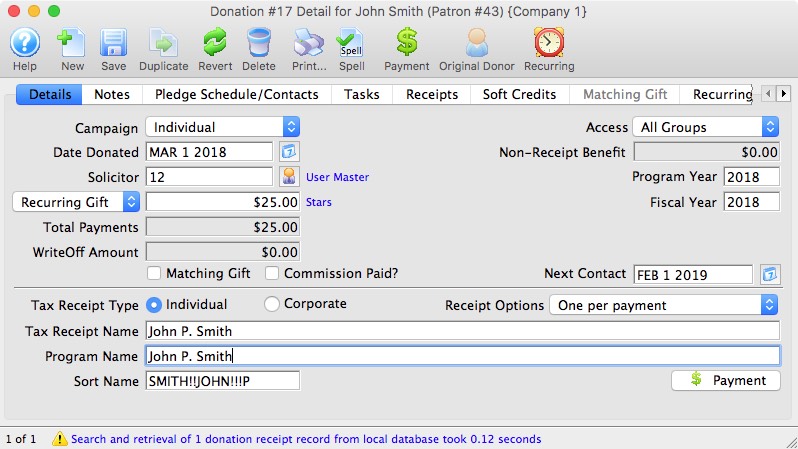

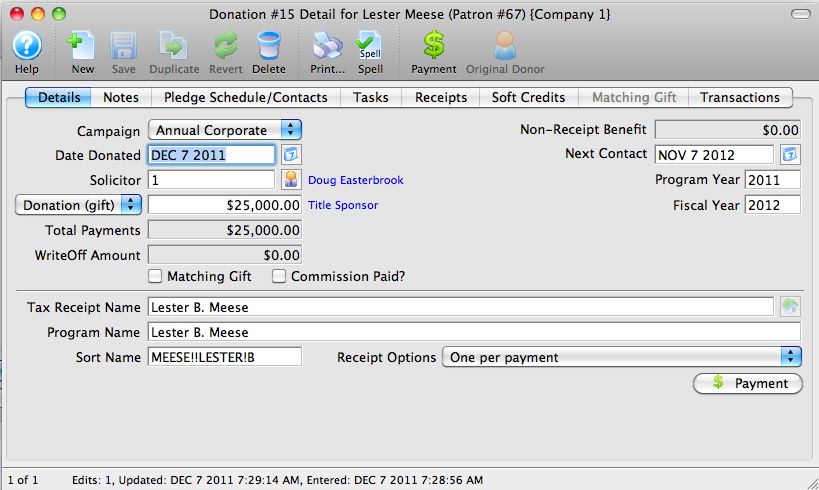

Details Window

- When Inserting Donations the Donation Detail Window is accessed through the donation module or the order window.

- To access a Patron's Donation Detail Window after the donation has been inserted, you can open the patron's Donation tab and the previous donation from there. Double click on any donation line and the Donation Detail Window will appear.

To access the Donation Detail window, you perform the following steps:

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Click the New

button.

button.

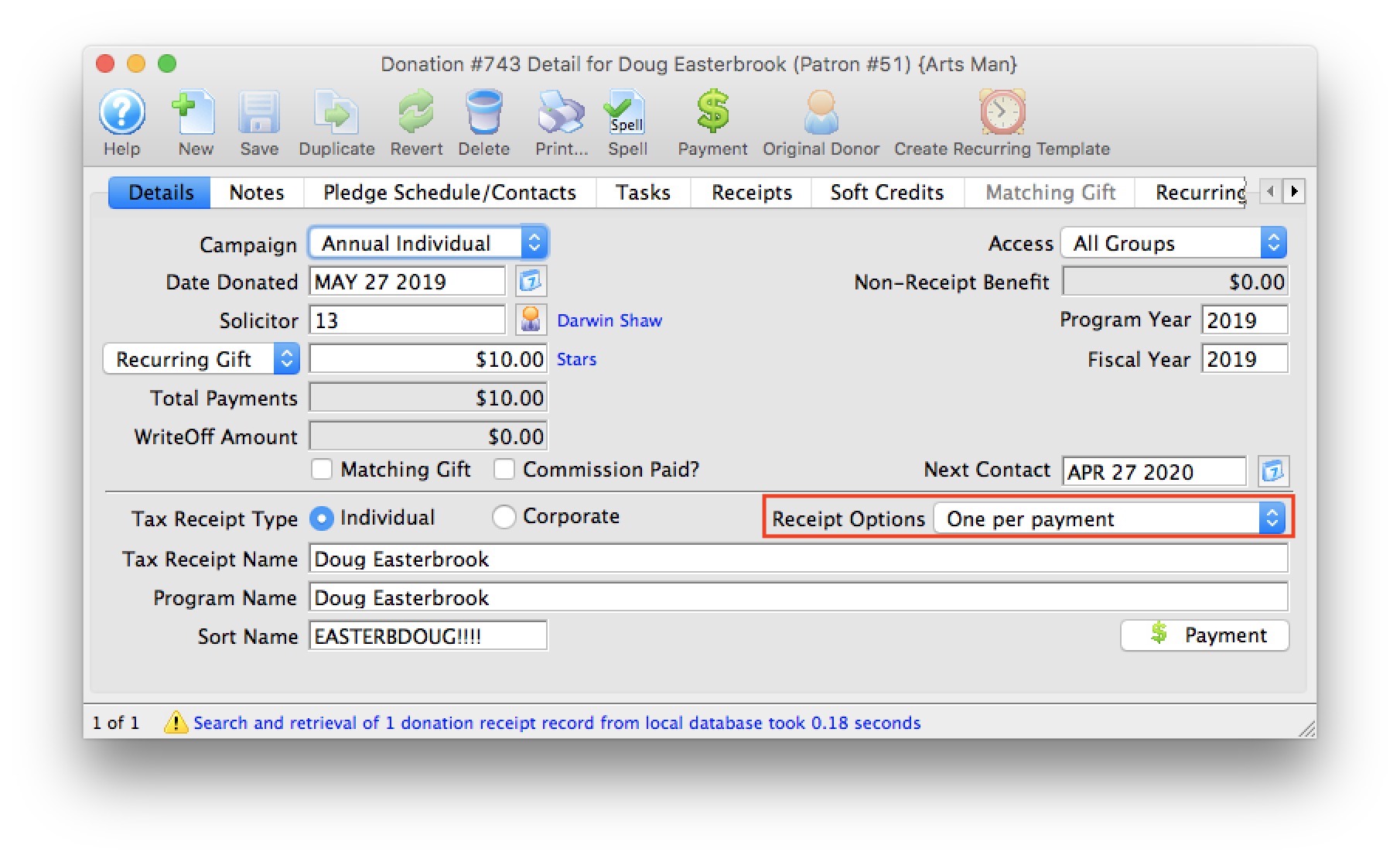

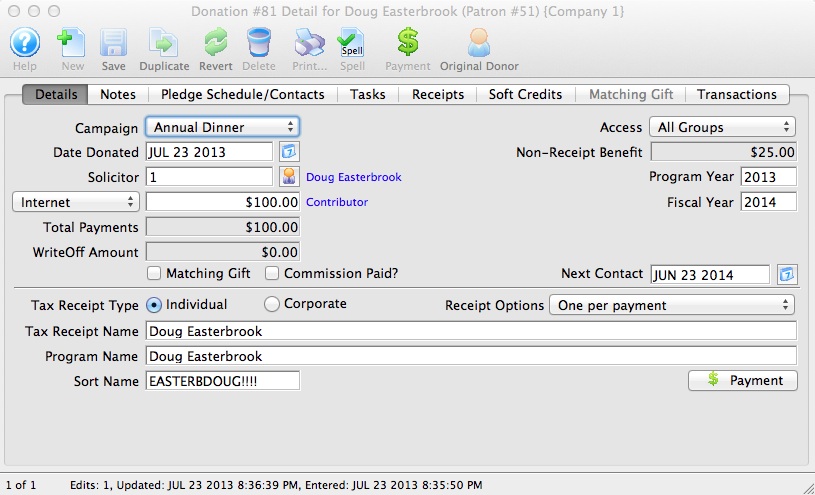

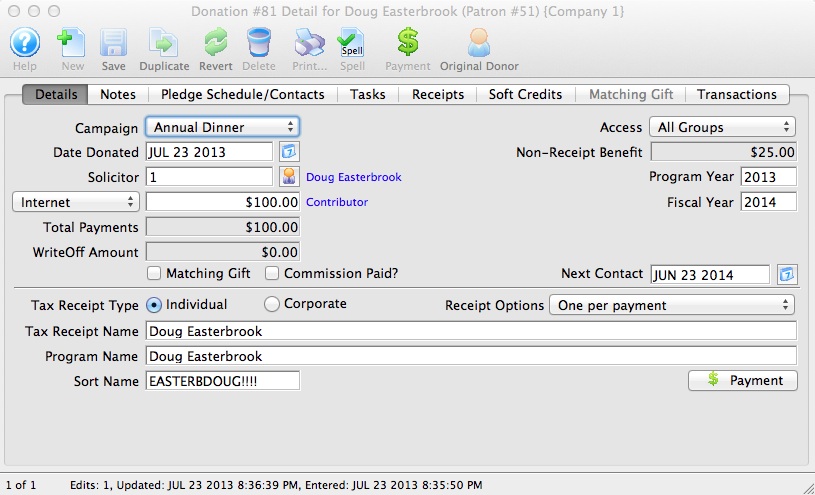

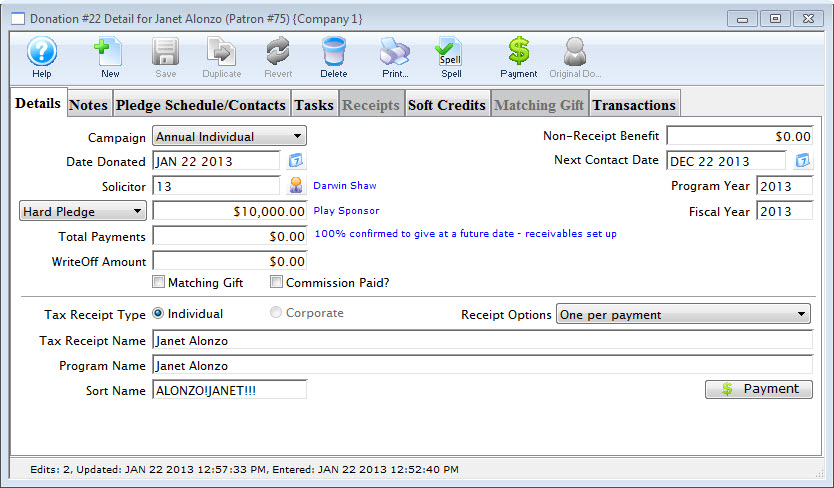

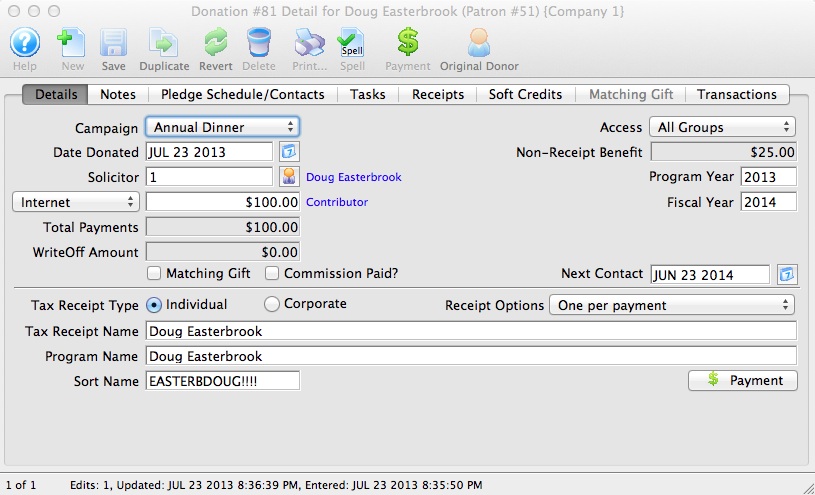

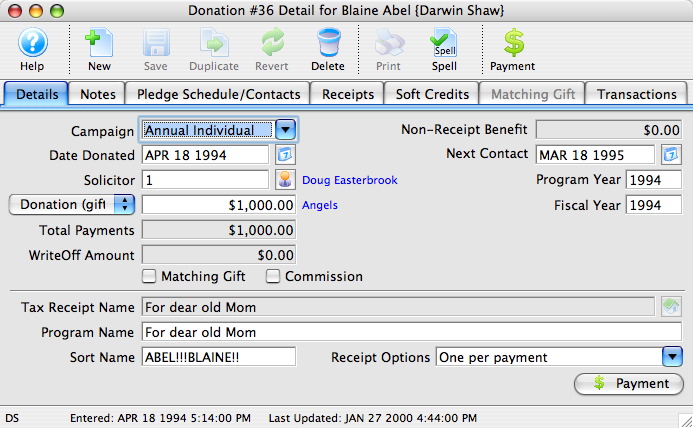

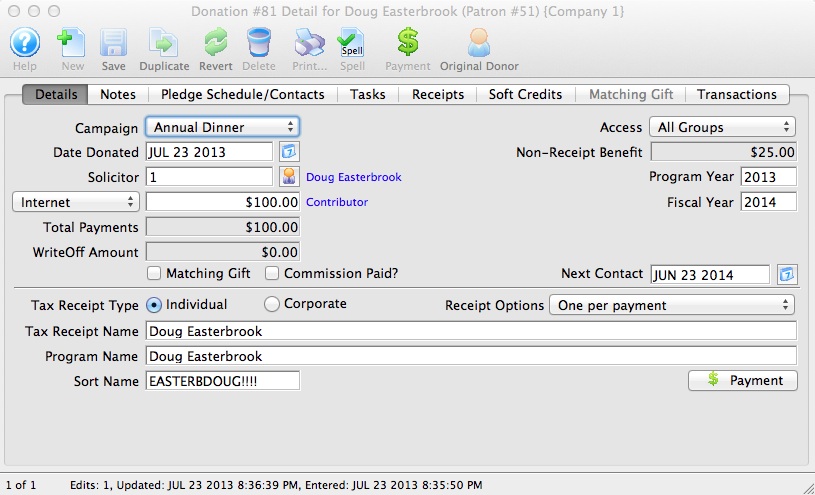

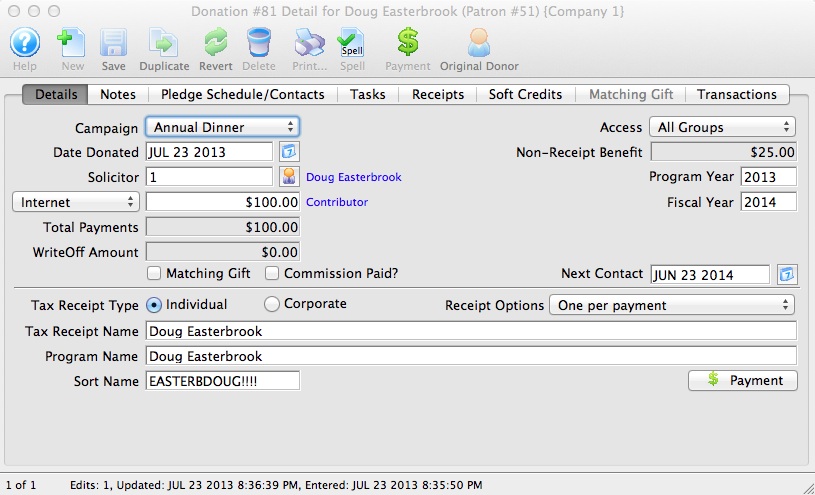

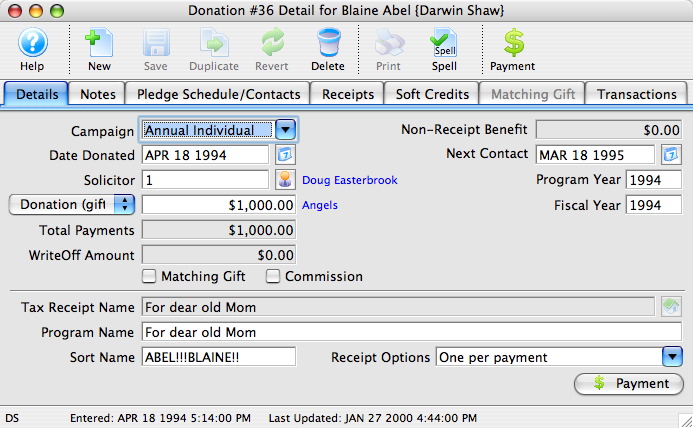

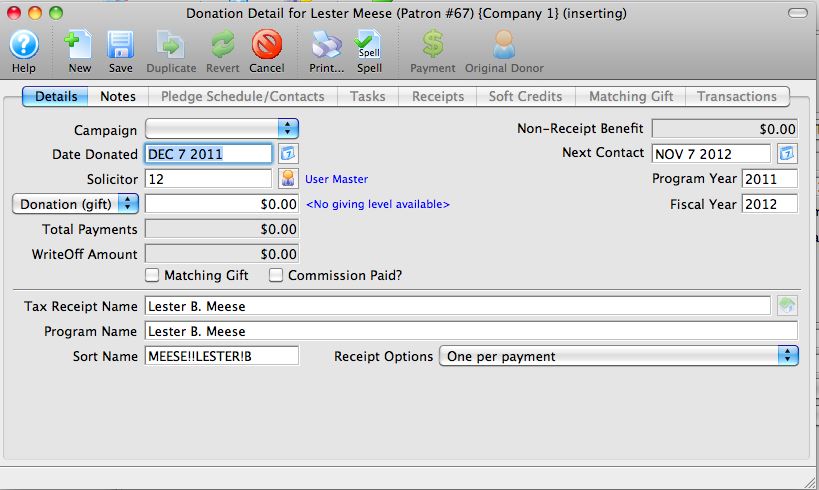

Parts of the Detail Window

|

Inserts a new donation. For more information on inserting donations click here. |

|

Saved changes made to the current donation. |

|

Reverts changes made to the donation back to the last saved point. |

|

Deletes a donation once the donation receipt and payment have been removed. For more information on deleting donations click here. |

|

Generates a report displaying the donation details. |

|

Checks the spelling within the data entry fields. |

|

Adds a payment to the order. For more information on adding payments click here. |

| Campaign | The drop down list contains the possible donation campaign to give the donation to. |

| Date Donated | Enter the date a donation was made or if the donation differ from the default computer date the date can be back dated into a prior calendar year for tax purposes. |

| Solicitor | Select the person responsible for receiving the donation from the drop down. This person must exist in the Employee table (see Setting up an Employee) |

| Donation (gift) |

There are two parts to the actual donation amount:

This amount is normally set up a receivable in Theatre Manager so that the system knows to expect a payment for this amount. It could be one payment or it could be post dated payments. However, the choice in the popup affects whether the GL is informed about the gift. There are generally 4 choices when entering a new gift:

|

| Total Payment | Amount of money received for the donation. A donation may be made in the form of a Stock and the payment amount may be more of less then the donation amount. For information on Stock gifts click here. | WriteOff Amount | The unpaid difference between the Donation and the Total Payment. |

| Matching Gift | Select the Matching Gift if you wish to link this donation to another patron who will also donate as a result of this patron giving a new donation. Click Here for more information. | Commission | Select Commisssion if the employee responsable for the donation receives a persentage of the sale. |

| Access | You can specify the groups of people who can access this donation if you wish to put some sort of restrictions on the record. |

| Non-Receipt Benefit | The amount deducted from the donation receipt to cover taxable benefits received by making the donation. |

| Next Contact | By default, the Next Contact Date is eleven months from the date of the donation. This date can be changed should you require a different date from the default. Use it in reports to print a list of donors that need contacted at that time to ensure that they give on a regular basis. |

| Fiscal Year |

The Fiscal Year defaults from the

|

| Program Year |

The Program Year generally tracks the fiscal year - meaning it is the same. However, you can make the program year an arbitrary year in the future or in the past -- so that you can track totals differently than fiscal year. Changing program year has no effect on financial data. It can be used as selection criteria for creating the program listing.

The allows your FISCAL YEAR to track IRS and CRA reporting/accounting requirements while program year can track your own reporting requirements It defaults to:

|

| Tax Receipt Name |

This field is used to record the name of the individual

who will receive the tax deductible receipt. Theatre Manager prints

a receipt for tax purposes in the name of the individual recorded

here, which could differ from the individual giving the donation.

Please refer to Tax Receipt Name Considerations when entering this field - there are some legal implications. |

| Program Name | This field is used to record how the patron would like to be recognized on the program. Theatre Manager generates a donor recognition report that ensures your donation list is complete and up-to-date. If the Donor wishes to remain anonymous this field should read "anonymous". Click here for more information on making the donation anonymous. |

| Sort Name | The sort name is suggested by Theatre Manager. It is initially based on the last name or company, depending on how the default donor name is selected and it may be changed. The sort name is used to position the donor's name in the program. For example, if the Program Name is 'Anonymous', the sort name could still be 'Smith'. This would cause the program to creating a listing for 'Anonymous' under S. |

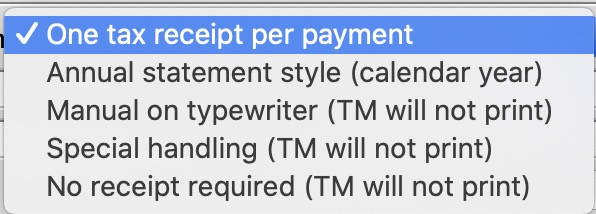

| Receipt Options | Choose how and when receipts should be Printed. The options are described on this web page. |

|

Click here for details on the Notes tab. |

|

Click here for details on the Pledge Schedule tab. |

|

Click here for details on the Receipt tab. |

|

Click here for details on the Soft Credit tab. |

|

Click here for details on the Matching Gift tab. |

|

Click here for details on the Transaction tab. |

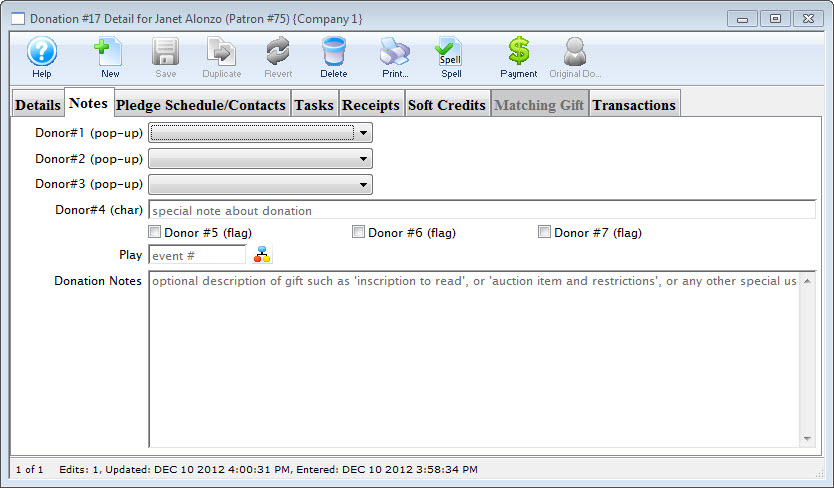

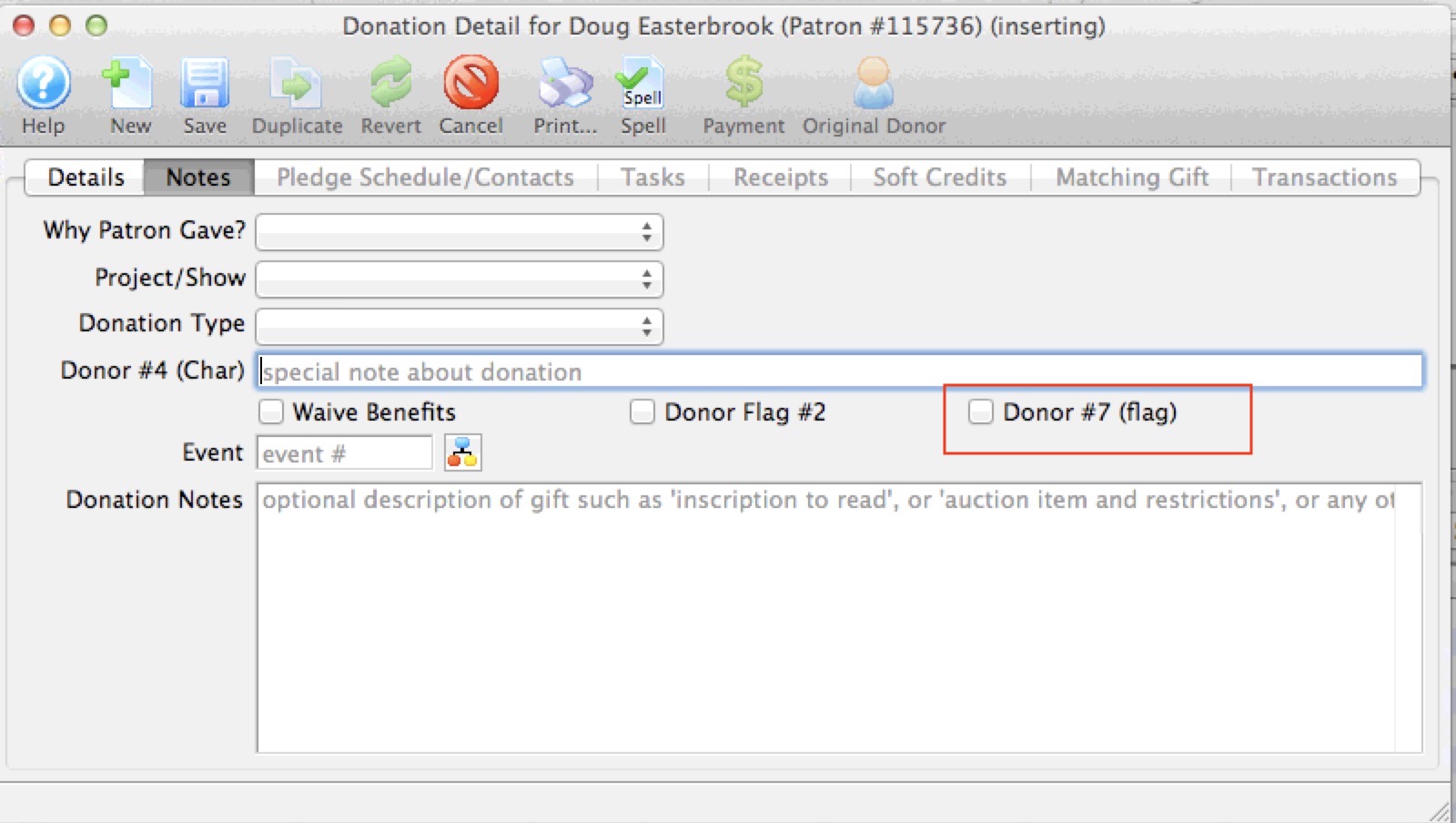

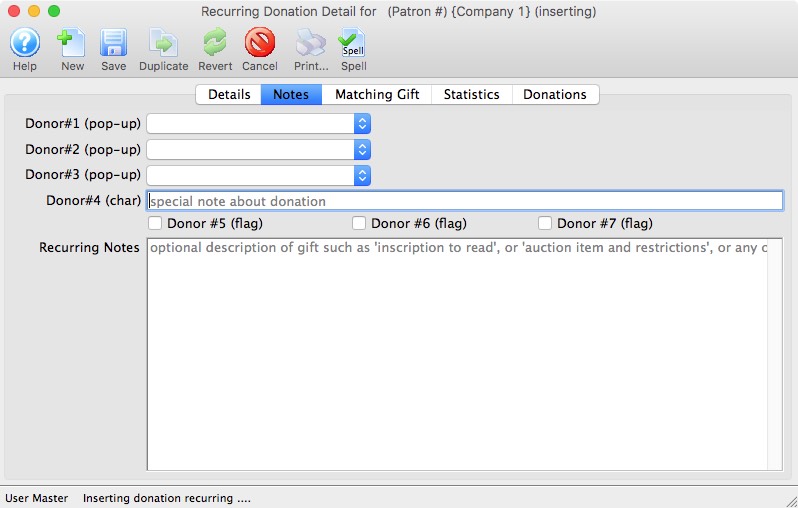

Note Tab

The Notes Tab allows you to select specific donors and event / plays and enter Notes about the selected donation.

Parts of the Notes Tab

| Donor #1 (pop-up) | A customizable pop-up field edited through the code tables. This pop-up can be made a mandatory field in Company Preferences. |

| Donor #2 (pop-up) | A customizable pop-up field edited through the code tables. This pop-up can be made a mandatory field in Company Preferences. |

| Donor #3 (pop-up) | A customizable pop-up field edited through the code tables. This pop-up can be made a mandatory field in Company Preferences. |

| Donor #4 (char) | A customizable character field. This field can be made a mandatory in Company Preferences. |

| Donor #5 (flag) | A customizable Check Box. |

| Donor #6 (flag) | A customizable Check Box. |

| Donor #7 (flag) | A customizable Check Box. |

| Play | Allows you to attach a play to this donation. Use the Event / Play Lookup  button to choose from a list of events / plays. button to choose from a list of events / plays. |

| Donation Notes | Any addition notes to be added to the donation. If the donation was a matching gift, notes to that effect will be automatically placed here. |

|

If any of the customized fields are made mandatory, you will need to edit the TMdonation.html web page in order to successfully accept donations online. |

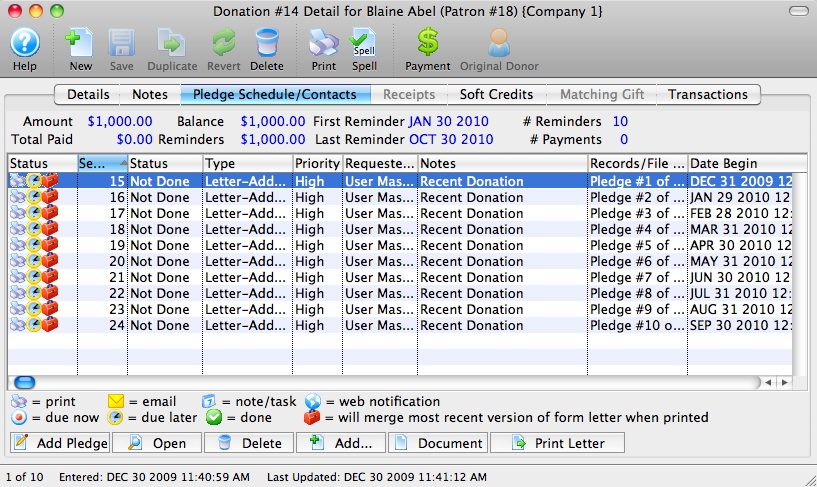

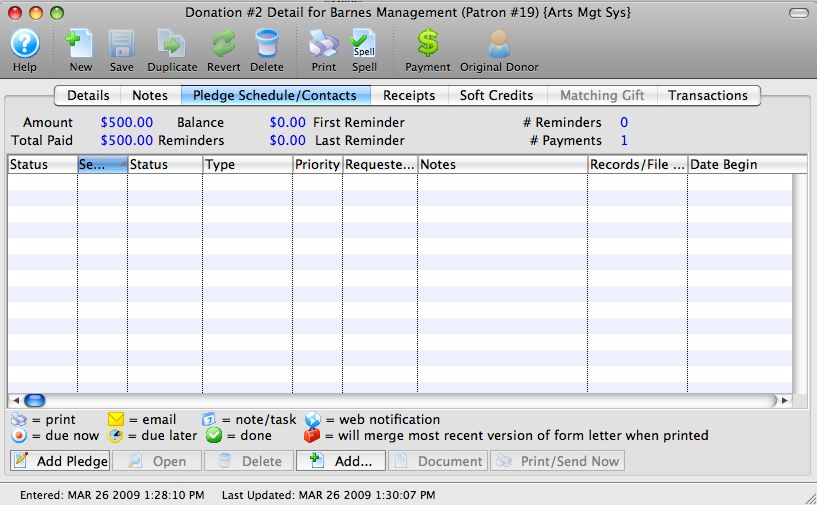

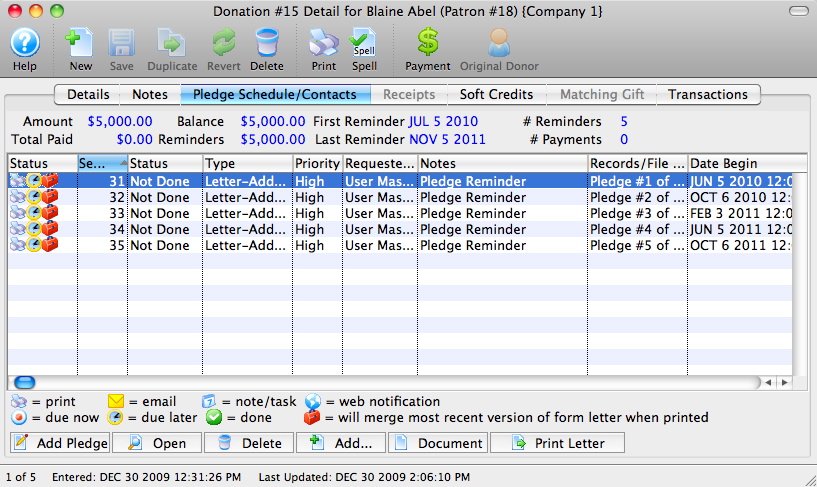

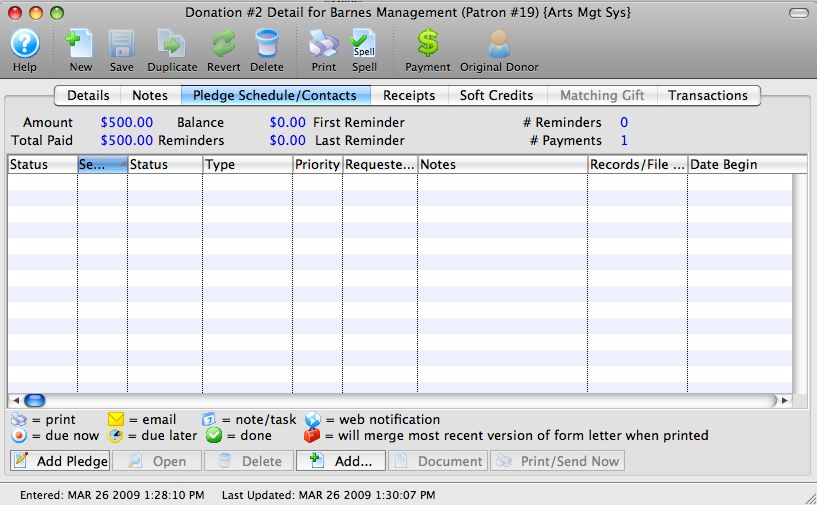

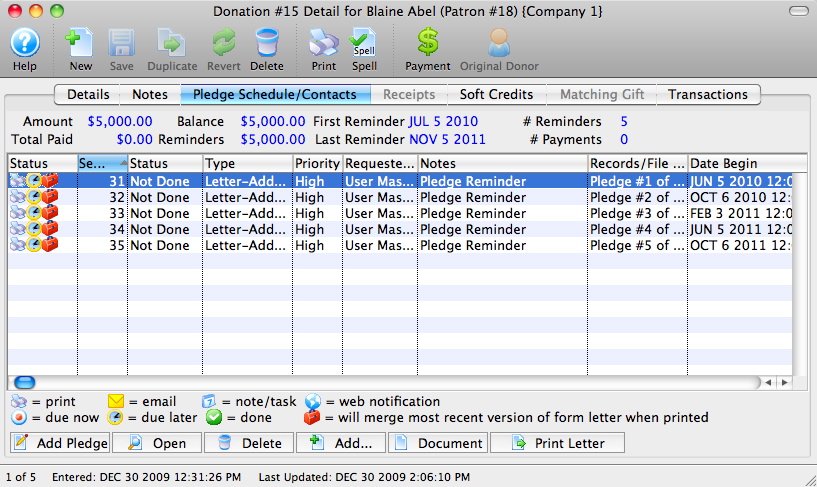

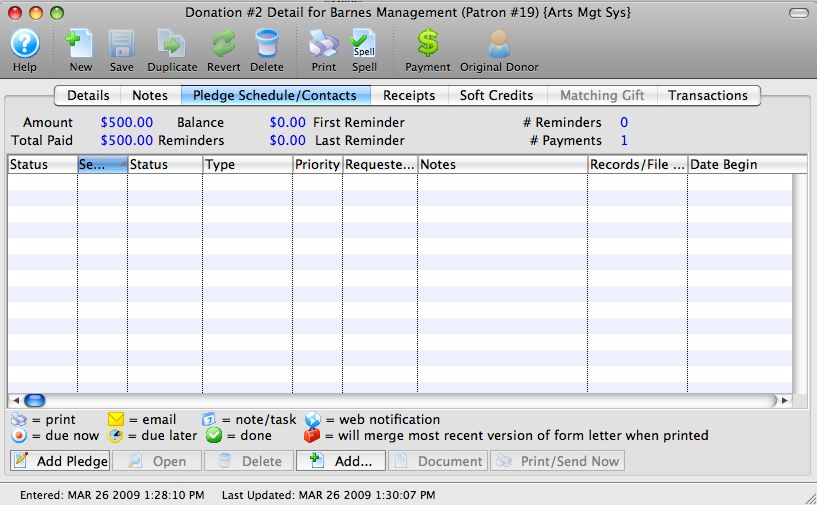

Pledge Schedule & Contacts Tab

This tab can be used to add Pledge Schedules and track all donation Contacts.

Parts of the Pledge Schedule / Contacts Tab

| Status | Pictorial progress of the letter, pledge or email. |

| Seq # | Sequence number of the letter, pledge or email. |

| Status | Verbal progress of the letter, pledge or email. |

| Type | Type of contact detail. |

| Priority | Rating of priority. |

| Requested By | Employee who added the letter, pledge or email. |

| Notes | Name of the letter or email. |

| Records/File Connected to Correspondence | Details of the attached letter, pledge or email. |

| Date Begin | Date the correspondence is set to begin. |

|

Adds a scheduled pledge reminded to the donation. For more information on scheduled pledges click here. |

|

Opens the selected letter, pledge or email. |

|

Deletes the selected letter, pledge or email. |

|

Adds a new letter or email to the donation. |

|

Opens the document that corresponds to the selected pledge, letter or email. |

|

Prints the selected letter. |

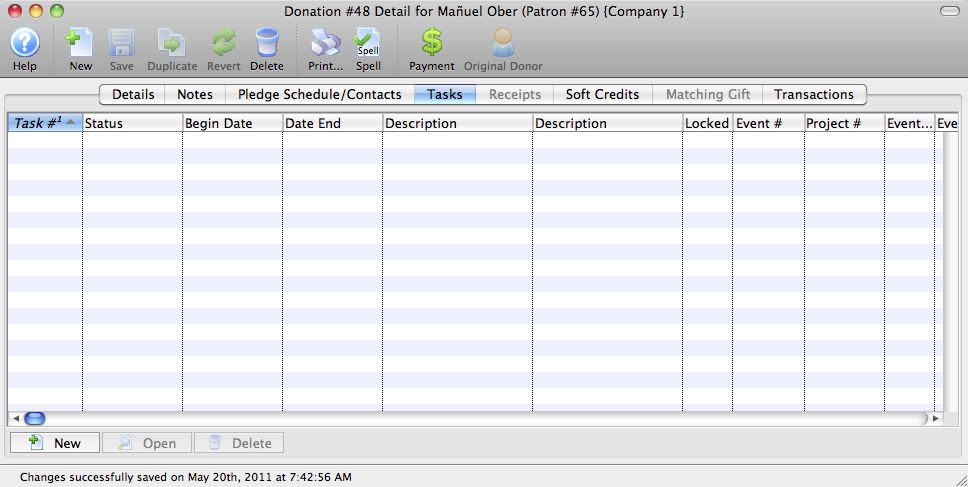

Tasks Tab

Calendars show tasks to be done in a variety of formats. Gantt charts (part of Projects) show tasks associated with each other and the relationships between the various pieces. Invoices use tasks and the associated people and resources as line items in an invoice to bill clients.

You can associate tasks with any number of people who are responsible for making sure the task gets completed. Tasks can be reminders to yourself about upcoming deadlines. Tasks can be used to schedule your time. Tasks can have physical resources assigned to them that may be billed or not.

Notifications or reminders can be set up for tasks so you don't miss a meeting or appointment.

To learn more about tasks and how to add them click here.

Parts of the Tasks tab

| Task # | The sequence number assigned by the database to the task. |

| Status | The current status of the task (Done, Not Done, In Progress, Cancelled). |

| Begin Date | Date the task is set to begin. |

| Date End | Projected completion date of the task. |

| Description | The description of the task. |

| Event Title | The title of the event / play associated with the task (if any). |

| Event Code | The event / play code associated with the task (if any). |

| Perf # | The Performance number associated with the task (if any). |

| Date | The date of the event associated with the task (if any). |

| Time | The time of the performance associated with the task (if any). |

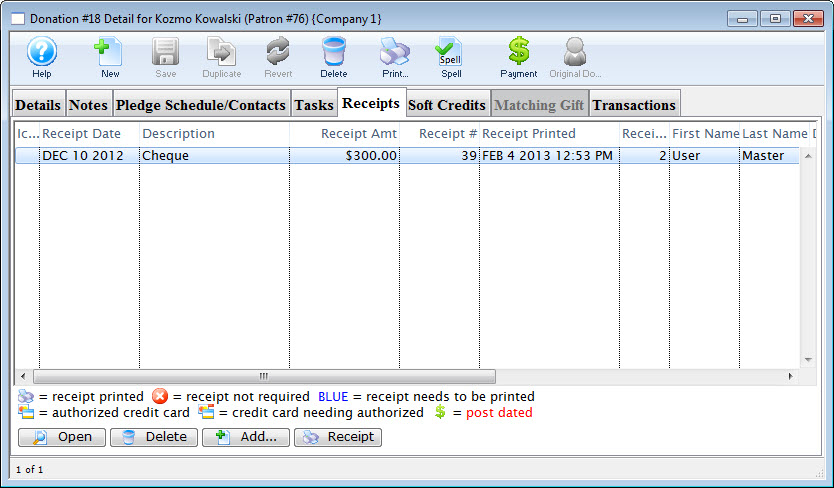

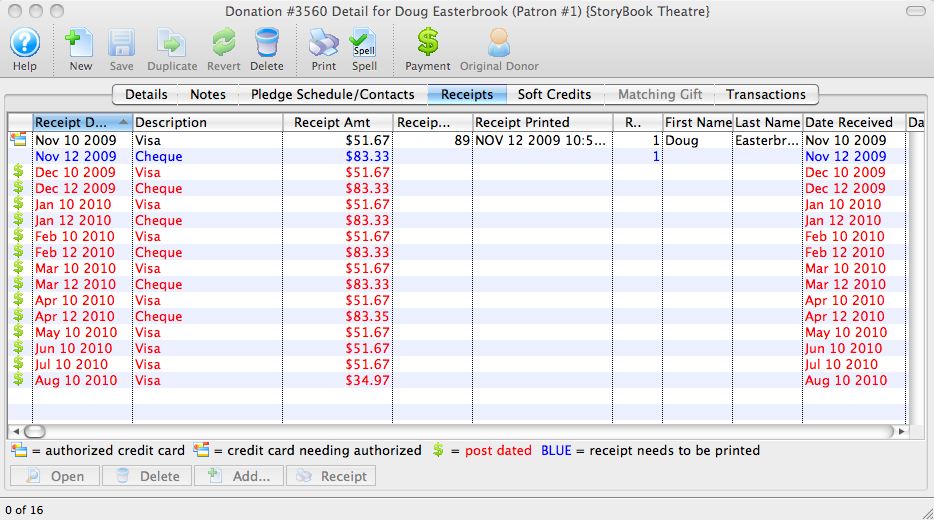

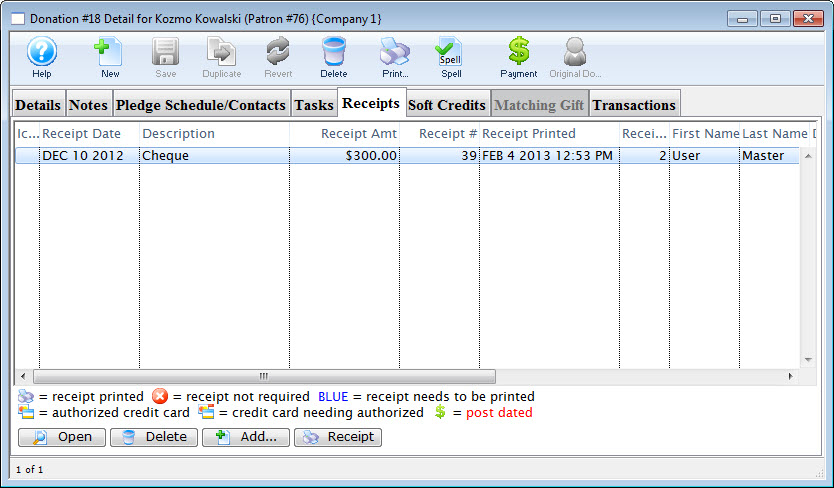

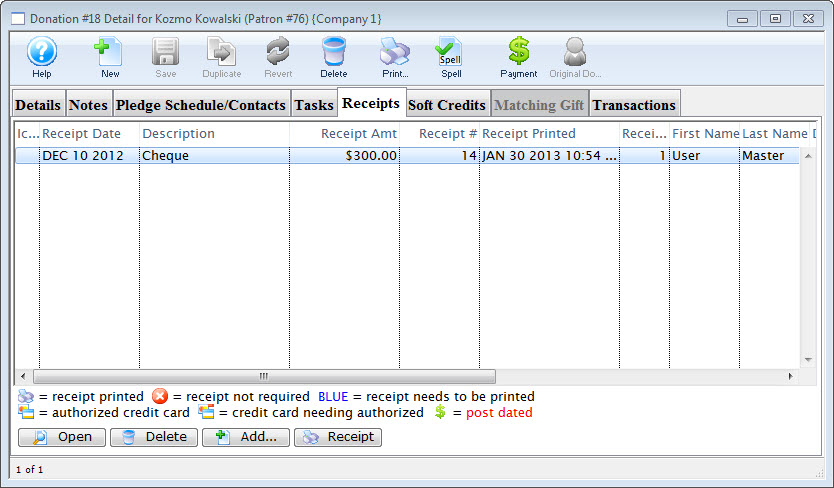

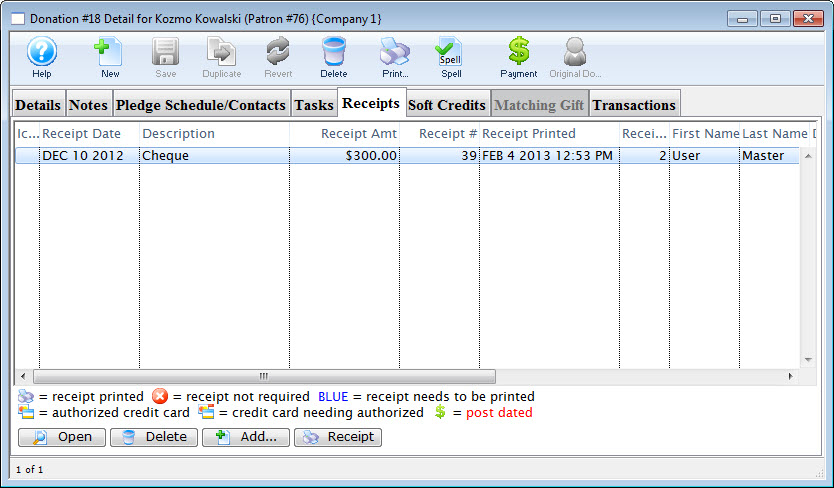

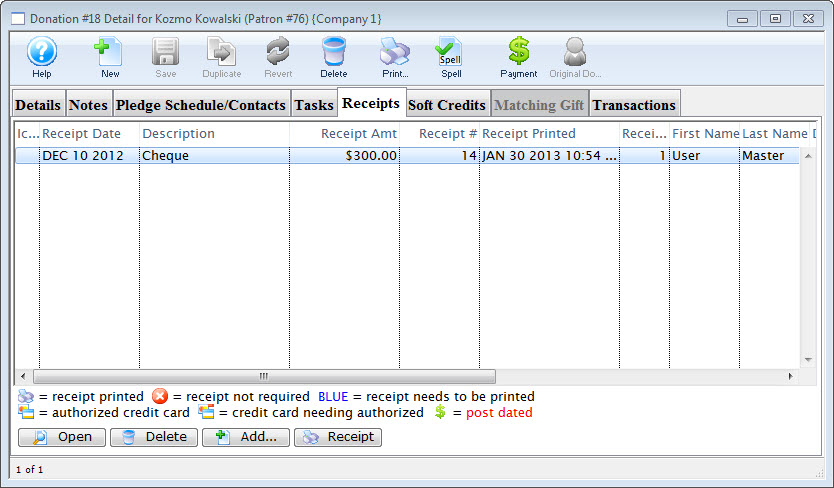

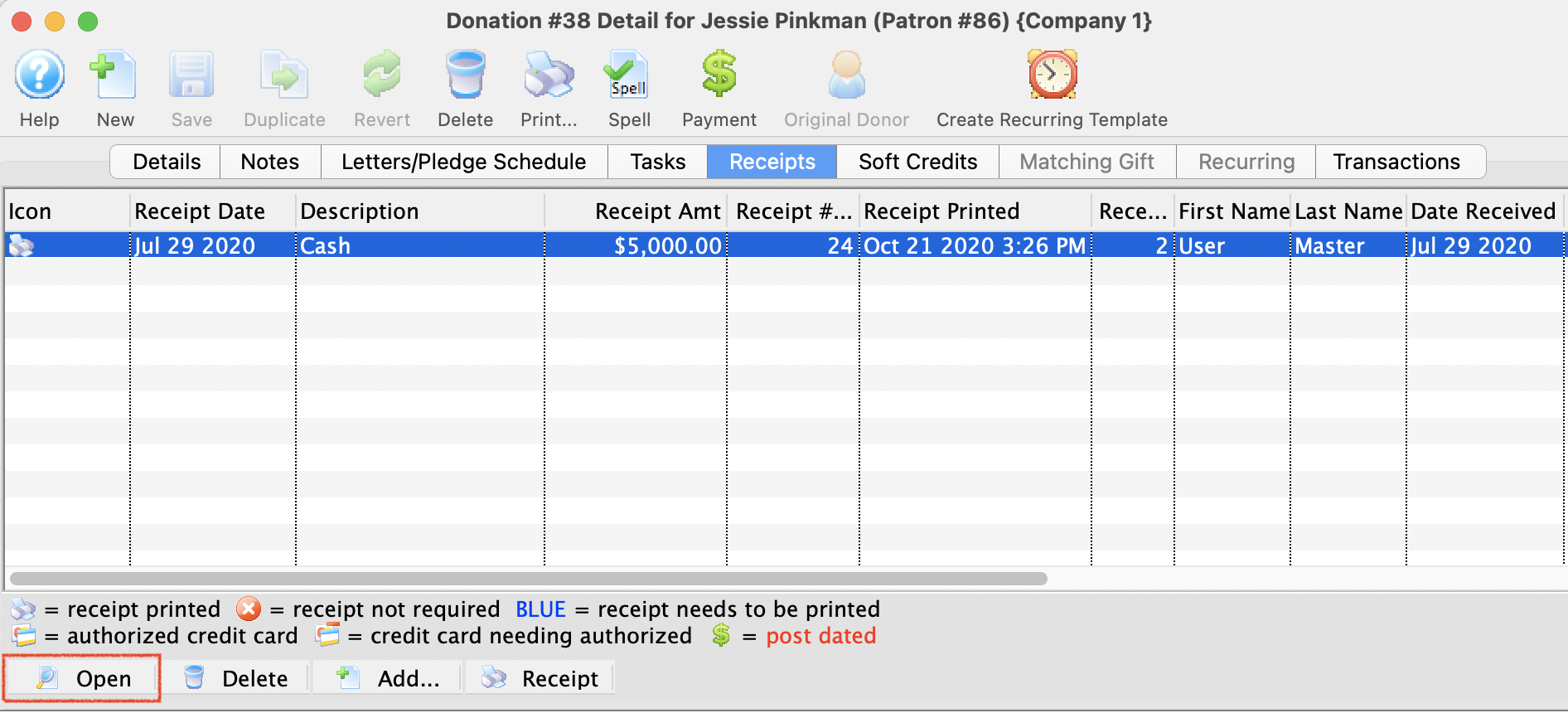

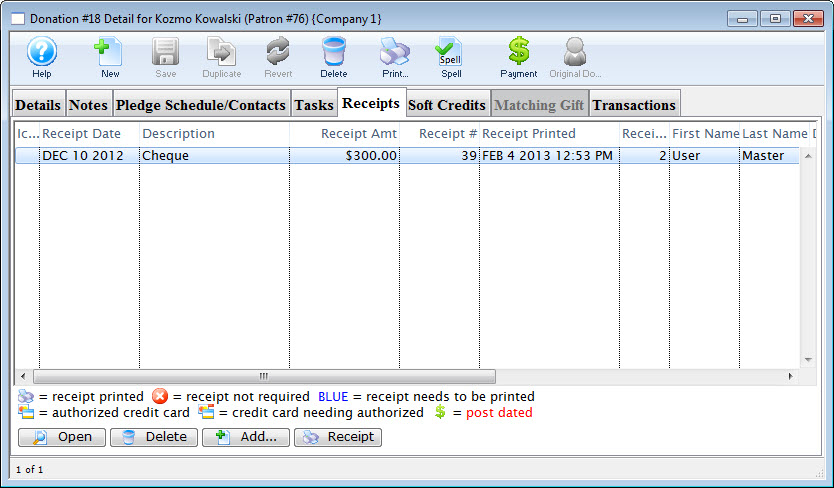

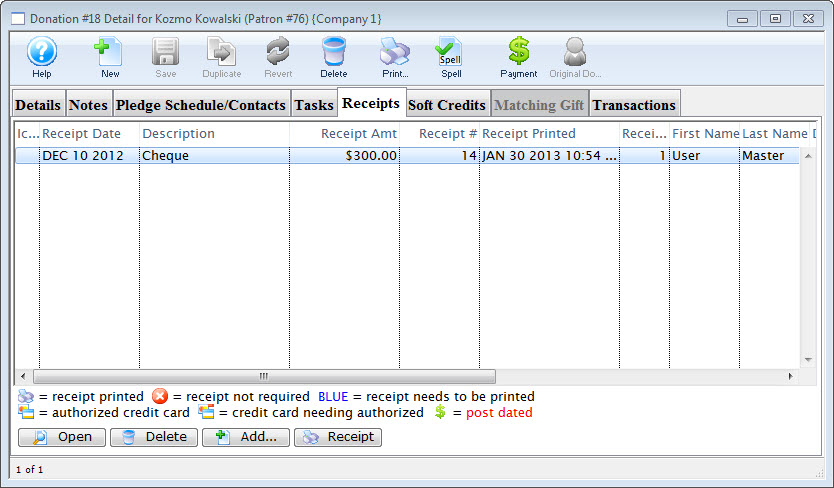

Receipt Tab

|

Please refer to receipt options to see how your choices of when and how receipts should be printed for the donation by Theatre Manager. |

Parts of the Receipt Tab

| Receipt Date | The Date the Receipt was created i.e. The day the payment was received. |

| Description | Method of payment received. |

| Receipt Amount | Amount the receipt was issued for. |

| Receipt # | The number of the receipt. This number is setup in Company Preferences under the Donation Receipts tab. |

| Receipt Printed Date | Date the receipt was printed. |

| Receipt Print Count | Number of times the receipt has been printed. |

|

Opens the Edit Manual Receipt detail window. |

|

Deletes the selected receipt. If after the receipt is deleted the total donation is greater than the receipted amount Theatre Manager will rebuild the order and recreate the receipts. |

|

Adds a form letter to the selected payment. |

|

Prints a ticket receipt for the selected payment. |

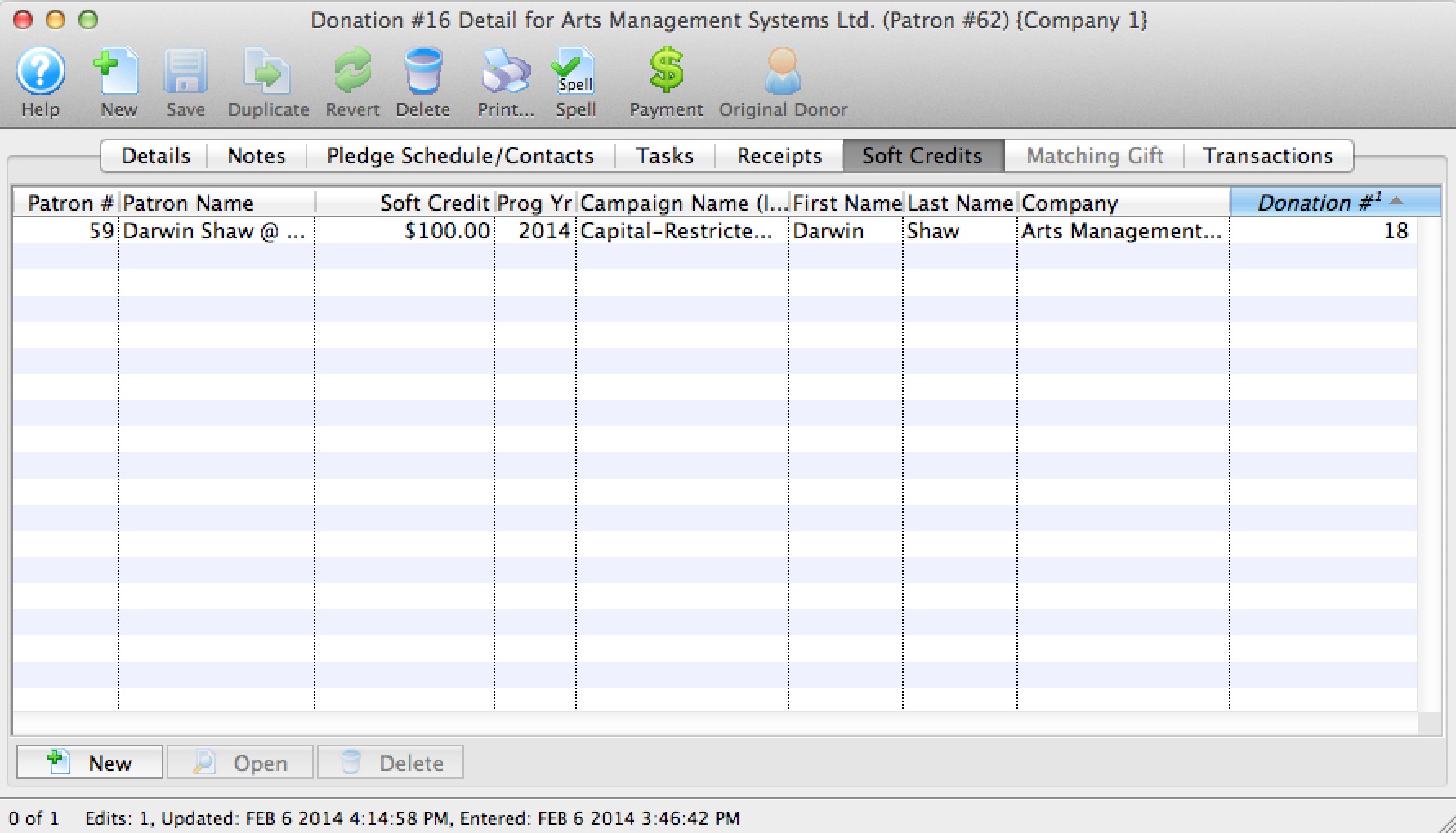

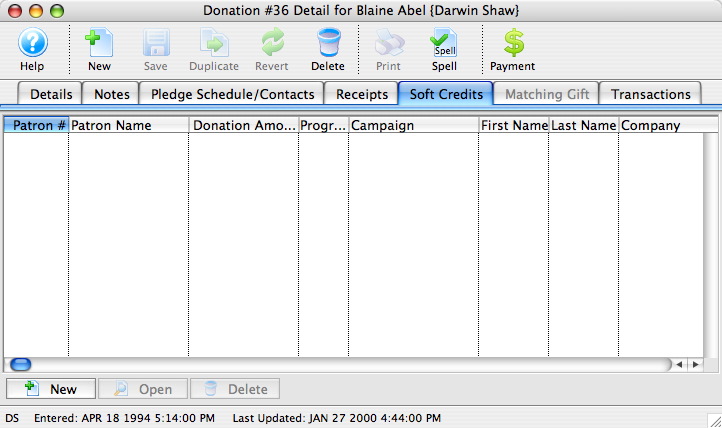

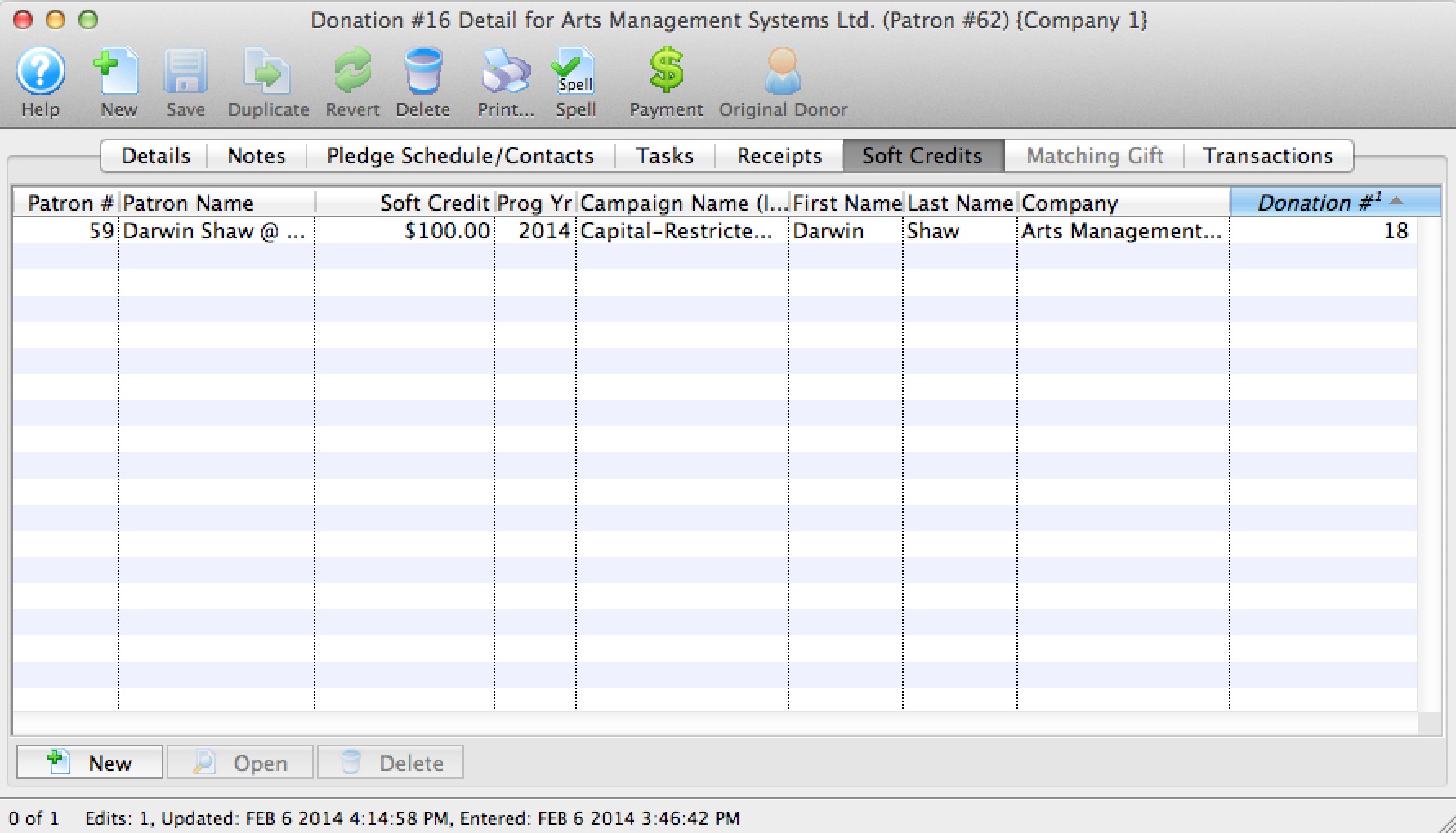

Soft Credit Tab

A Soft Credit is used to attach a patron other then the donor to the donation. The purpose is to recognize a patron for the value of the contributions they helped raise.

Parts of the Soft Credit Tab

| Patron # | Reference number for the patron associated by the soft credit. |

| Patron Name | First and last name of the patron. |

| Soft Credit | Amount of the donation the patron is to be recognized for. |

| Program Year | The year in which the patron should be recognized in publications. |

| Campaign Name | Campaign the donation was contributed to. |

| First Name | First name of the patron. |

| Last Name | Last name of the patron. |

| Company | Company the patron works for. |

|

Inserts a new soft credit. For more information on creating soft credits click here. |

|

Opens the selected soft credit for editing. |

|

Deletes the selected soft credit. |

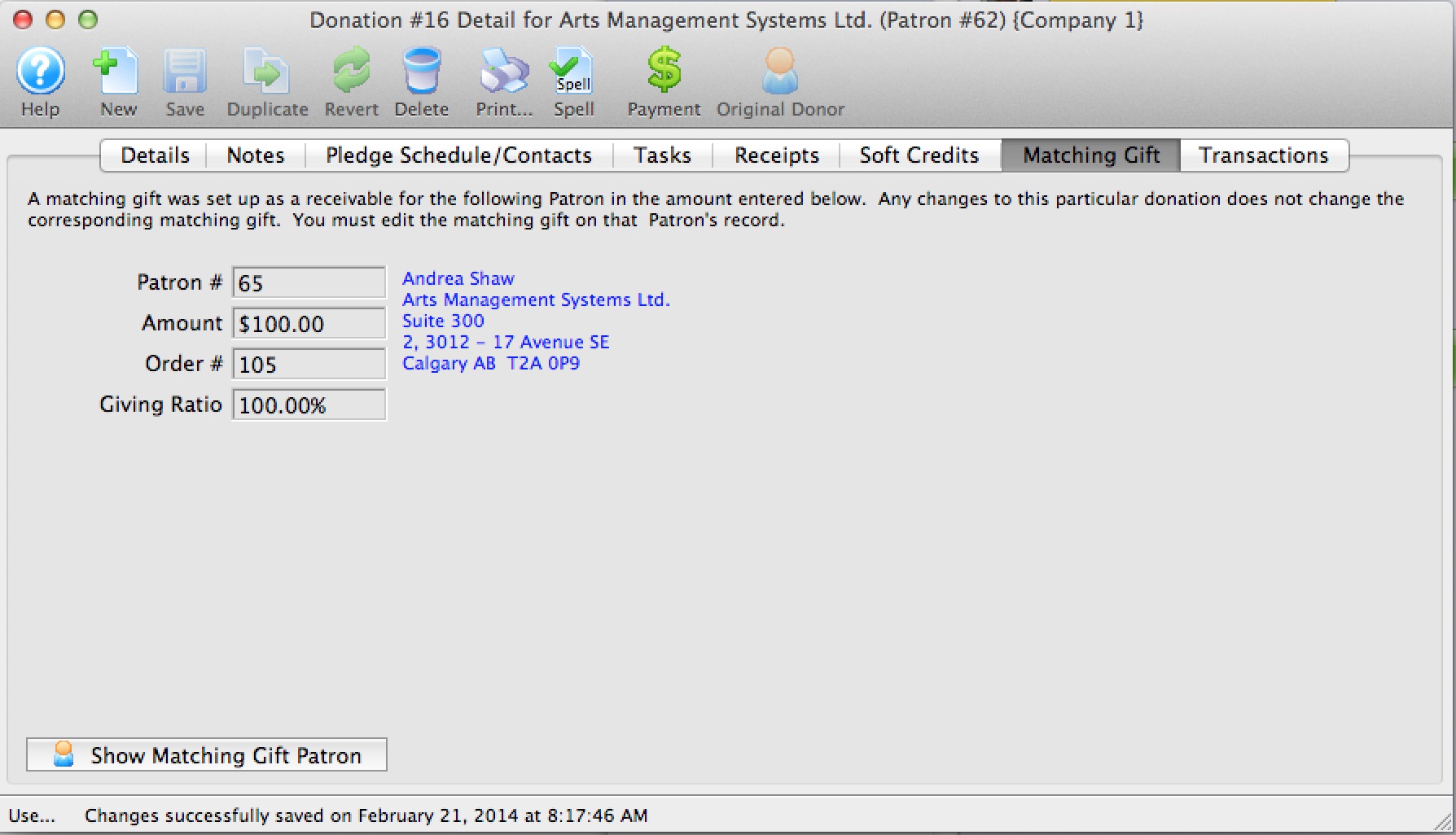

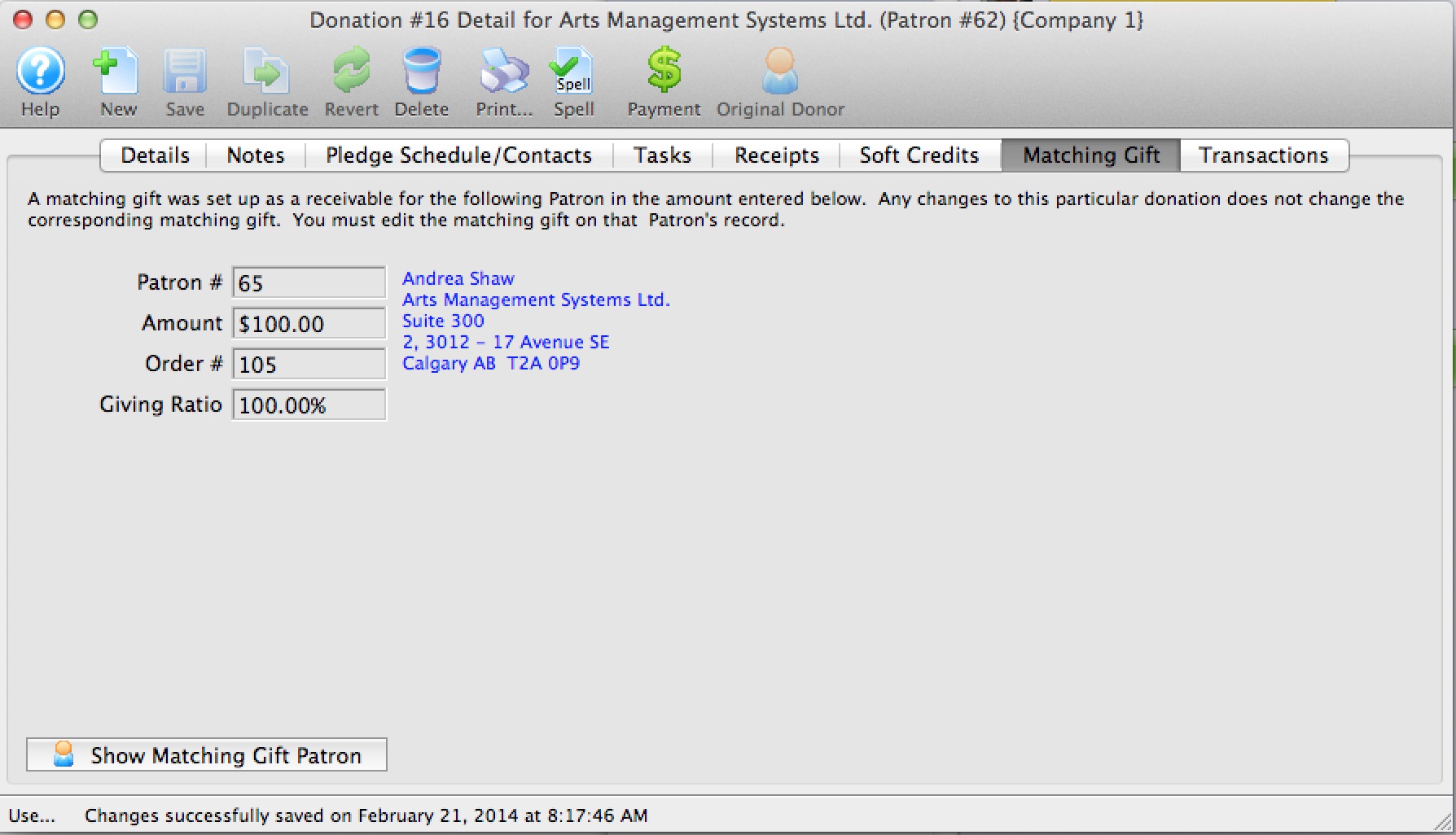

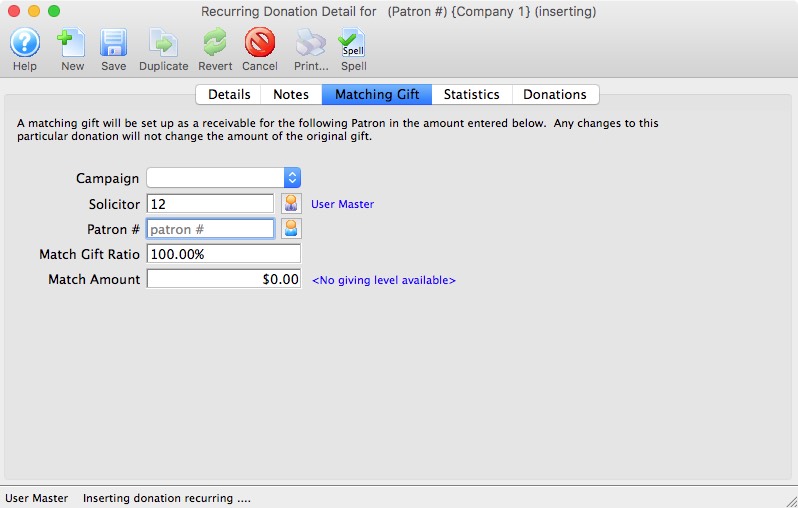

Matching Gift Tab

For details on inserting matching gifts click here.

Parts of Matching Gift Tab

| Patron | Patron number for the matching gift patron. |

| Amount | Value of the donation the matching gift patron will make. |

| Order # | The order number in the matching gift patrons file. |

| Giving Ratio | The percentage the matching gift patron's donation is in relation to the original donation |

|

Opens the patron record for the matching gift patron. |

Quick reference Information for Matching Gifts

|

Quick reference information for Setting up the Gifter |

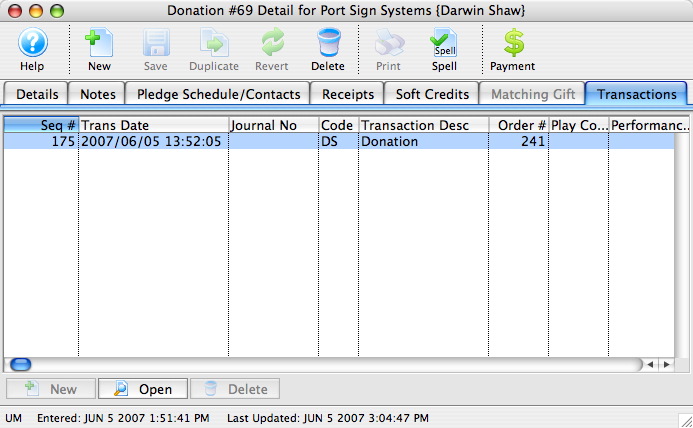

Transaction Tab

Parts of the Transactions Tab

| Seq # | The transaction reference number. |

| Trans Date | Date the transaction took place. |

| Journal No | Journal Entry reference number. |

| Code | Theatre Manager reference code used to determine the type of transaction. |

| Transaction Desc | Brief description of what the transaction was. |

| Order # | Reference number used to tract the components of the order. |

| Play Code | Play code reference the donation is associated with. |

| Performance Code | Performance code reference the donation is associated with. |

|

Opens the selected transaction displaying the transaction details window. |

Campaign Setup

|

You can download the Cheatsheets (1-2 pages) and Screencasts (online video demonstrations of the functions with narration) by clicking on the icons. |

Campaigns are at the heart of the donation module. For accounting and marketing purposes, Theatre Manager allows you to divide your fundraising activities into as many "campaigns" as you wish. You may choose to have a single Annual Campaign that rolls over from year to year, or you may opt to create a new Annual Fund Campaign each year, thereby allowing you to place funds from each year into separate GL account.

While all funds for campaigns are initially processed through your general operating accounts, certain campaigns - such as the Capital Campaign - may actually reside in another bank or bank account. To handle this, Theatre Manager uses a Donation Bank Transfer (or "clearing" account) that signals your accountant to move funds from the main account to the other bank account that is being used for the Capital Campaign. And Theatre Manager handles all this accounting for you through the End Of Day.

Campaigns can be set be used only in specific places (box office vs, the web) and for specific purposes (all ticket returns go to a specific campaign, while general gifts have more options). Solicitors can be set to a specific employee or "champion" or can be left unset so that whomever solicits the donation will get the credit for having done so. This is particularly helpful in "Ticket Round-up" campaigns where Box Office staff can compete to see who raises the most funds.

Each campaign can be assigned a specific "Giving Level Matrix" which is simply a listing of dollar levels and their matching name. For example:

- $0.00 to $99.99 Donor

- $100.00 to $249.99 Friend

- $250.00 to $349.99 Star

- $350.00 to $499.99 Director

- $500.00 to $999.99 Producer

- $1,000.00 to $999,999.99 Playwright

You can also indicate within each level what benefits they may receive for their gift (if any) and record any impact that may have on their taxable receipt amount.

Setting Up Stock Gifts / Donations

We have a number of sites that receive stock donations. The general practice, is to value the stock at time of gift. This is the valuation for the tax receipt the donor receives.

The theatre can keep the stock (perhaps for an endowment investment) or turn it over to a broker to sell it under the direction of the theatre.

The donation value is most often recognized at the time of the gift. The amount actually received can be more or less than that valuation.

To handle this, yopu create a payment method called 'stock gain/loss' to be written off to a special account. You create this new payment method in code tables. For more information on code tables, click here.

For future reference, in the donations notes field, you can include the information regarding amount of shares, at what price, and when you sold them in the donation notes field.

Should you create the GL account as an expense account or revenue account?

The required GL Accounts are:

- Stock (Asset) - only if you keep Stock in the current form as Stock to be sold at a later date

-

Stock Gain/Loss (Revenue GL Account)

The account numbers and actual type are defined by your accountant.

Any brokerage fees (hopefully you have a generous broker who does not keep the fees) are treated the same way as a Gain/Loss on the sale of the stock.

Example A:

Receive $1,000 Stock and keep it as stock

Donation $1,000

| Payment Method | = Stock $1,000 (goes into the GL as a debit/asset) |

| Tax Receipt | = $1,000 |

Sell the Stock ($1,000) that was initially entered as Payment Method Stock for a surrender value of $1,200

| Payment Method | = Stock -$1,000 (to remove the initial stock asset) |

| Payment Method | = Cash $1,200 |

| Payment Method | = Stock Gain/Loss -$200 (goes into the GL as a credit/gain) |

| Tax Receipt | - none at this point because it was already issued during initial receipt of stock |

OR Sell the Stock ($1,000) that was initially entered as Payment Method Stock for a surrender value of $900

| Payment Method | = Stock -$1,000 (to remove the initial stock asset) |

| Payment Method | = Cash $900 |

| Payment Method | = Stock Gain/Loss $100 (goes into the GL as a debit/loss) |

| Tax Receipt | - none at this point because it was already issued during initial receipt of stock |

Example B:

Receive $1,000 Stock, Convert it to Cash for $1,010

Donation $1,000

| Payment Method | = Cash $1,010 |

| Payment Method | = Stock Gain/Loss -$10 (goes into the GL as a credit/gain) |

| Tax Receipt | = $1,000 |

Example C:

Receive $1,000 Stock, Convert it to Cash for $990

Donation $1,000

| Payment Method | = Cash $990 |

| Payment Method | = Stock Gain/Loss $10 (goes into the GL as a debit/loss) |

Tax Receipt $1,000

Donation Entry

- Box Office

- Online

- Pledges

- In conjunction with ticket sales

For more information on the features of the donation module, there are a number of cheatsheet and videos. Click here for a listing of the Donation Module quick reference materials.

Follow through the links below to learn how to enter and maintain donations in Theatre Manager.Inserting a Donation

It is important to recognize that donations can be entered from more then one place in Theatre Manager. You can enter a donation from the donation tab or from the orders window while a patron is purchasing tickets.

Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Click the New

button. The Donation Detail window opens.

button. The Donation Detail window opens.

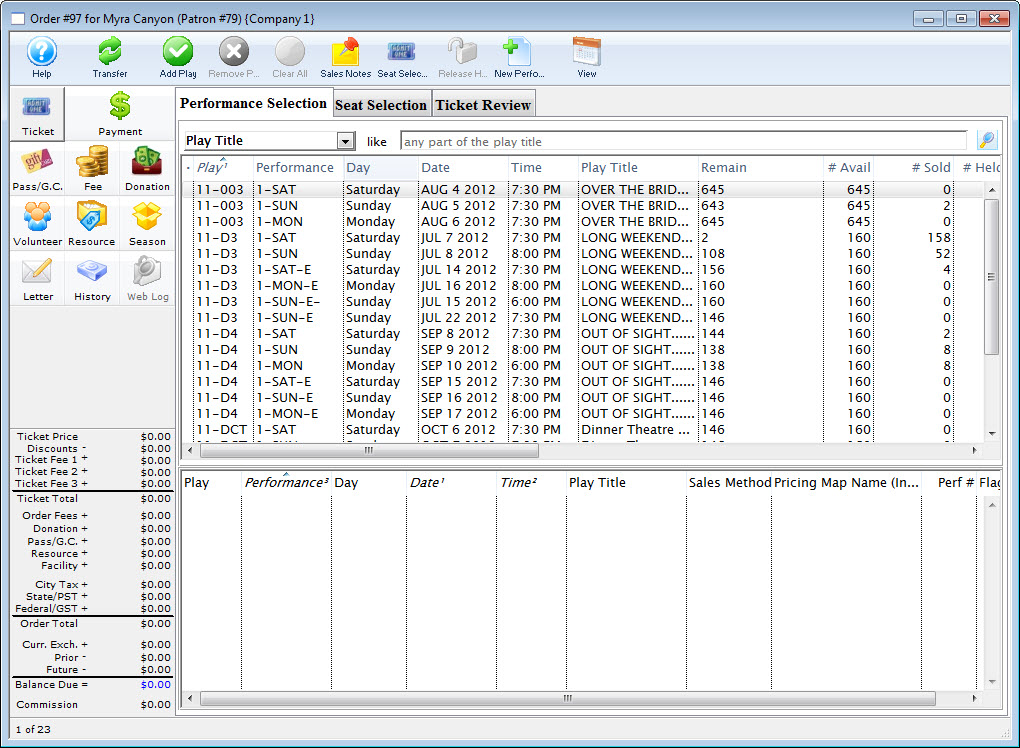

Alternatively

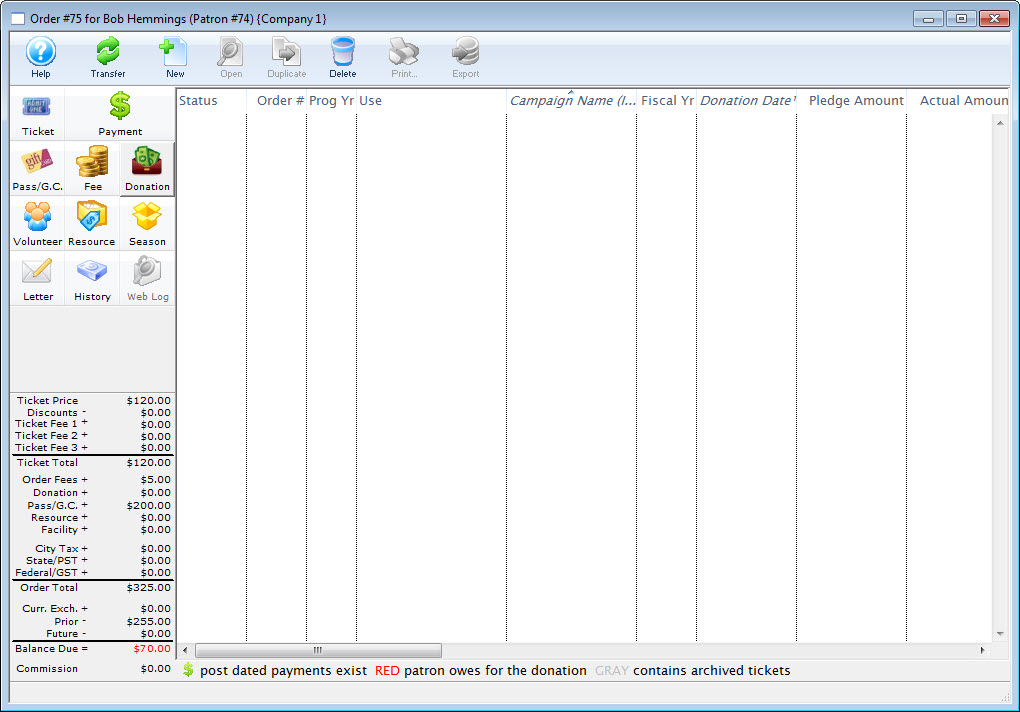

To add a Donation to an existing order, or while creating an order, you would:

- In the Orders window, click the Donations

button.

button. - Click the New

button in the Order >> Donations toolbar / ribbon bar.

button in the Order >> Donations toolbar / ribbon bar.

The Donation Detail window opens.

Campaign The drop down list contains the possible donation campaign to give the donation to. Date Donated Enter the date that donation was made. If the donation date differs from the default computer date, you can back date the donation by up to 3 months into a prior calendar year for tax purposes. Donations always appear on tax receipts according to the year on the donation date.

Note that Revenue Canada has stated:

- that the donation date and date entered into the system must both be displayed on a receipt if they are different to deal with year end issues and

- checks entered after actual year end but which are for the prior year.

Solicitor Select the person responsible for receiving the donation from the drop down. This person must exist in the Employee table (see Setting up an Employee) Donation (gift) Click in to the amount field and enter the donation amount. Depending on the selection in the popup to the left, this sets up an as a receivable in Theatre Manager so that the system knows to expect a payment for this amount. It could be one payment or it could be post dated payments. In the popup to the left of the amount, the typical choices are listed below. The affect how money is reported to finance to create a receivable.

- Categories that do not report to finance

- Prospect - Indicates that the donation is not real and will not be reported to finance. Use this designation to track key major donations, bequests, likely grants, or other possible funding sources. Amounts can be raised or lowered without affecting financial reports

- Soft Pledge - Similar to prospect. The intention of this category is to indicate that you have verbal (but not written) commitment for a large donation.

- Categories that cause G/L entries to be created

- hard pledge - When you receive any signed paperwork for a pledge that is considered legally binding, use this option. Generally it means people are paying over time. on the odd occasion, you may need to switch a Prospect or Soft Pledge (not reported to finance) over to a Hard Pledge or Donation when all the hard work has been completed and a prospective donation becomes reality.

- Donation (gift) - Generally used for most donations where a check arrives or when advised that a grant proposal has been accepted and money is on the way.

- Donation Refund for Ticket - an option to delineate when refunding tickets and the donation was for the refunded ticket.

Total Payment Amount of money received for the donation. A donation may be made in the form of a Stock and the payment amount may be more of less then the donation amount. For information on Stock gifts click here. There are a number of rules for USA 503c registered charities that may affect the amount entered.

WriteOff Amount The unpaid difference between the Donation and the Total Payment. Matching Gift Select the Matching Gift if you wish to link this donation to another patron who will also donate as a result of this patron giving a new donation. Click Here for more information. Commission Check the Commission Paid box to indicate if a commission was paid to a third party to procure this gift. Theatre Manager will enter the date that the commission was paid. Non-Receipt Benefit The amount deducted from the donation receipt to cover taxable benefits received by making the donation such as a dinner or a show. You will not be able to enter a receiptable benefit unless you have set it up in the donation campaign setup. You may also have to indicate standard benefit amounts at each donation range in the giving level matrix. Next Contact By default, the Next Contact Date is eleven months from the date of the donation. This date can be changed should you require a different date from the default. Use it in reports to print a list of donors that need contacted at that time to ensure that they give on a regular basis. Program Year The Program Year defines the time frame the donation will be recognized in published material. Use it in reports to print a list of Program Names within the Program Year. Fiscal Year The Fiscal Year is selected from the fiscal year set up in default settings. Refer to Accounting for more information Tax Receipt Name This field is used to record the name of the individual who will receive the tax deductible receipt. Theatre Manager prints a receipt for tax purposes in the name of the individual recorded here, which could differ from the individual giving the donation.

While you can put anything into the tax receipt name, there are some legal implications. Please refer to this page on the true donor as explained in a Government Of Canada document.

If you cannot ascertain the true donor with certainty, you'll need to ask them for any correction. If you still cannot, then you should mark their donation receipt option as No Receipt Required so that the system will not print one. Program Name This field is used to record how the patron would like to be recognized on your program listings. The default name is populated into the program recognition field in the order that follows: - If there is a default donor publication name in the donor tab of the patron window, this will ALWAYS be used as the default publication name.

- If there is 'COMPANY' name in the patron record, then the donation will be set to corporate and the company name will populate in this field. You can easily change it by clicking on individual to set the patron's name in the field

- If the above two options do not apply, then the default is the patron's name, in the format specified in the company preferences

- You can then Change the recognition name manually For example:

- if the Donor wishes to remain anonymous this field should read "anonymous". Click here for more information on making the donation anonymous.

- Or if the name is 'in memoriam' or 'in honor of', then simply change the program name to state 'In Memory of .....'

Sort Name The sort name is suggested by Theatre Manager and is used to DETERMINE THE SORT ORDER of patrons (within a giving level) on the donor program insert reports. It is initially based on the last name or company, depending on how the default donor name is selected and it may be changed. The sort name is used to position the donor's name in the program. For example, if the Program Name is 'Anonymous', the sort name could still be 'Smith'. This would cause the program to creating a listing for 'Anonymous' under S.

In order to maintain a reasonable alphabetic sort order, the sort name starts out with either:

- For individual donations:

- the first 7 characters of the last name (padded with ! if need be)

- the first 7 characters of the first name (padded with ! if need be)

- The first character of the middle name (or a single ! if no middle name)

- -OR- the company name without spaces (for corporate donations)

The sort name is designed so that you can alter the natural sort order of patrons. For example:: - Anonymous typically falls under 'A', but you can force it to appear where the patron's last name would fall, or change sort name to ZZZZ to make it fall at the end

- In Memory of Spot the Family Dog can be made to fall under Spot if you make the sort name Spot or under Family if you make the sort name Family

- Normally, you would not change the sort name, this just gives some extra capability for extraordinary situations like 'In Memoriam' or 'Anonymous' or 'on behalf of' gifts.

Tax Receipt Options There are a number of options for printing tax receipts, some of which Theatre Manager will handle for you. Please refer to the explanation on what each receipt option means and how the system processes them.

Please read very carefully about Revenue Canada's Policies on issuing tax receipts.. Improper receipting can result in heavy fines. - Enter the Donation Details.

- Proceed to the

tab if required.

tab if required.

- Click the Payment

button.

button.

- Pay for the donation.

Click Payment for additional information.

| Quick reference information Donations Overview |

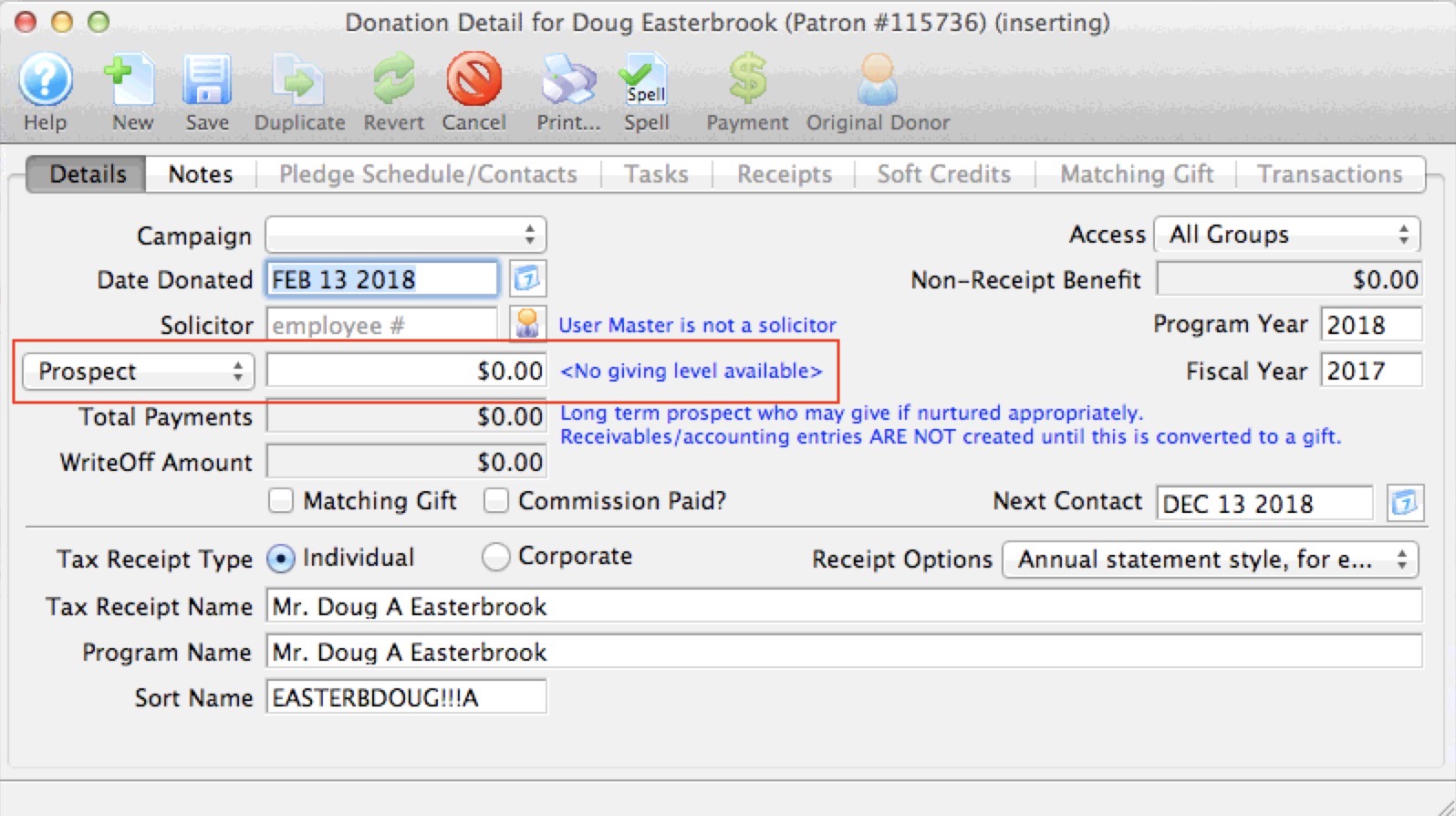

Entering a Prospect or Soft Pledge Donation

A prospective donor's name may come from discussions at a Development or Staff meeting, or noticing a donor on another venue's Donor Wall that isn't in your current donor list. it might also be for the purpose of Planned Giving

As soon as you identify a prospective donor, you should start a Prospect Donation in Theatre Manager. This way, you can track the progress of moving the potential donor towards an actual gift.

|

A Prospect Gift or Soft Pledge will not affect your financials in any way. Entering a Prospect Gift is simply a way of tracking a potential gift without creating any Receivables. |

Entering a Prospect Donation

- Start by opening the Patron Record of the prospective donor. For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Click the New

button. The Donation Detail window opens.

button. The Donation Detail window opens. - On the left-hand side of the Donation Detail window, you will see a drop down for:

- Prospect

- Soft Pledge

- Hard Pledge

- Donation (gift)

Select "Prospect"

- Complete the remainder of the fields for the prospective gift.

- Click the SAVE button at the top of the Donation Detail window.

|

Alternatively, refer to Enter Donations on the Order Window when already within an order. |

The Donation Detail window opens.

You will also note a change in the blue text to the right of the field. It now says:

Long term prospect who may give if nurtured appropriately. Receivables/accounting entries ARE NOT created until this is converted to a gift.

Some prospect gifts will remain as prospect gifts for a long time - perhaps even forever. They will always be recorded in the Patron Record so you can see what work has been done with this particular Donor.

Using Prospect for Planned Giving

|

A Prospect Gift or Soft Pledge will not affect your financials in any way. Entering a Prospect Gift is simply a way of tracking a potential gift without creating any Receivables. This gives you a place to track all interactions with the patron during the planned giving process. |

Setup and Data Entry

To handle these in Theatre Manager:

- Make a donation campaign, if it is deemed best to have a different one for tracking purposes

- Indicate that the donation be set up as a PROSPECT

- Enter the potential value of the planned gift

- put something in the notes about what the planned gift is for or how you will receive it

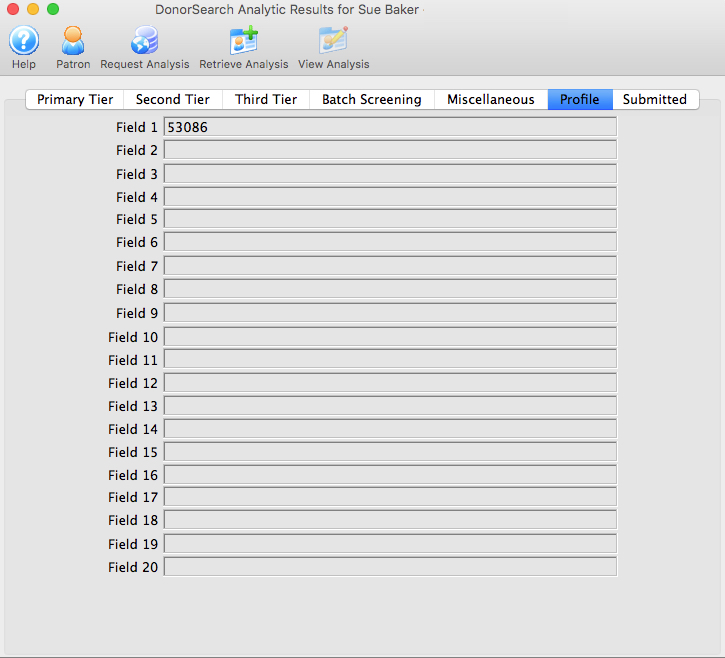

- optionally, use one of the custom donation fields for an additional identifier. This image shows that flag #7 is not taken, so you might rename that as 'planned gift' in company preferences if an additional marker is required to simplify pulling some reports.

What to do before you actually receive the Planned Gift

Before you actually receive the planned gift, there will undoubtably be changes to the information, discussions, reporting, etc. You can:

- Use the TASK tab to track meetings , to-do's or such with the potential donor

- In one of the tasks, if you get documentation from the donor, stick it into the attached files tab of the task

- Track any letters you send specific to the planned gift in the pledge Schedule/Contacts tab

- This gives you a central source of all interactions about this specific planned gift with the patron.

What changes when you get the planned gift?

- Change the PROSPECT marker to GIFT - this initiates the financial data to be sent to finance for the GL

- enter the true amount of the planned gift, if it has changed from what you thought

- Enter full payment or any sort of payment plan that the planned gift species -- just like any other donation

- Prepare a tax receipt, any custom acknowledgement for this kind of gift, or any required government forms - which you can also track in the attached files tab of a task

In the end, a planned gift is just like any other donation ..... except it starts its life as a PROSPECT before being converted to an actual gift.

Donation Tax Receipt Name Considerations

|

While you can put anything into the tax receipt name, there are some legal implications. If you are in Canada, please read Revenue Canada's Policy Commentary CPC-010

For those in the USA, you may wish to lookup the details of IRS publication 1771 |

|

Please read about Revenue Canada's extensive policies on issuing tax receipts.. Improper receipting can result in fines. |

This handy chart below comes from the Revenue Canada web site and illustrates some common examples. In all cases, Revenue Canada indicates the need to highlight the true owner of the donation. If the donors name cannot be ascertained 100%, then no receipt should be issued.

Donation Tax Receipt Options

|

Please read carefully about Revenue Canada's Policies on issuing tax receipts. The CRA web site mentions:

Theatre Manager modelled the contents of receipts after the requirements/samples on Revenue Canada's Web Site.. The US has fewer, although somewhat similar requirements as mentioned in publication 1771 |

|

Read how to batch print receipts that have not been printed. |

|

Please note: receipts are issued for each payment made towards the donation. Receipts are not issued for the donation.

The reason is that donations are only an indication of what the patron intends to give and payments are what they actually gave. A receipt cannot be issued until the payment is made and each payment is given its own receipt number and date. |

Tax Receipt Options

Theatre Manager has a number of tax receipt options that you can set for each donation. In addition there is a setting for each campaign on the edits tab that can be used to only print donations above a certain amount.

Receipt Options Types Printed by Theatre Manager

- One tax receipt per Payment - is the default. Each payment is issued a separate tax receipt when the payment is received. If there are 10 payments, you will create 10 receipts at when each payment is entered.

- Annual Statement Style (calendar Year) - will print a one page tax receipt for the patron listing all donations in the calendar year marked as using this style of receipt. If a receipt was previously printed, it is so indicated on the statement.

Receipt Options to be handled Manually

- Manual On typewriter - are used when the donation and payments are complex enough and the only way to observe various government regulations is to simply type one up in a word document or on an old fashioned typewriter. Theatre Manager ill not print any receipts for this donation. Once finished the donation receipt, you may want to import a PDF of the document into a task to record what was sent.

- Special Handling - are also used for complex receipting requirements. We suggesting that this be used if you create a form letter for this purpose

- No Receipt Required - there are cases when you should not print a receipt for a donation even if a receipt is normally created for the campaign. Use this option when the true donor cannot be identified, or if the entire donation receives benefit.

If you cannot ascertain the true donor of a gift, select No Receipt Required to comply with Revenue Canada regulations.

Which receipt type to use?

-

One per payment receipts are best suited for:

- Larger donations paid with one or two payments

- When the customer wants a receipt after a payment

- if you want to strictly follow Canada's governmental reporting requirements and use facsimile signatures and/or are using preprinted forms

-

Annual Style receipts are best suited for:

- Donations with many payments or post dated payments

- recurring donations that never end.

- If the client wants for one receipt for all donations in the year

-

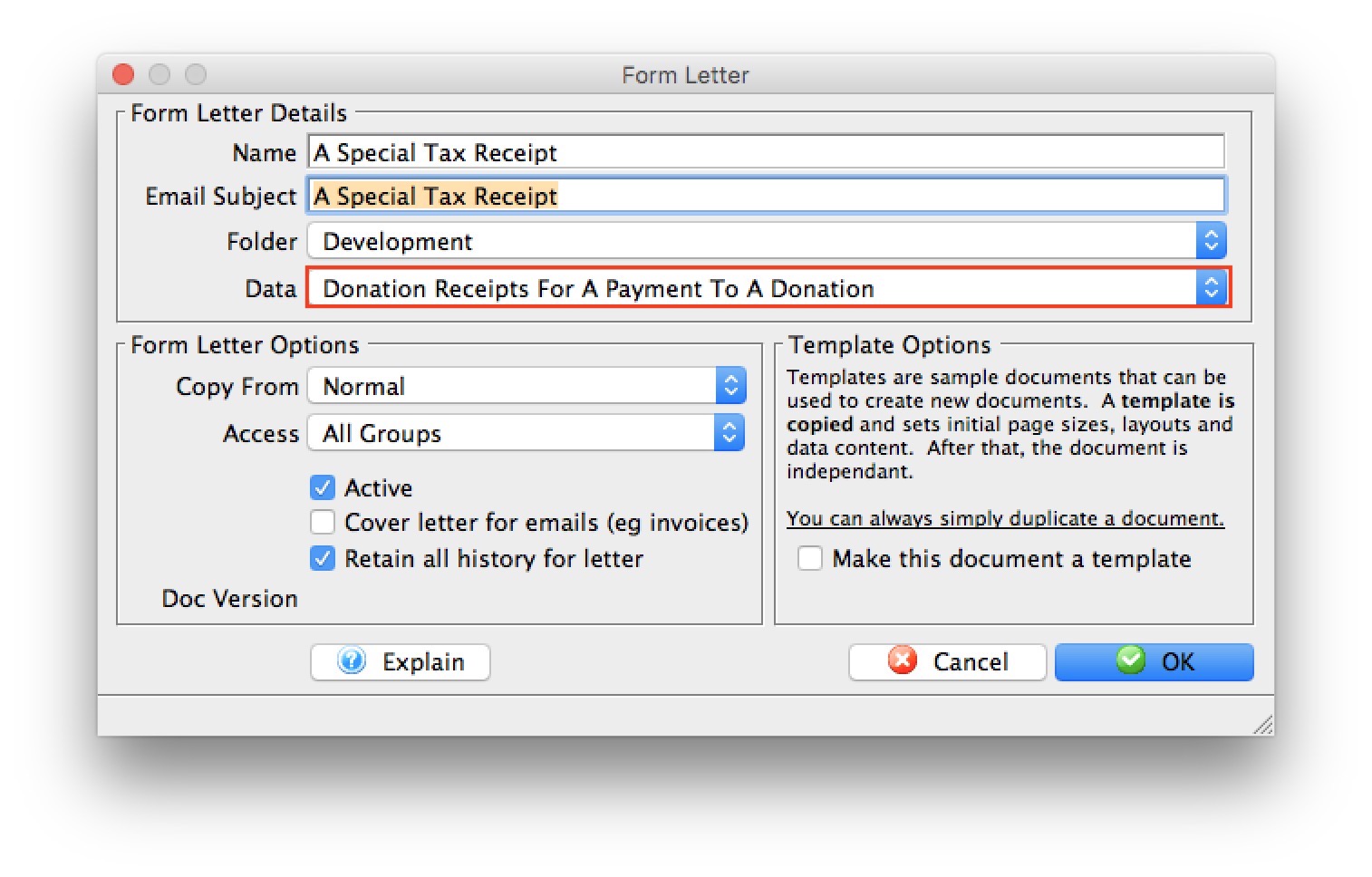

Form letters can be used to print receipts if the options provided or the situation warrants something custom to be created.

To use form letter receipts:

To use form letter receipts:

- Mark the receipt type as Special Handling so that TM will not attempt to print one for each payment

- Make sure to mark your receipts printed manually on the receipt tab - which will generate a receipt number in Theatre Manager

- Create a standard form letter (based on donation receipts file as per the image to the right) and place a table in the form letter containing the receipt data you want to show that also includes the receipt number.

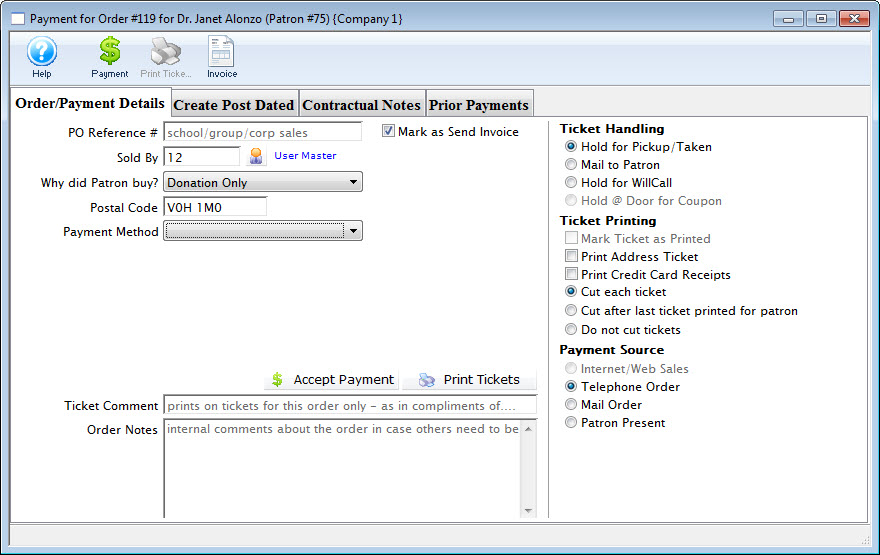

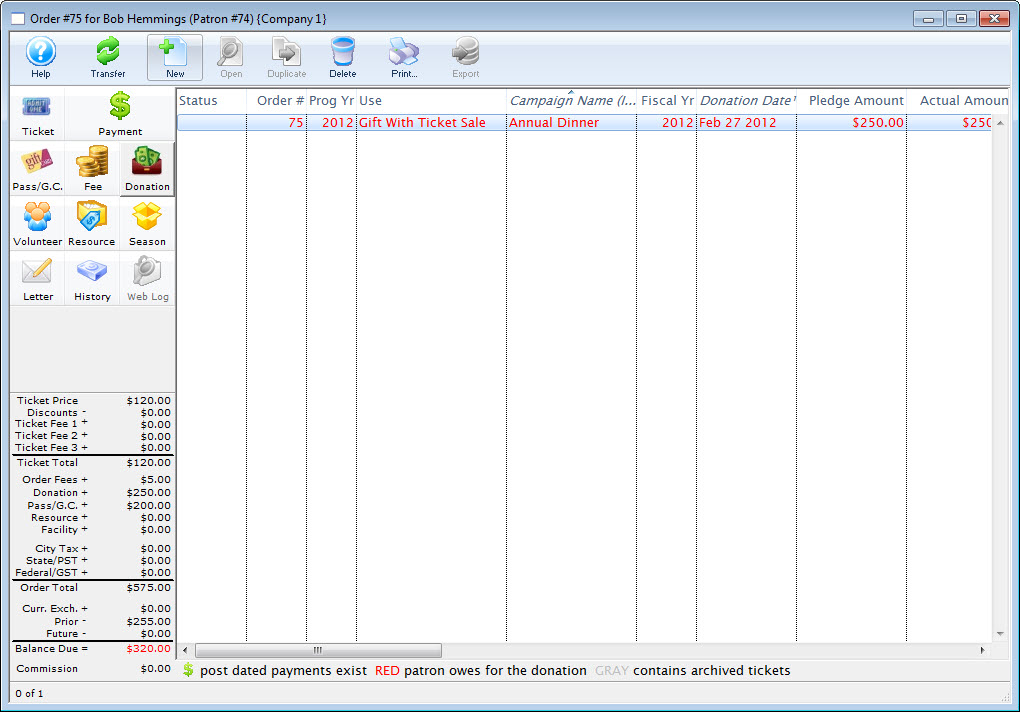

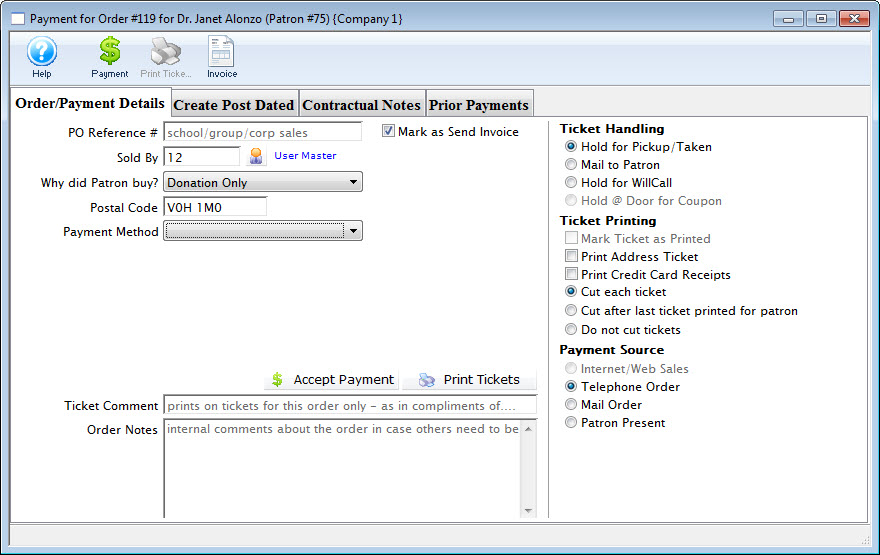

Entering Donations on the Order Window

You can add one or more donations to the same order that contains subscriptions, tickets and/or gift certificates. There are a number of reasons why you may wish to do this:

You can add one or more donations to the same order that contains subscriptions, tickets and/or gift certificates. There are a number of reasons why you may wish to do this:

- A donation that accompanies a season subscription renewal

- A patron may not be able to attend the upcoming event / play and would like to turn in their tickets. Click here for an explanation of how to turn a refunded ticket into a donation.

- A single donation that is targeted for multiple campaigns would be entered in this window. You would enter multiple individual donations to each campaign that add up to the total donation amount. As each donation is added, the total appears at the bottom left od the screen in the financial summary.

- Similarly, donations for a multi year pledge or capital campaign are entered in this manner. Enter a separate donation for each program year that add up to the total expected amount.

Note: Any payment to an order with multiple donations is applied to the individual donations in this order:

- Program Year - this mean that for donations that span multiple years, arrange them so that the program year is entered in the order that you want payments allocated.

- Donation Date - if there are donations for the same program year, then payments are applied according to the donation date.

- Donation Number - if the multiple donations have the same program year and donation date, then the payments are applied to donation in order of the donation number.

|

Once a payment is applied to a an order with multiple donations, you cannot change the allocation of receipts unless you:

|

- In the Order window click the Donation

button.

button.

The Order window can be accessed by purchasing ticket, a membership or by simply adding a payment to an existing order.

- Click the New

button.

button.

- Enter the Donation Details.

- Click the Save

button.

button.

- Close the Donation Detail window.

- Click the Payments

button.

button.

- Pay for the donation.

Click Payment for additional information.

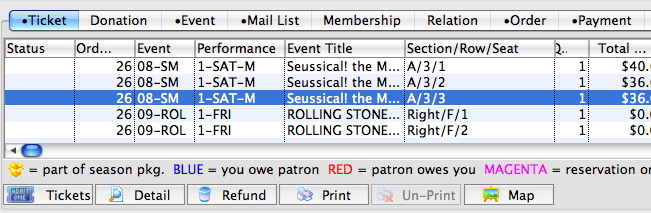

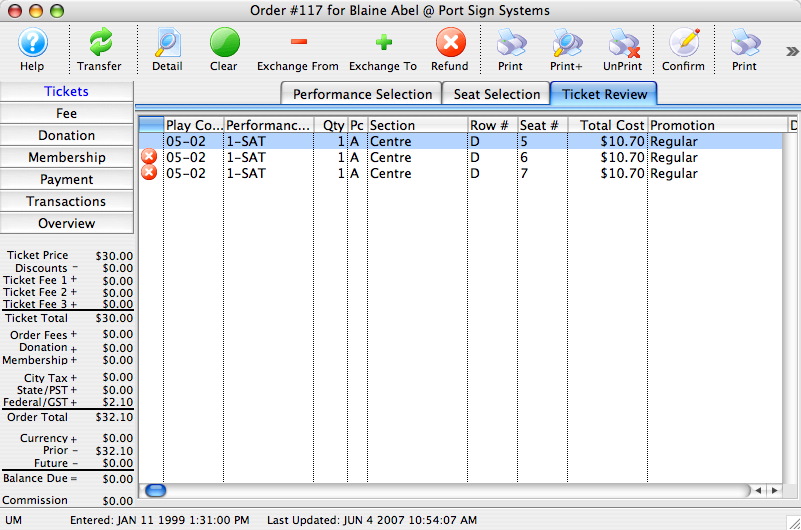

Converting Refunded Tickets to Donations

A patron may come to you and tell you that they cannot attend an upcoming event / play and therefore they would like you to refund their tickets, but they also tell you that they would like the company to keep the money as a donation.

To convert a refunded tick to a donation, you would perform the following steps:

- Open the Patron Record.

For details on locating a Patron Record click here.

- Select the ticket(s) to be refunded.

Only tickets within the same order can be refunded at the same time.

- Click the Refund

button.

button.

The Order window will open.

- Click the Confirm

button.

button.

This will release the seats to be refunded back to the Box Office. The order will now have an outstanding CREDIT balance.

- Click the Donations

button located in the left column of the window.

button located in the left column of the window.

- Click the New

button in the top icon bar.

button in the top icon bar.

The Donation Default Settings window will open.

- Click the Yes

button.

button.

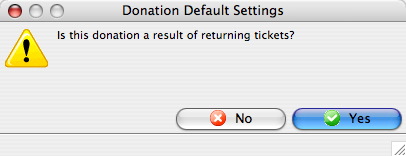

A new Donation Detail window will open.

- Enter the Donation information.

Certain detail information will automatically be inserted by default i.e. Donation Amount and Date Donated. Click Donation Detail for more information on entering Donation information.

- Click the Save

button.

button.

- Close the Donation window.

The Order window will return. The balance in the lower left corner will be zero.

- Close the Order window to complete the transaction.

Theatre Manager will have refunded the tickets from the patrons account and converted the value of those tickets into a donation. The tickets will then be returned so they can be sold to other patrons.

|

Quick reference information for convertioning a refund to a donation, you can download: |

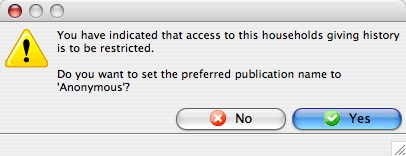

Creating Anonymous Donations

Some patrons may want to make a donation, but remain anonymous. This can be done easily in Theatre Manager, by changing the Program Name for the donation. When you change this value, the donation will be stored under anonymous for the first letter of the patron's last name. That is, Tom Potimer's anonymous donation will be stored under P Anonymous.

To create an anonymous donation, use the following steps:

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Click the New

button.

button.

- Enter the Donation Details.

- Change the Program Name to Anonymous.

- Click the Payment

button.

button.

- Pay for the donation.

Click Payment for additional information.

|

Quick reference information on how to make a donation anonymous: |

How to Toggle Between Individual and Company Donations

|

There MUST be a company name in the patron record for a donation to become a Corporate donation. |

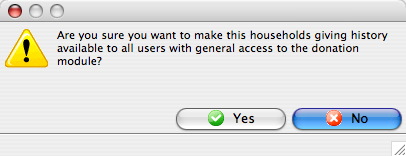

You have discovered a donation and receipt for an individual should have been made in the individual's company name. In Theatre Manager, if the donation is not printed (or you unprint it), you can easily change from:

- an individual to their company

- the corporation to the individual, -or-

- one individual name to another in the household

Please be aware of Revenue Canada's Policy Commentary CPC-010 for legal interpretations regarding the donor name in Canada.

For quick reference information, see the following information on Toggling Between Individual and Corporate Donations.

|

For quick reference information on Toggling Between Individual and Corporate Donations |

To toggle between corporate and individual donations, you perform the following steps:

- Open the donation.

Click here for more information on how to open the donation.

- Click the Receipt Tab.

- Double-click on the receipt to apply the changes to.

The receipt detail window opens.

- Click in the Receipt # box and delete the number.

The date will automatically clear from the Date/Time Printed field.

- Click the Save

button.

button.

Repeat Steps 3 - 5 for every receipt listed for the donation (if there is more than one).

- Close the receipt detail window.

- Tax Receipt Type: Click the button to change who the donation and receipt is applied to.

Click Corporate if you are switching from an individual donation to a company donation.

Click Individual if you are switching from a company donation, to an individual donation.

When you click the appropriate tax receipt type, the Tax Receipt Name, Program Name and Sort Name fields will switch to the company/individual name.

Setting or Changing the Donation Program Name

If you wish to change the program name (the donor's name as they wish it to appear in the program listing) for a donation it can be done while you are entering the donation. If after the donation has been processed and the patron name on the donation needs to be changed:

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Select the Donation to change and click the Open

button.

button.

- Edit the Program Name as needed.

- Click the Save

button.

button.

- Close the Donation Detail window.

The Donation will now be seen under the new name in the Program Name column of the Donation tab.

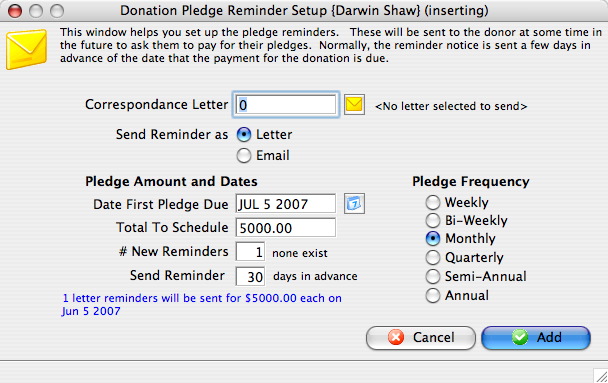

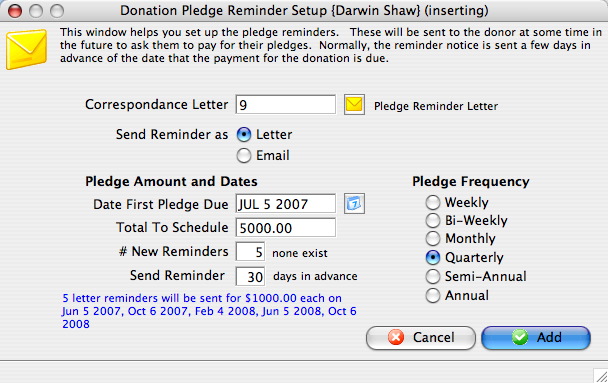

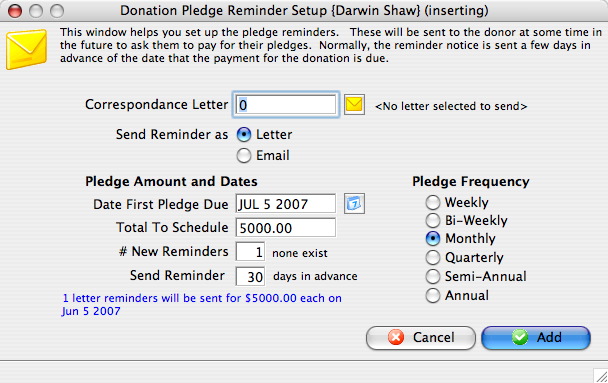

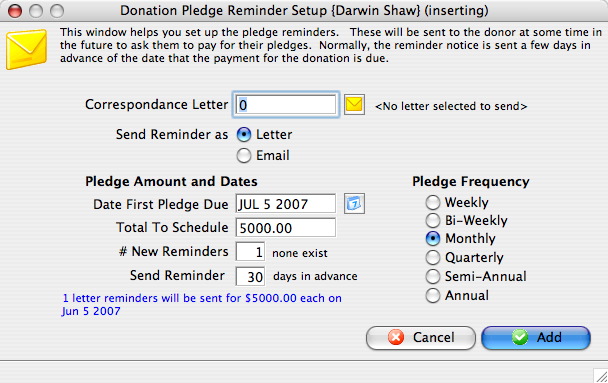

Pledge Schedule

A Pledge Schedule allows you to assign pledge reminder letters to a donation, so that at a certain time (weekly, monthly, quarterly, etc.) you can print letters reminding donors that their payments are due.

To set up a pledge schedule, you perform the following steps:

- Open the Pledge Schedule/Contacts

tab in the Donation Detail window.

tab in the Donation Detail window.

Click here to learn more about adding pledges.

- Click the Add Pledge

button.

button.

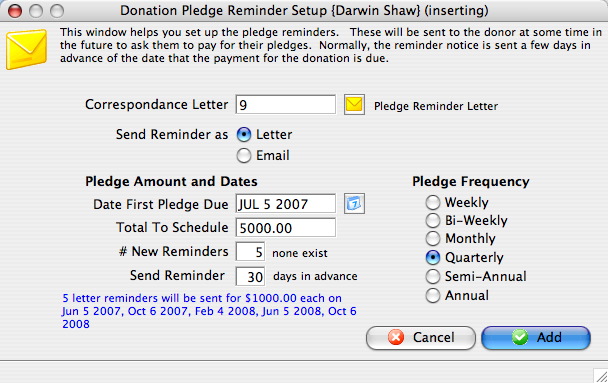

The Donation Pledge Reminder Setup window opens.

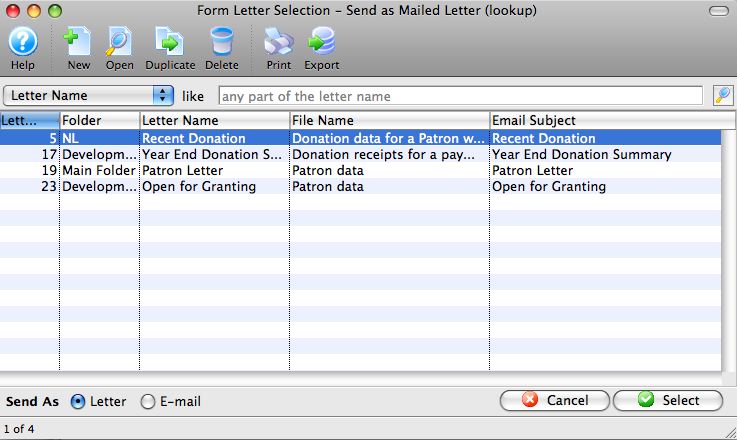

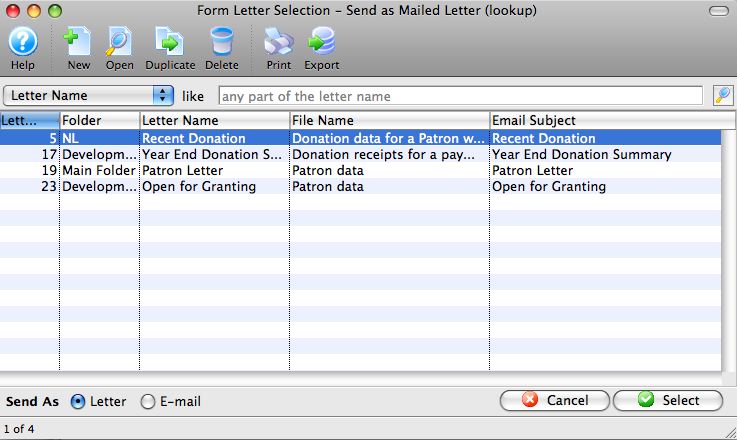

Correspondence Letter Select a letter to be sent as the reminder. Send Reminder as Choose to send pledge reminders as a letter or an email. Date First Pledge Due Date the first reminder will be sent. Total To Schedule Amount added to the pledge schedule at this time. # New Reminders Number of pledge reminders to be added to the donation. Send Reminder Number of days ahead of the pledge due date the letter should be sent out. Pledge Frequency Amount of time reminders are to be spread out over. - Click the Letter Search

button.

button.

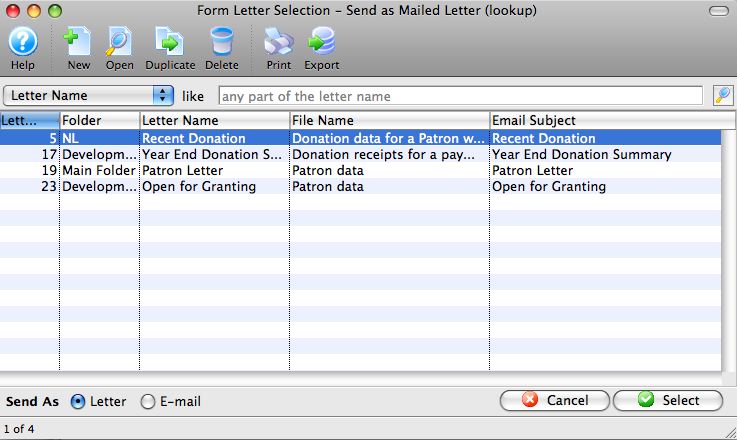

The Form Letter Selection window will open.

- Select a Form Letter.

Single click on a letter to select it.

- Click the Select

button.

button.

- Alter the remaining values as required.

- Click the Add

button.

button.

| For Quick Reference Pledge Scheduling, You can download: Cheatsheets (1-2 pages) and

Screencasts (online video demonstrations of the functions with narration) |

Cheatsheet |

Mp4 |

Pledged Donations

A pledged donation is when a patron says they are going to give the company X number of dollars over a period of time. A patron may pledge $600, pay $50 immediately and say they will pay $50 a month so there total for the year is $600. Also they may pledge $600 and ask you to post date the payments to be made once a month on there credit card or postdated cheques. Theatre Manager deals with these types of donations within the Donation Detail window which is opened when a new donation is being made or edited.

| For Quick Reference Pledge Scheduling, You can download: Cheatsheets (1-2 pages) and

Screencasts (online video demonstrations of the functions with narration) |

Cheatsheet |

Mp4 |

Pledges without Postdated Payments

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Click the New

button.

button.

- Enter the Donation Details.

- Click the Pledge Schedule/Contacts

tab.

tab.

- Click the Add Pledge

button.

button.

The Donation Pledge Reminder Setup window will open.

Correspondence Letter

Select a letter to be sent as the reminder.

Send Reminder as

Choose to send pledge reminders as a letter or an email.

Date First Pledge Due

Date the first reminder will be sent.

Total To Schedule

Amount added to the pledge schedule at this time.

# New Reminders

Number of pledge reminders to be added to the donation.

Send Reminder

Number of days ahead of the pledge due date the letter should be sent out.

Pledge Frequency

Amount of time reminders are to be spread out over.

- Click the Letter Search

button.

button.

The Form Letter Selection window opens.

- Select a Form Letter.

Single click on a letter to select it.

- Click the Select

button.

button.

- Alter the remaining values as required.

- Click the Add

button.

button.

- Click the Payment

button.

button.

- Change the Payment Amount to reflect the amount the patron will pay at the time the donation is created.

- Click the Accept Payment

button.

button.

- Place the remaining amount of the pledge On Account.

As they pay more of there pledged amount additional payments will be made to the order. For more information on adding payments to an order click here.

Pledges with Postdated Payments

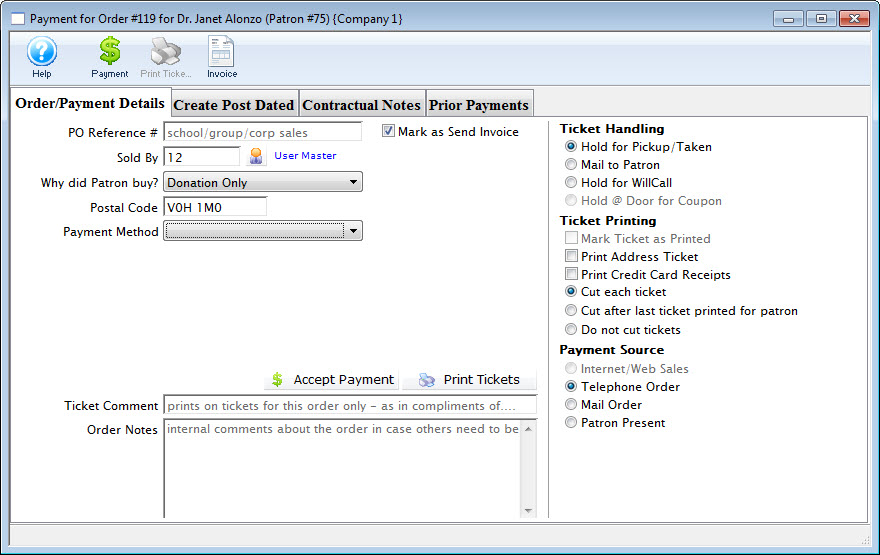

Another method to deal with the Pledged amount is to use the Create Post Dated tab on the Payment for Order window. Under this tab you can setup a schedule of payments for the pledge.

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Click the New

button.

button.

- Enter the Donation Details.

- Click the Pledge Schedule/Contacts

tab.

tab.

- Click the Add Pledge

button.

button.

The Donation Pledge Reminder Setup window will open.

- Click the Letter Search

button.

button.

The Form Letter Selection window will open.

- Select a Form Letter.

Single click on a letter to select it.

- Click the Select

button.

button.

- Alter the remaining values as required.

- Click the Add

button.

button.

- Click the Payment

button.

button.

- Click the Create Post Dated

tab.

tab.

- Enter the Post Dated Payment details.

For more information on entering post dated payments click here.

- Click the Create Post Dated

button.

button.

- Close the Payment for Order window.

Theatre Manager creates the payments for the allotted time period. When viewing the Donation in the Donation tab the Donation Amount Due is blank. The balance is $0.00 because the payments have been guaranteed through the creation of the Post Dated Payments. Theatre Manger will show the posted dated payments in the end of day wizard when they are to be deposited.

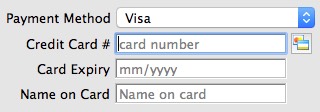

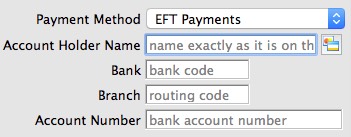

Changing the Donor's Credit Card

Sometimes, issues may arise if the payments stretch over a long time. If the:

- customer's card number is changed by the bank, you can change all future payments en masse

- patron wants you to substitute a different card for some or all future payments, use the link above

- expiry date changes, you can use the above process, or you can simply find the card in the patrons account and change the expiry date.

- credit card gets declined in end of day, then remove it from the deposit for a few days.. You might do this is the patron says the card is still valid and they need to put money on it,

- the actual payment dates and schedule need changing, you will need to:

- delete the existing post dated payments

- Add the new post dated payment(s) with the revised payment schedule

Soft Credits

A soft credit is a way to give recognition to someone who 'encouraged' the original hard donation without entering a real donation.

For example:

- Patron 'A' was encouraged to give a real gift or pledge of $500 by a Board member.

- Enter the full donation under Patron 'A'

- In the soft credit tab, you can assign an amount to the Board member that will increase their recognition total in the donation module without causing a real donation to be entered.

- The donation program listing can be told to accumulate real donations, soft credits and matching gifts to provide the aggregate recognition

When producing the program listing, Theatre Manager lets you determine if you want to include soft credits in the summary, just like you can optionally include matching gifts.

Theatre Manager keeps totals for current soft credits, prior year soft credits, and total soft credits - just like it does for actual donations. This means you can find people who had soft credits last year but not this, etc.

Almost all the donation reports have the ability to show soft credit data.

- Click the New

button.

button.

Alter the values as required.

- Click the Save

button.

button.

| Patron # | This is the Patron account that you wish to add a soft

credit for. You can use the  button to access the list of records to find the patron.

button to access the list of records to find the patron. |

| Soft Credit | This is the amount of the soft credit that you wish to add. This assigns a giving level to the credit. |

| Campaign | This allows you to set the soft credit for a different campaign than the original donation. This allows you to have a corporate donation, but the person who solicited the donation will be getting the soft credits, which can appear on an individual campaign |

| Program Year | Allows you to determine which program year this soft credit will apply to. This is the year that this soft credit will appear in the Program Insert. |

| Fiscal Year | Allows you to determine which program year this soft credit will apply to. This is the year that this soft credit will appear in the Program Insert. |

| Include matching gift amount... | This allows you to determine whether or not to include the matching gift amount when determining program list recognition. |

| For Quick Reference Soft Credits, You can download: Screencasts (online video demonstrations of the functions with narration) |

Flash |

Mp4 |

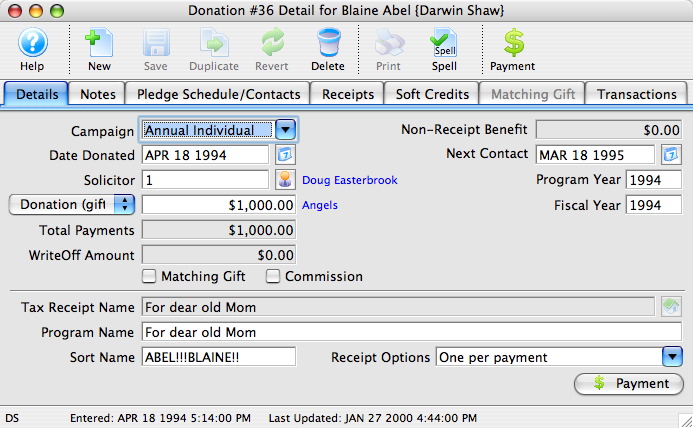

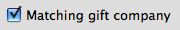

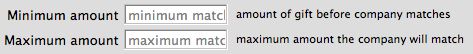

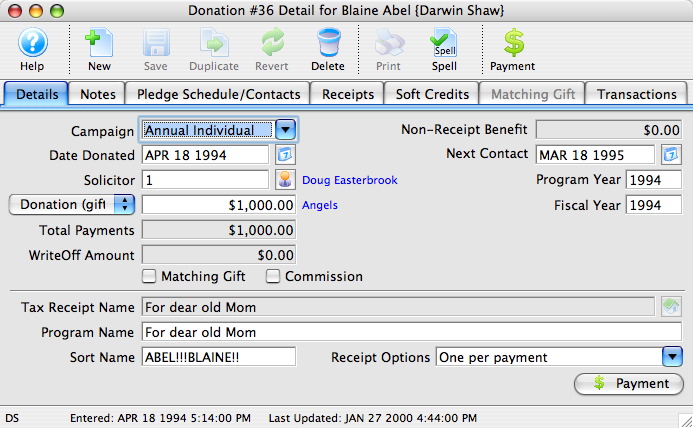

Matching Gift

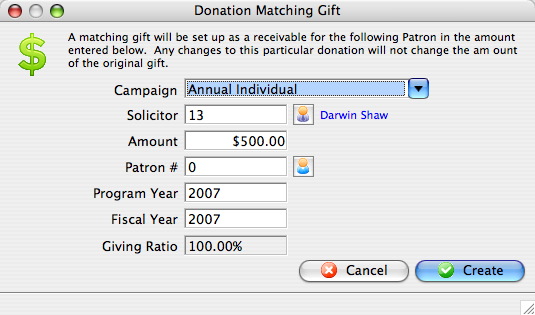

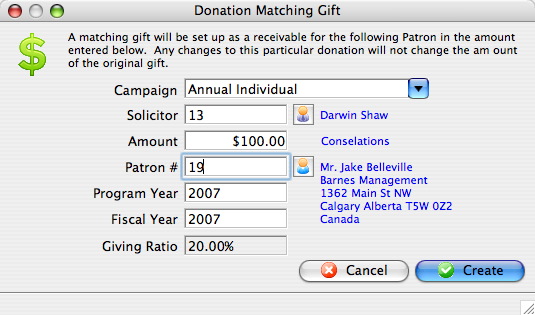

A Matching Gift is a donation from another patron as a result of the current donation being entered. Example: as a result of Blaine Abel's donation, Jake Belleville would also like to donate by matching his gift. The amount of the matching gift can be less than, the same as, or more than the amount of the current patron's donation.

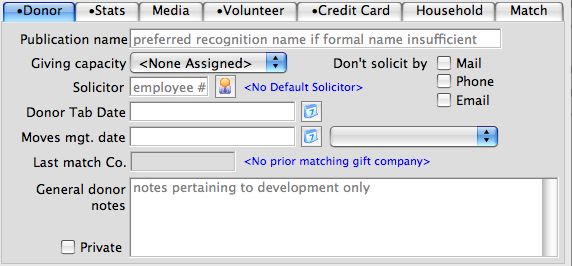

- Open the Patron record for the patron who will be matching the gift.

In the example about this would be Jake Belleville. For more information on finding a patron click here.

- Click the Match

tab.

tab.

- Check the Matching Gift box and enter a Matching Gift Ratio.

The Matching Gift Checkbox must be checked if this patron is to be used as a matching gift company.

The Matching Gift Ratio can be altered at the time of the donation by editing the amount the matching gift patron will be donating.

In addition, any minimums or maximums set by the Matching Gift company can be indicated here.

- Click the Save

button.

button.

- Open the Patron Record for the Patron making the Donation.

In this example the patron would be Blaine Abel.

- Click the Donation

tab.

tab.

- Click the New

button.

button.

- Enter the Donation Campaign and Donation Amount.

- Check the Matching Gift

box.

box.

The Donation Matching Gift window will open.

- Click the Patron Search

icon next to the Patron # field.

icon next to the Patron # field.

Search the contact list to locate the patron making the matching gift. In this example it would be Jake Belleville. For more information on using the Contact List click here.

- Select the Patron who will be matching the donation.

Single click on a patron to select them.

- Click the Select

button.

button.

- Enter the Amount of the matching gift.

By default Theatre Manager assumes the matching gift to be the same as the donation. If the ratio has been modified under the donor tab of the matching gift patron that ratio is calculated and inserted in to the matching gift detail. The matching gift can be more or less than the amount of the current donation. Edit the Amount to change the giving ratio.

- Click the Create

button.

button.

Once the payment transaction has been completed the Donation Detail window will return and the Matching Gift tab will be displayed.

- Click the Payment

button.

button.

- Pay for the donation.

Click Payment for additional information. Once a payment is received the Donation Detail window will reopen.

- In the Matching Gift tab, click the Show Matching Gift Patron

button.

button.

The Donation List Window for the matching gift patron will be opened

- Select the Donation

tab.

tab.

- Select the Matching Gift donation.

- Click the Open

button.

button.

- Click the Payment

button.

button.

Pay for the donation if all information is correct

|

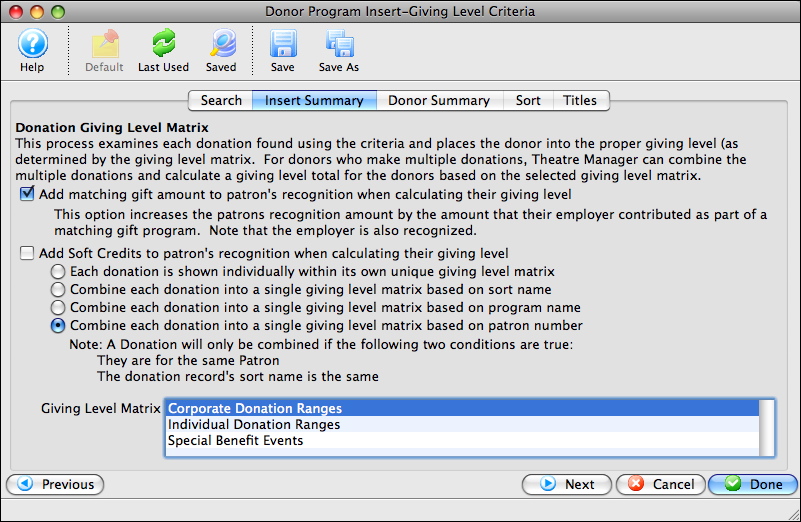

You can run the Donation Reports & Receipts >> Donor Program Insert reports (either one) on this data and the matching gift will be included for the individuals donations. |

When running these reports, on the Insert Summary tab click "Add matching gift amount to patron's recognition when calculating their giving level"

|

Quick reference Information for Matching Gifts Quick reference information for Setting up the Gifter |

|

||

|

Matching Gifts Part 2 - Adding Gift To Donation & Running a Report |

Modifying a Donation

Typical things to change are:

- Increasing the donation amount or modifying any other data on the donation.

- Decreasing the donation amount after it has been receipted

- Modifying one or more program and/or tax receipt names en masse for donations for the patron.

Increasing the Donation Amount

You may wish to modify a donation for various reasons. To add notes, make payments on pledges ect. Modifying a donation is preformed quickly through the Donation Detail Window.

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Select the Donation to edit.

Single click on a donation to select it.

- Click the Open

button.

button.

- Change data as needed.

If a receipt has been printed for the donation you will not be able to edit the Tax Receipt Name Field.

- Click the Save

button.

button.

The changes have now been made to the donation.

- Close the detail window.

Decreasing the Donation Amount

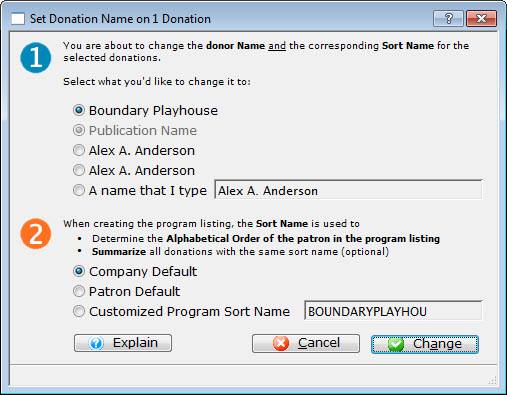

Donations - Set Donation Name

button.

button.

The Set Donation name dialog opens.

Step 1. You are about to change the donor Name and the corresponding Sort name for the selected donation. Select the name you want to change it to.

|

You are given a number of choices and the option to enter another name. However, please read about Canada's Tax Receipt Name Implications if you want to type something other than the patron's name. |

Step 2. When creating a program listing, the Sort Name is used to determine the aplhabetical order of the patron in the program listing and to summarize all donations with the same sort name. Select the Name you want to change to.

Again you are offered a list you can select from and the option to enter your own Customized Sort Name.

Once you have made your selections, press the Change  button.

button.

You are returned to the Donations tab.

Gift In Kind

Gift in Kind is a donation of gift or services rather than money. For example: the donation of a computer or other office equipment, building materials and paint supplies for props, clothing for wardrobe or the donation of one's time. There is a perceived value for these goods and services which can be considered a donation and are subject to a receipt for tax purposes.

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Click the New

button.

button.

- Select the Donation Campaign from the drop down.

- Fill in the Donation Amount as the appraised amount of the gift.

- Enter remaining information.

- Click the Payment

button.

button.

This opens the Order Payment window.

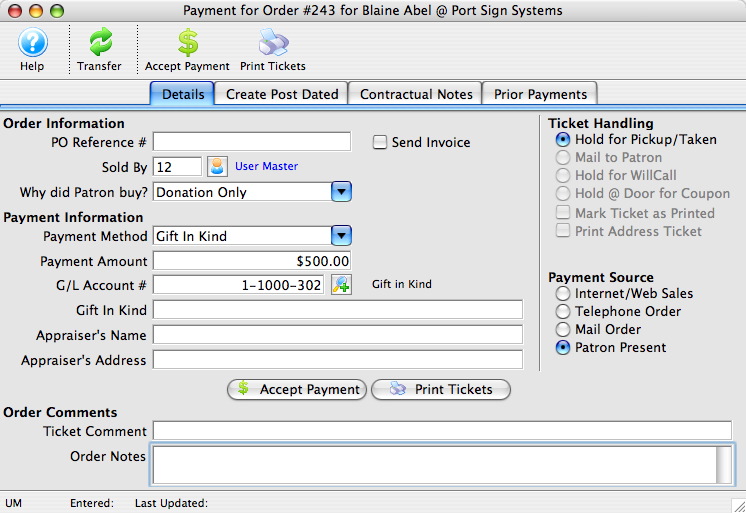

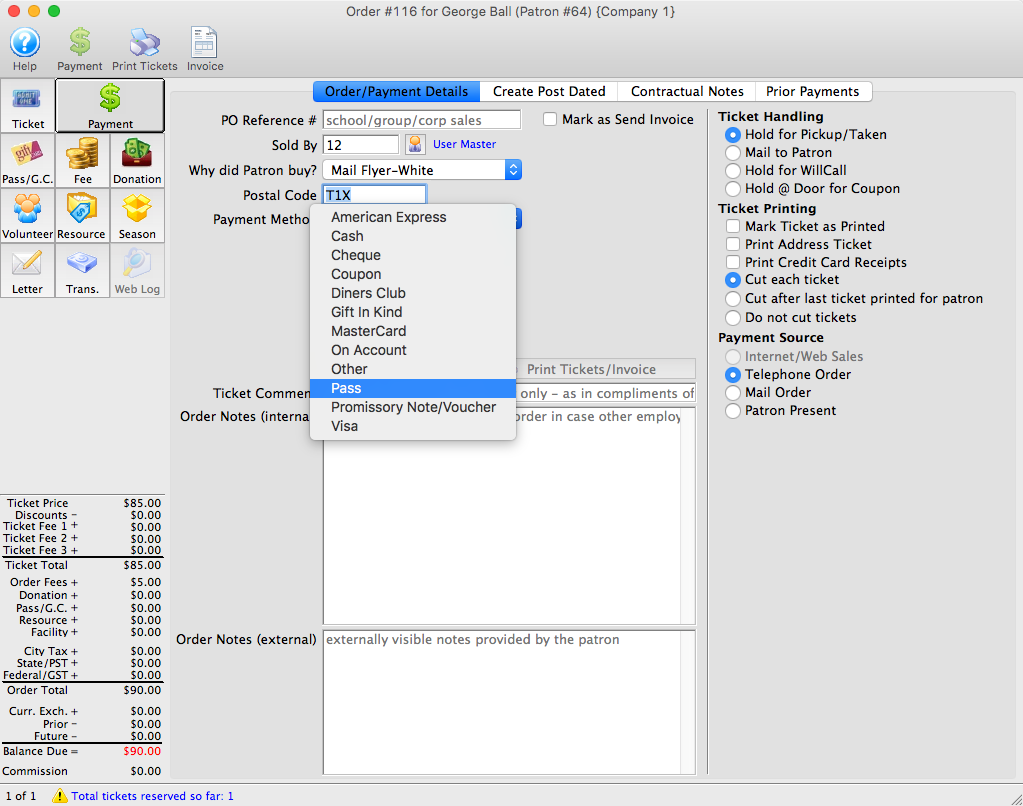

- Select Gift in Kind from the Payment Method drop down menu.

>

- Enter a description of the Gift In Kind, the Appraiser's Name and the Appraiser's Address for reference.

This information may be required for auditing purposes.

- Click the Accept Payment

button.

button.

- Close the Donation Detail Window

The gift in kind donation will now appear on the Donation List window. Details on the payment type can be seen under the Payment

tab.

tab.

| For Gift In Kind Quick Reference, You can download: Screencasts (online video demonstrations of the functions with narration) |

Flash |

Mp4 |

Splitting an Existing Donation and Payment Across Multiple Campaigns

There can be times when a patron makes a donation and payment to a campaign. After the face, it is discovered the donation should be split across multiple campaigns. Follow the instructions below if this happens.

- Un-print the donation receipt if it has already been printed. For more information on un-printing donation receipts, click here.

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Order

tab.

tab. - Select the Order containing the donation to be changed.

- Click the Open

button.

button.

The Order window opens.

- Click the Donation

button.

button. - Highlight the donation to be removed.

- Click the Delete

button.

button.

The donation will now be deleted and removed from the list.

- Click the New

button.

button.

The Donation Detail window opens.

- Enter the donation campaign.

- Enter the price of the donation, adjusted to be split across multiple campaigns.

- Click the Save

button to save the donation.

button to save the donation. - Repeat Steps 9 to 12 as many times as needed to split the donation across multiple campaigns.

- Close the window.

The payment previously made will be split across all of the donations entered.

Deleting a Donation

- Once a payment has been deleted or reversed, the amounts on the donation can be modified or the donations can be deleted.

- If the donation is deleted -and-

- it is has a matching gift the matching gift

- that matching gift will not be deleted.

- If you require the matching gift to be deleted as well you must repeat the steps for that donation.

- Only donations which have all payments removed may be deleted.

- However refer to reducing the value of a donation to see how to reduce one

- Before you can delete a donation all printed tax receipts associated with the donation must be un-printed.

How to delete a Donations

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Select the donation to be refunded.

Single click on the donation to select it.

- Click the Open

button.

button.

The Donation Detail window opens.

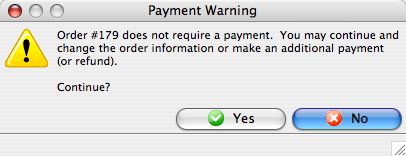

- Click the Payment

button.

button.

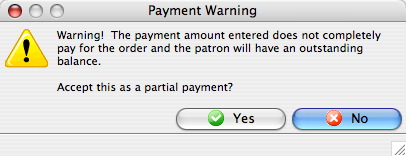

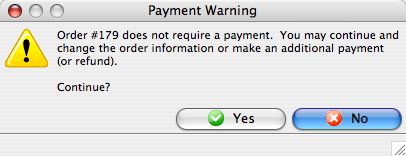

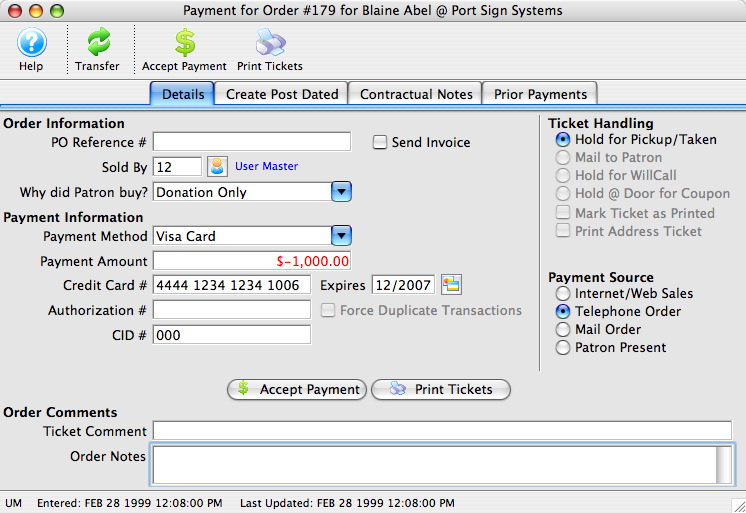

A Payment Warning appears, indicating there is no payment required for this order.

- Click the Yes

button.

button.

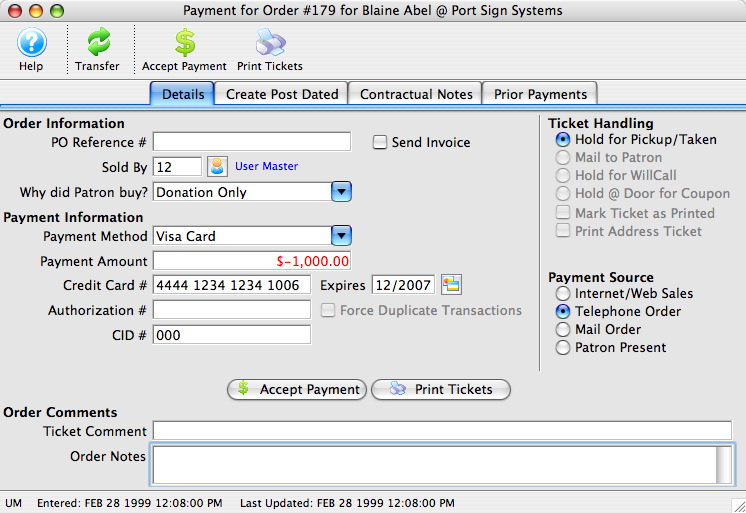

- Enter a negative payment for the value of the donation.

You can use the Prior Payments

tab to review how the original payment was made.

tab to review how the original payment was made.

- Click the Accept Payment

button.

button.

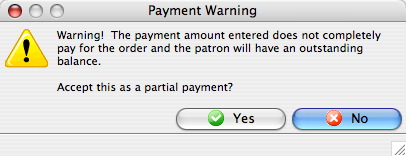

A Payment Warning dialog opens, indicating the payment made does not complete the order.

- Click the Yes

button.

button.

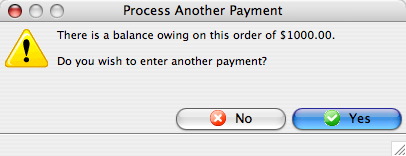

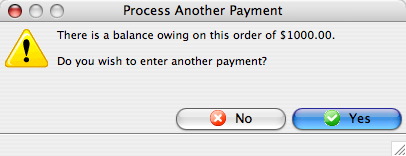

The Process Another Payment window appears.

- Click the No

button.

button.

The Donation Detail window appears.

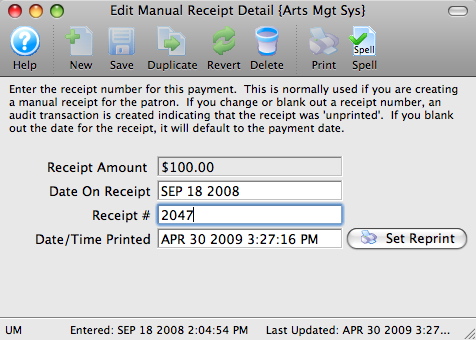

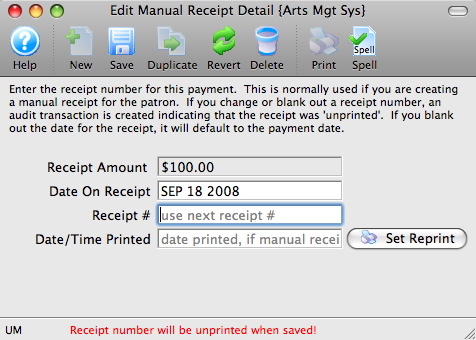

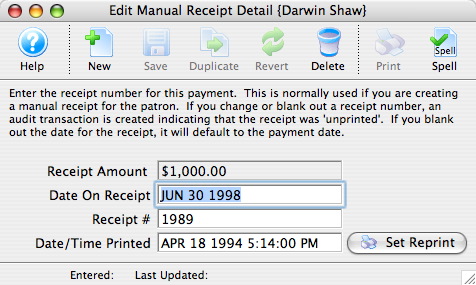

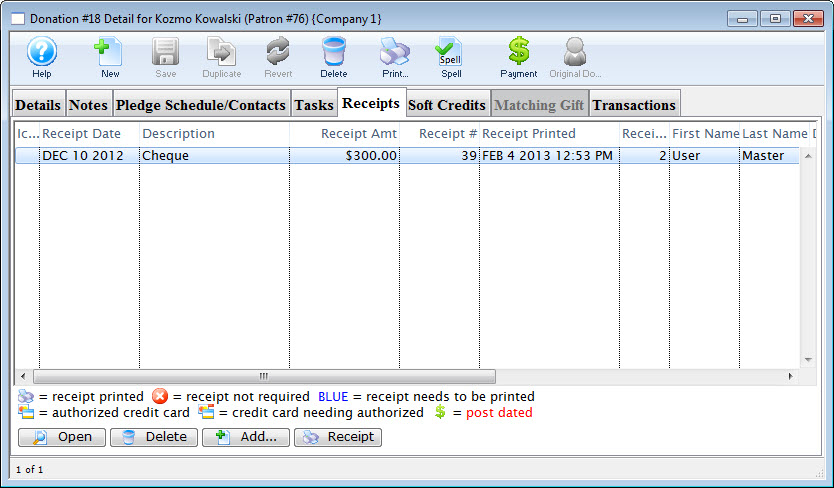

- Click the Receipts

tab.

tab.

- Click the Open

button.

button.

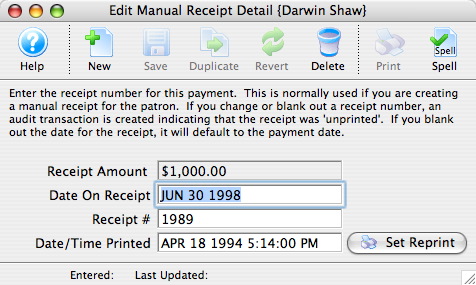

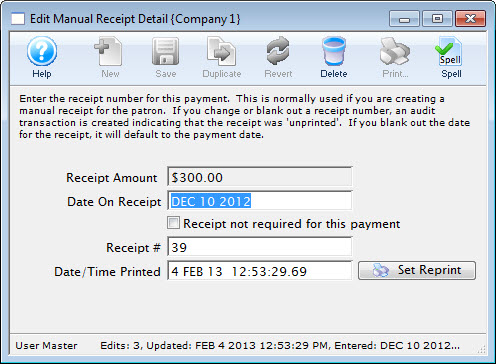

The Edit Manual Receipt Detail window opens.

- Delete the Receipt #.

- Close the Edit Manual Receipt Detail window.

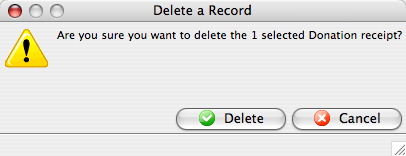

- Click the Delete

button.

button.

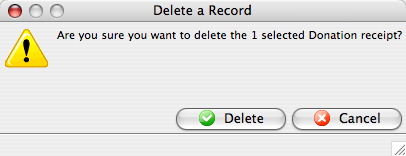

The Delete A Record confirmation window opens.

- Click the Delete

button.

button.

The receipt is removed from the Donation Detail window.

- Close the Donation Detail window.

The Patron Record will display the Donation

tab.

tab.

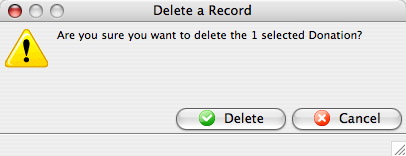

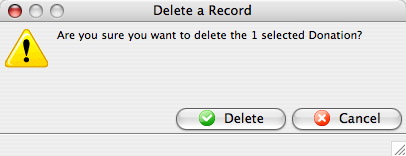

- Click the Delete

button.

button.

The Delete A Record confirmation window opens.

- Click the Delete

button.

button.

The Donation is now deleted from the Patron Record.

| For Quick reference information on Deleting a Donation, You can download: Screencasts (online video demonstrations of the functions with narration) |

Flash |

Mp4 |

Deleting and Refunding Donations

You use this function when a mistake has been made in entering a donation. Once the donation has been deleted, the payment for the donation can be refunded or modified. If the donation to be deleted is accompanied by a matching gift the matching gift will not be deleted. If a matching gift needs to be deleted, the same steps must be repeated for that donation in that patron's record.

Before you can delete a donation, all printed tax receipts associated with the donation must be un-printed.

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donations

tab.

tab.

- Choose the donation to be deleted.

Single click on a donation to select it.

- Click the Delete

button.

button.

A warning dialogue box opens.

- Click the Delete

button.

button.

A note appears at the bottom of the Patron window. The donation has been deleted but not refunded.

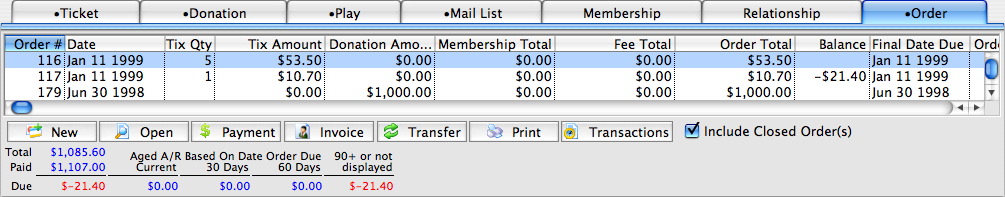

- Click the Orders

tab.

tab.

An outstanding receivables of $21.40 can be seen for Order # 117.

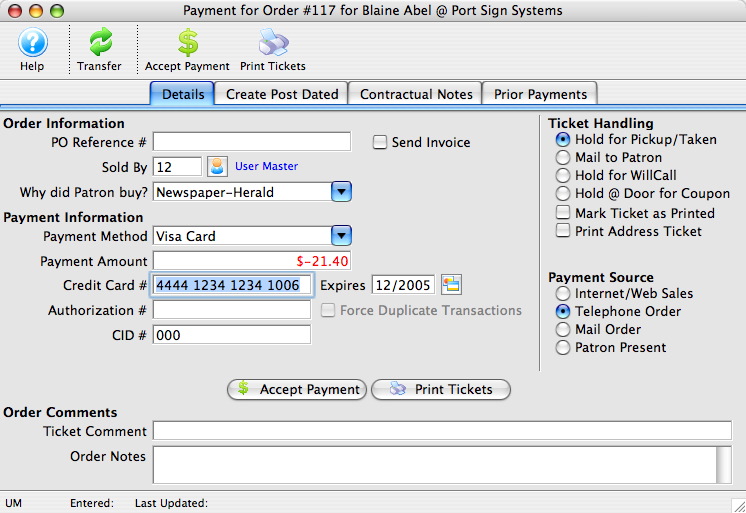

- Select the order to be refunded or modified.

- Click the Payment

button.

button.

The Payment Order window for the selected Order opens.

- Select the method in which the patron is to be refunded

That is, Cash or Credit Card if the transaction has been processed. If the original purchase method is unknown, click the Prior Payments

tab to view all previous payments to this order.

tab to view all previous payments to this order. - Click the Accept Payment

button.

button.

The payment and donation have now been refunded.

|

Any donations with receipts printed cannot be deleted until the receipt(s) for that donation are un-printed. Only users with proper security access can un-print receipts. |

| For quick reference information in Deleting and Refunding Donations you can access the following: |

Refunding a Donation

There are three steps to take in order to refund a donation. The first is to refund the payment, second the tax receipt needs to be removed and finally the donation itself needs to be deleted.

- Open the Patron Record.

For details on locating a Patron Record click here.

- Click the Donation

tab.

tab.

- Select the donation to be refunded.

Single click on the donation to select it.

- Click the Open

button.

button.

The Donation Detail window will open.

- Click the Payment

button.

button.

A Payment Warning opens, indicating there is no payment required for this order.

- Click the Yes

button.

button.

- Enter a negative payment for the value of the donation.

Use the Prior Payments

tab to review how the original payment was made.

tab to review how the original payment was made.

- Click the Accept Payment

button.

button.

A Payment Warning will appear indicating the payment made does not complete the order.

- Click the Yes

button.

button.

The Process Another Payment window opens.

- Click the No

button.

button.

The Donation Detail window opens.

- Click the Receipts

tab.

tab.

- Click the Open

button.

button.

The Edit Manual Receipt Detail window will open.

- Delete the Receipt #.

- Close the Edit Manual Receipt Detail window.

- Click the Delete

button.

button.

The Delete A Record confirmation window opens.

- Click the Delete

button.

button.

The receipt will be removed from the Donation Detail window.

- Close the Donation Detail window.

The Patron Record will displaying the Donation

tab.

tab.

- Click the Delete

button.

button.

The Delete A Record confirmation window will appear.

- Click the Delete

button.

button.

The Donation is now deleted from the Patron Record.

| For quick reference information in Deleting and Refunding Donations you can access the following: |

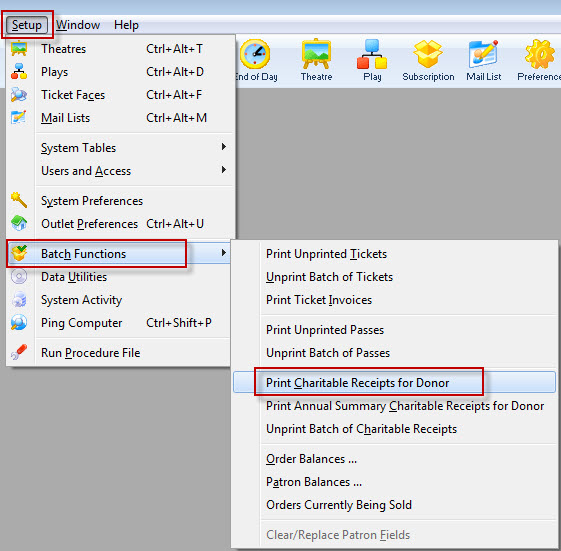

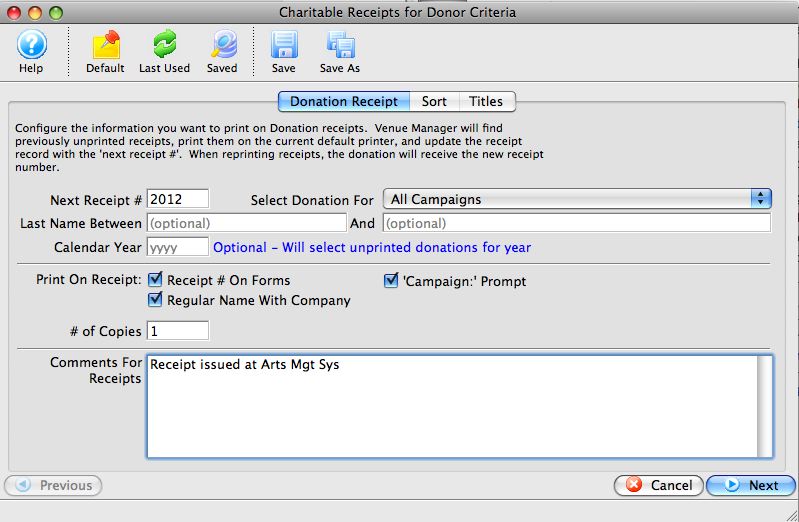

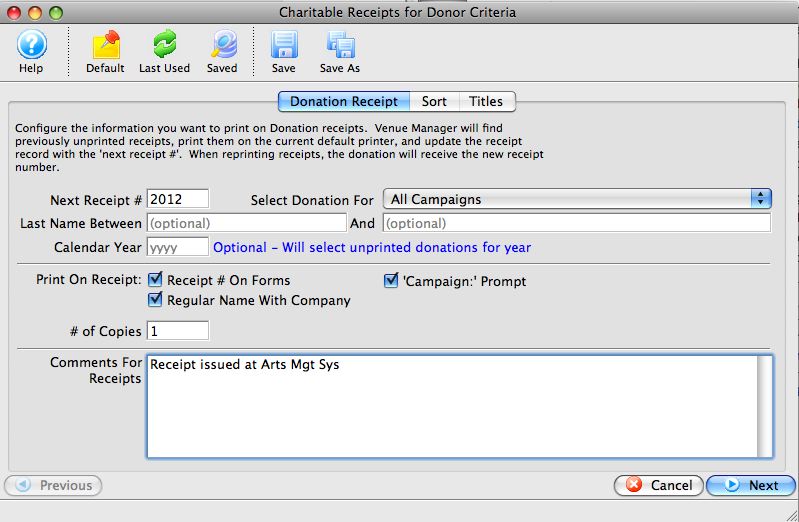

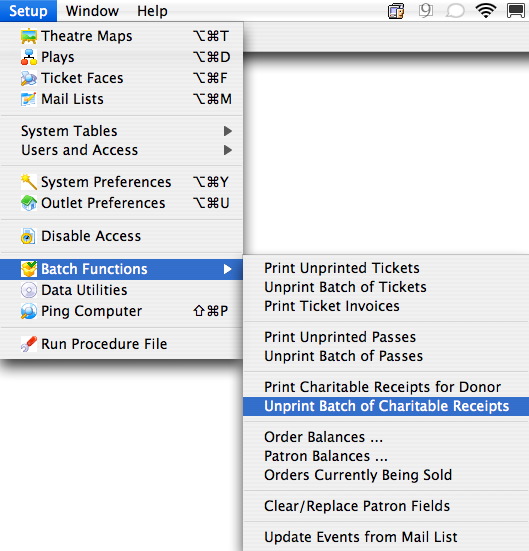

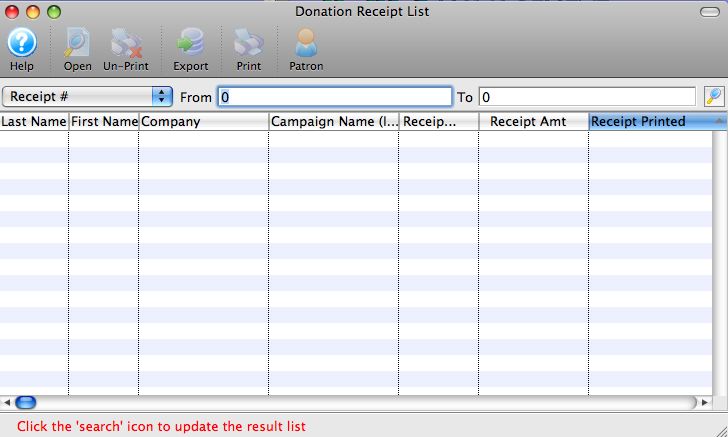

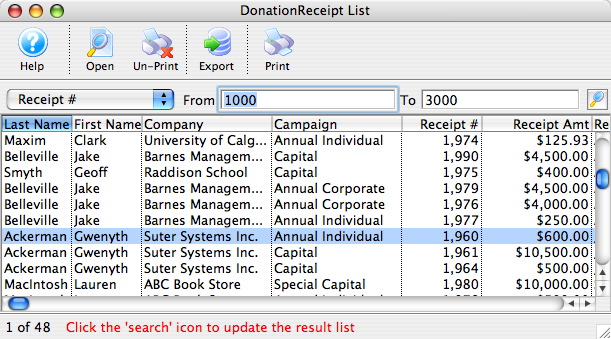

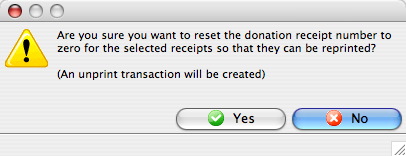

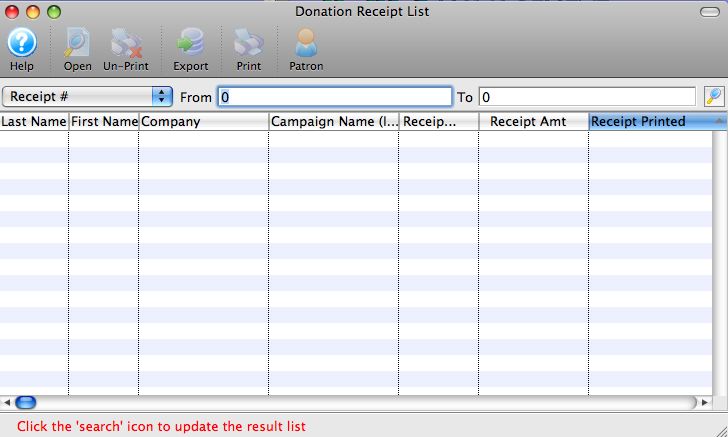

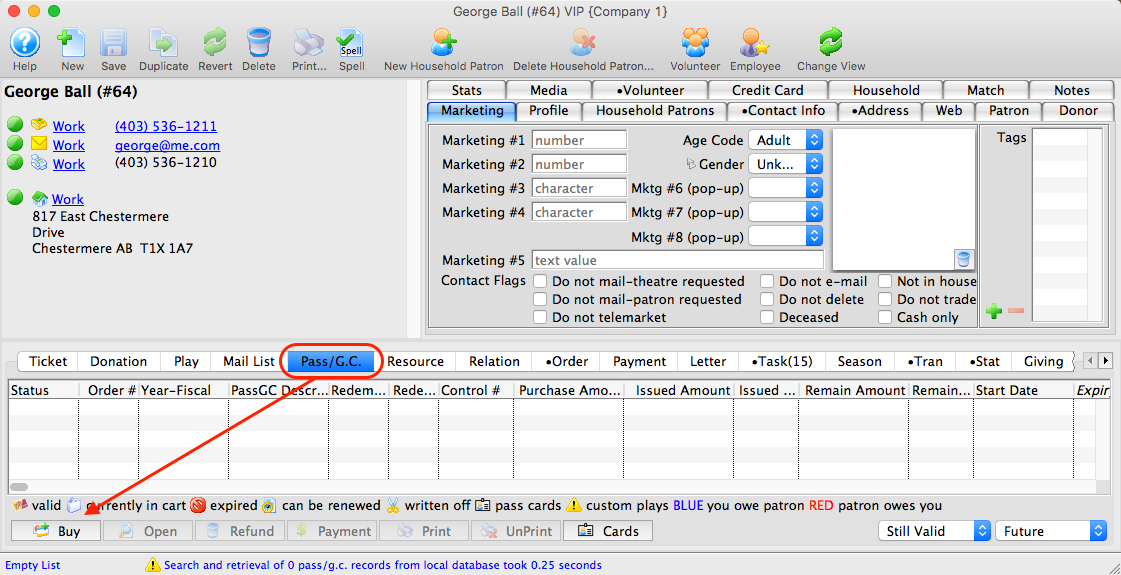

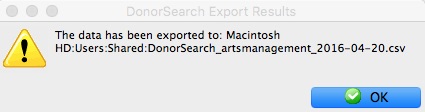

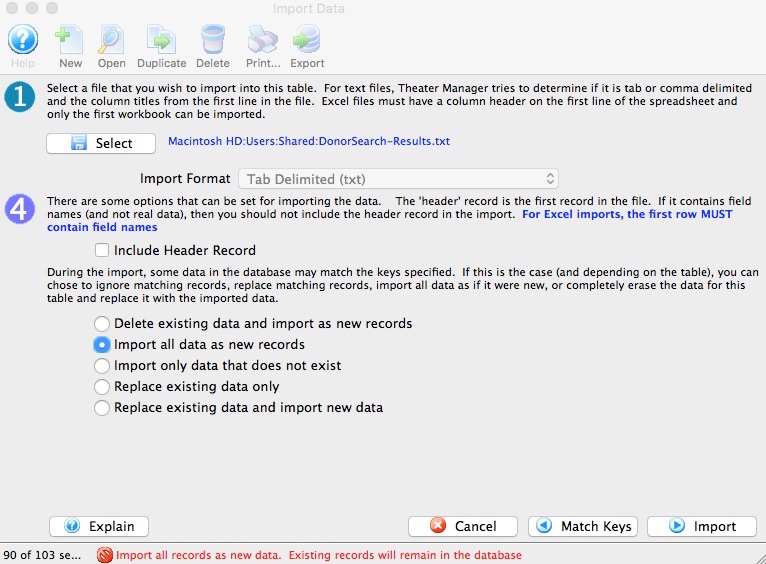

Donation Receipt Printing