Setting up the Chart of Accounts

The following steps are required to setup the General Ledger. If you don not compete the setup procedures, this could cause errors in posting.

- Confirm and update the credit card types in the Code Table setup.

For more information on setting up the Credit Card types, click here.

- Determine the detail required for tracking sales revenue, ticket markups, ticket discounts, ticket exchanges, and ticket refunds.

For more information on the Detail Level, see below.

- Determine the taxes that are applied to ticket sales and set the Default Data Tax controls so they are applied correctly.

For more information on the Tax Table setup, click here.

- Create or update the General Ledger accounts.

For more information on creating a general ledger account, click here.

- Enter the account numbers required for posting into the Default Data general ledger window.

- Determine when receivables are to be recorded in the General Ledger.

For more information on this setting, click here.

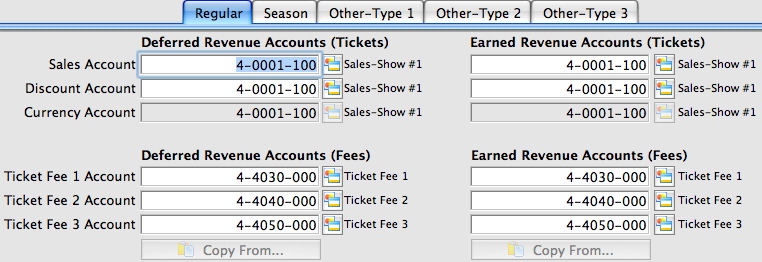

- Input the correct revenue account numbers into the setup windows under the Events / Plays.

Determine the General Ledger Revenue Detail Required

The Plays and Dates window has seven general ledger account number fields. These fields are used to enter account numbers from the General Ledger Chart of Accounts to direct the type of revenue received, to a specific account number. Depending on the level of detail your organization requires, you can enter separate General Ledger account numbers in each field, or the same account number could be entered in all the fields.

|

The number of General Ledger accounts setup depends on the detail required. |

Detailed Setup |

Simplified Setup |

|

The maximum detail is achieved when each event / play has a separate general ledger account number for sales, refunds, exchanges, markups, discounts, and service charges. The General Ledger would provide detailed information for each account. The general ledger entries created would display each revenue account affected by the transactions journalized in the entry. |

A simplified setup would use the same general ledger account number for sales, refunds, exchanges, markups and discounts. Another general ledger account number would be setup for service charges. The General Ledger Chart of Accounts would have only one revenue account. The general ledger entries created would display only one account number for all the transactions journalized for the event / play, recording all the revenue into one account. |

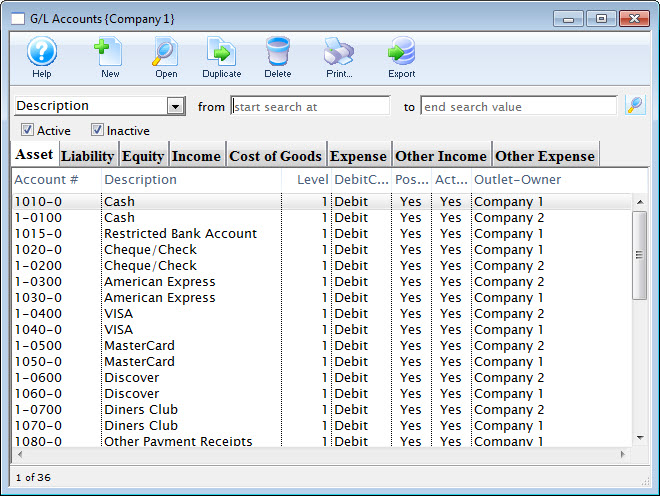

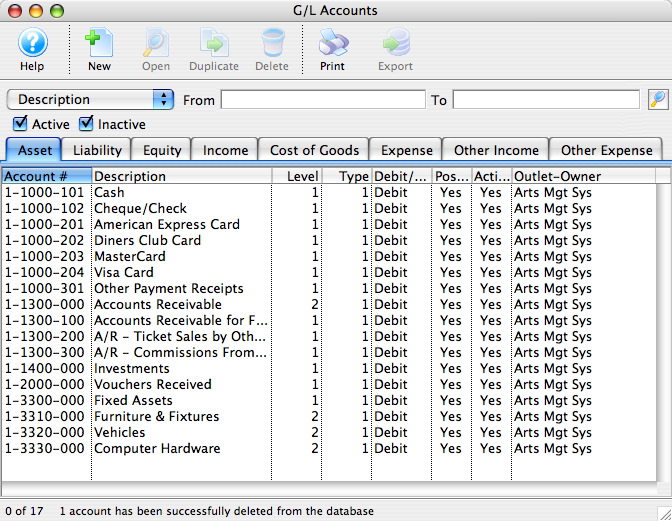

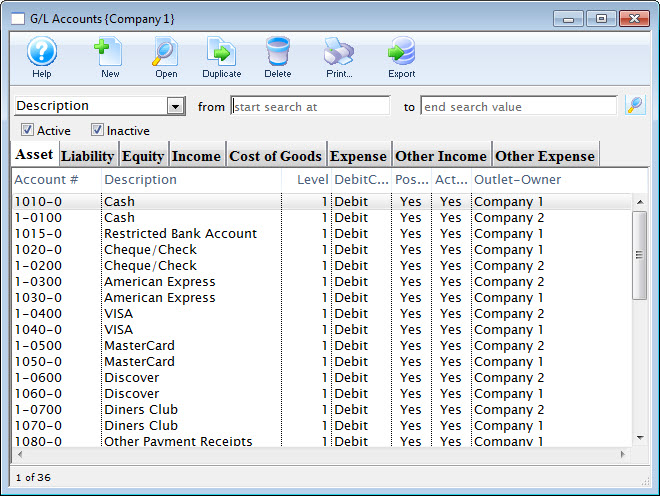

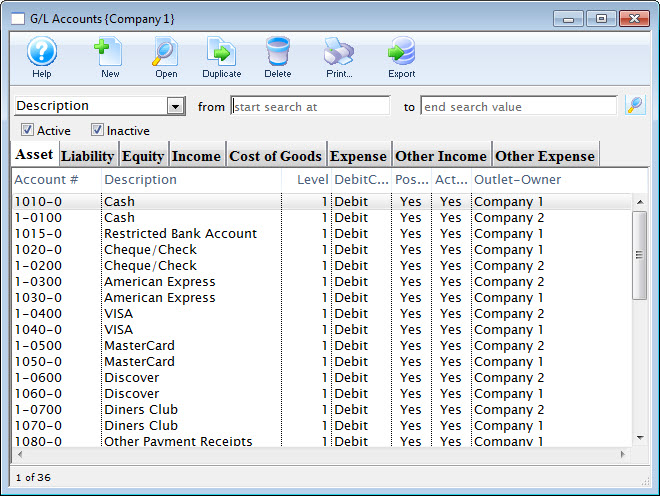

Chart of Accounts Window

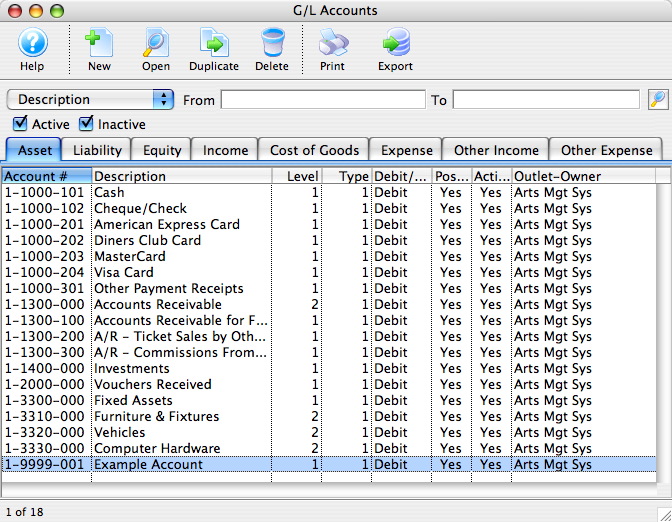

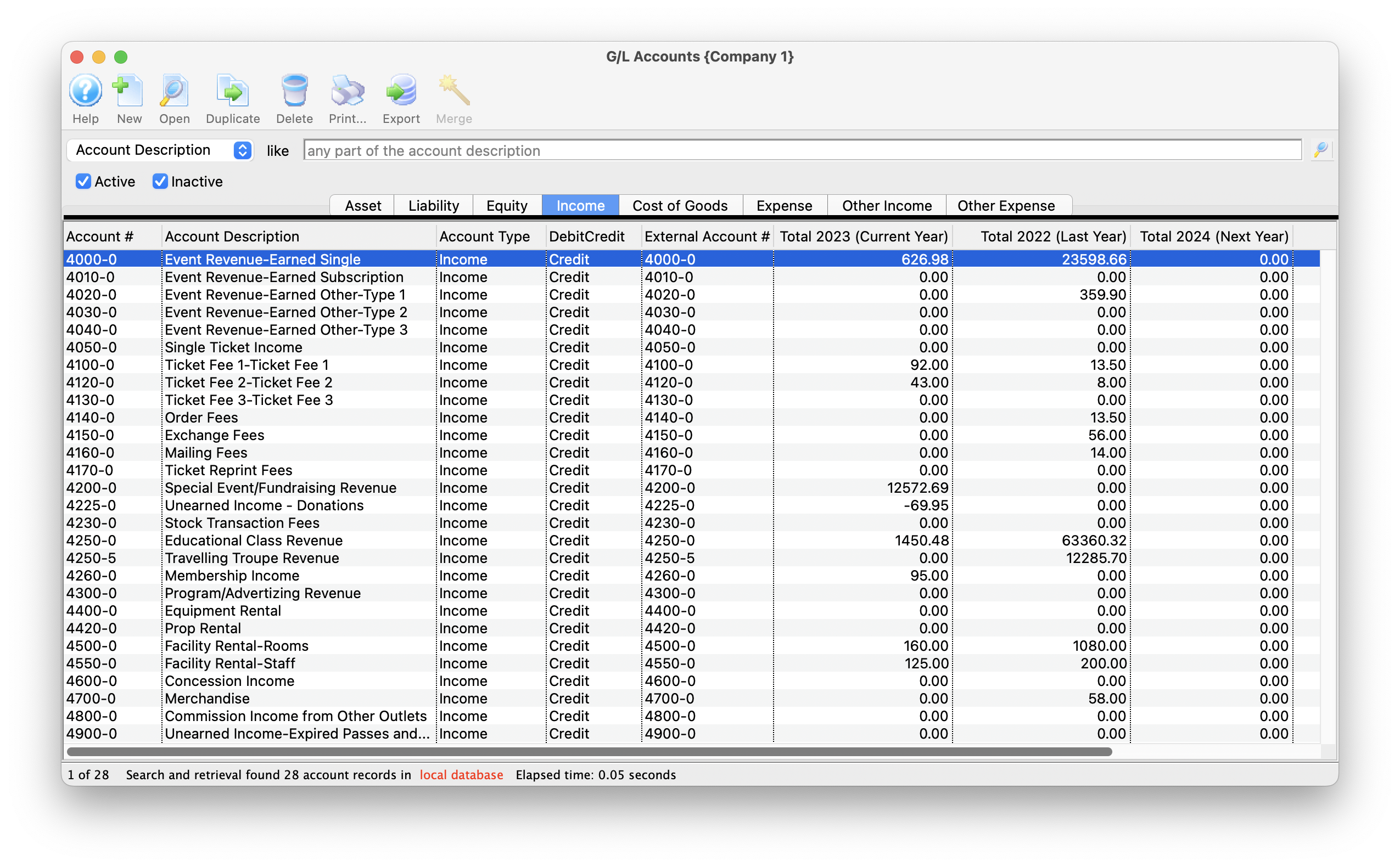

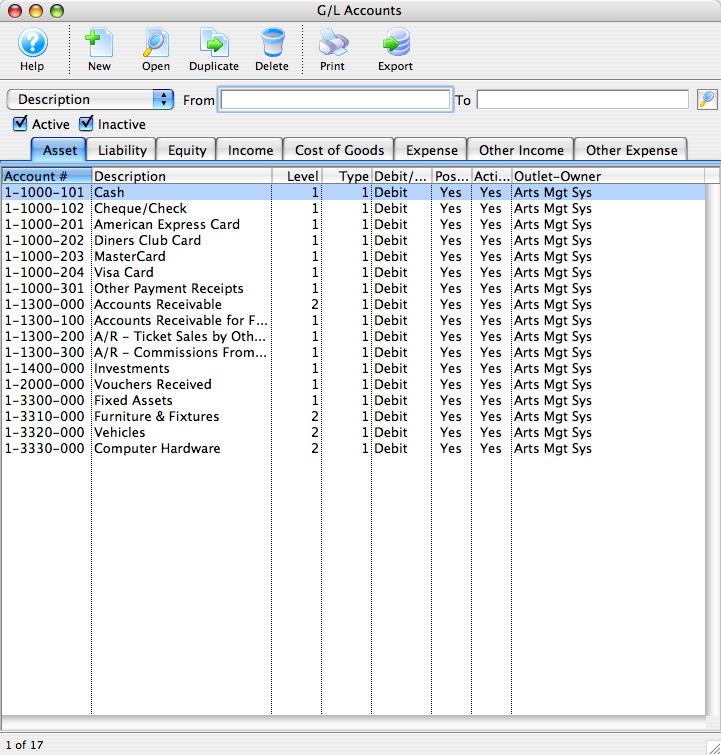

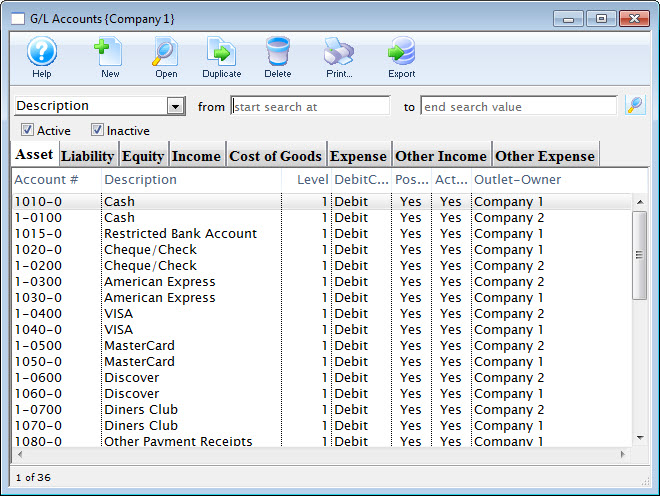

The General Ledger Chart of Accounts contains all the accounts your organization sets up in the G/L. Both the active and inactive accounts can be displayed using the selection field at the bottom of the window.

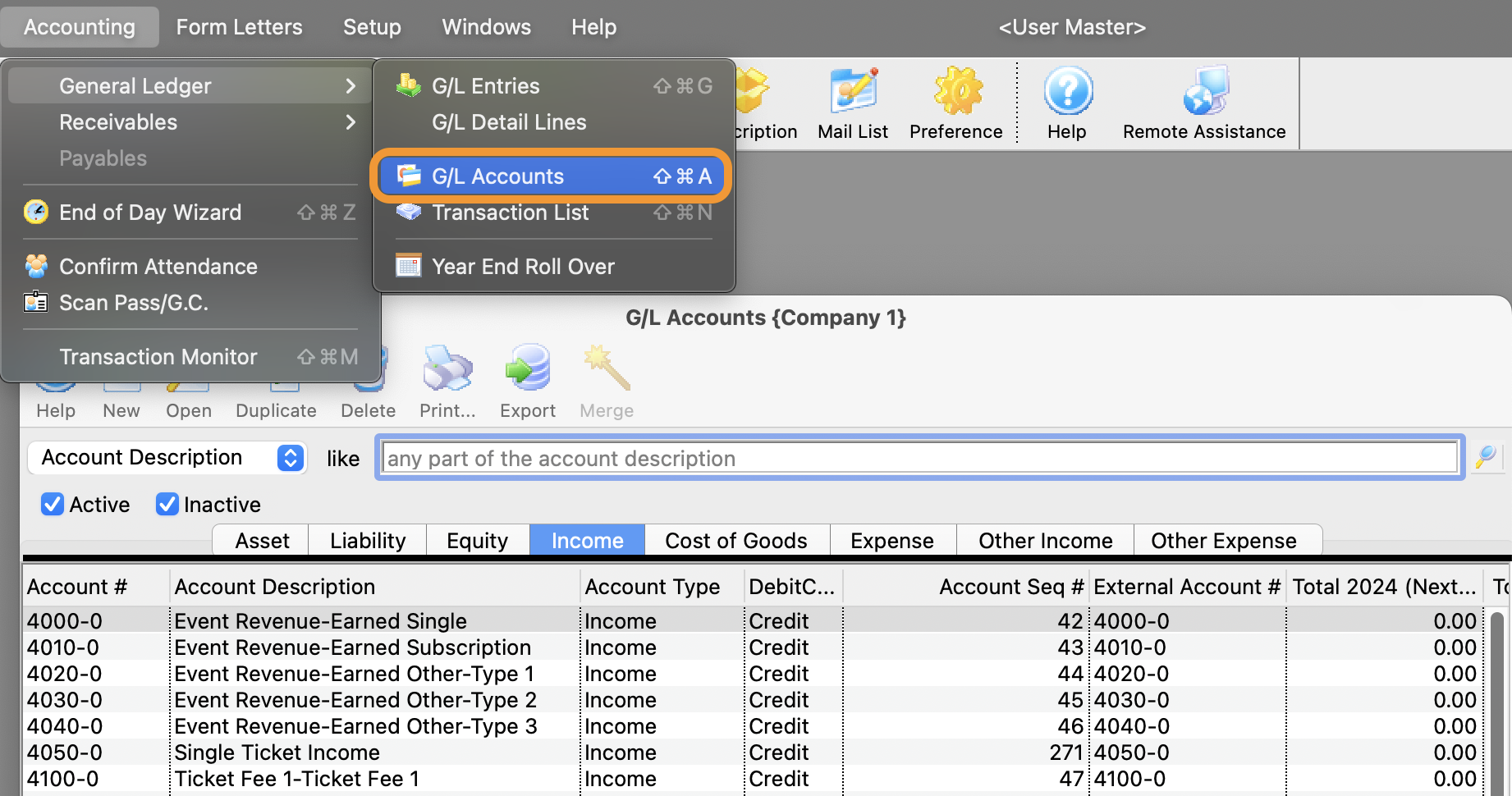

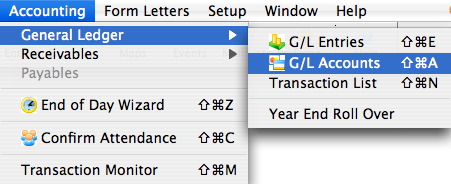

To open the Chart of Accounts, select the Accounting >> General Ledger >> G/L Accounts menu.

The G/L Chart of Accounts window opens.

Parts of the GL Account Window

|

Insert a New G/L Account. |

|

Open the detail window for a G/L Account. |

|

Create a copy a G/L Account |

|

Delete a selected G/L Account. |

|

Generate a report of the current list of G/L Accounts. |

|

Export the G/L Account details. |

|

Merges G/L Accounts (if more than 1 account is selected). |

| Asset | Displays all the accounts which have been setup as Asset Accounts. Click here to view a sample of Asset accounts. |

| Liability | Displays all the accounts which have been setup as Liability Accounts. Click here to view a sample of Liability accounts. |

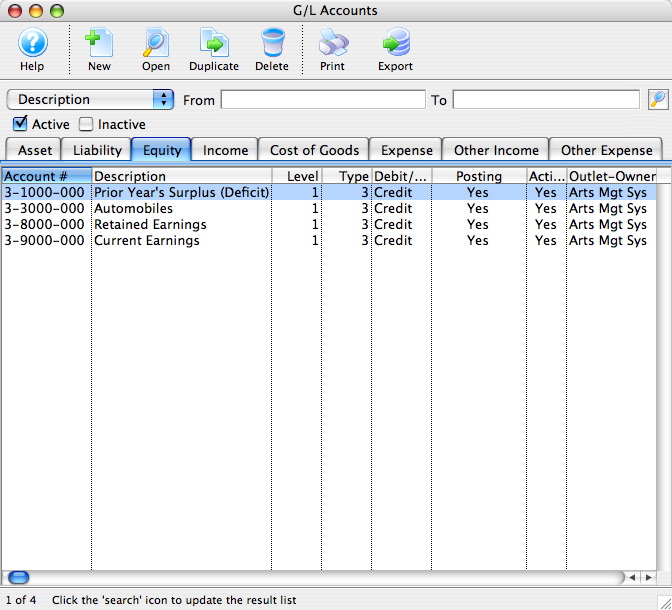

| Equity | Displays all the accounts which have been setup as Equity Accounts. Click here to view a sample of Equity accounts. |

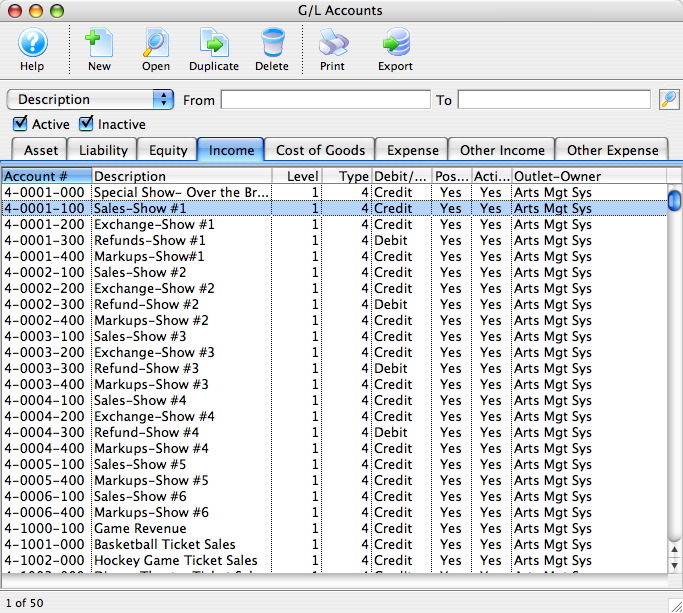

| Income | Displays all the accounts which have been setup as Income Accounts. Click here to view a sample of Income accounts. |

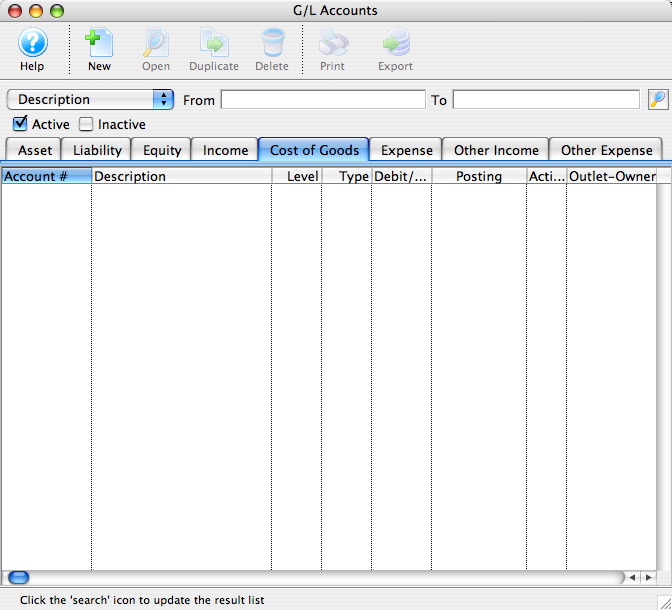

| Cost/Sales | Displays all the accounts which have been setup as Cost/Sales Accounts. Click here to view a sample of Cost/Sales accounts. |

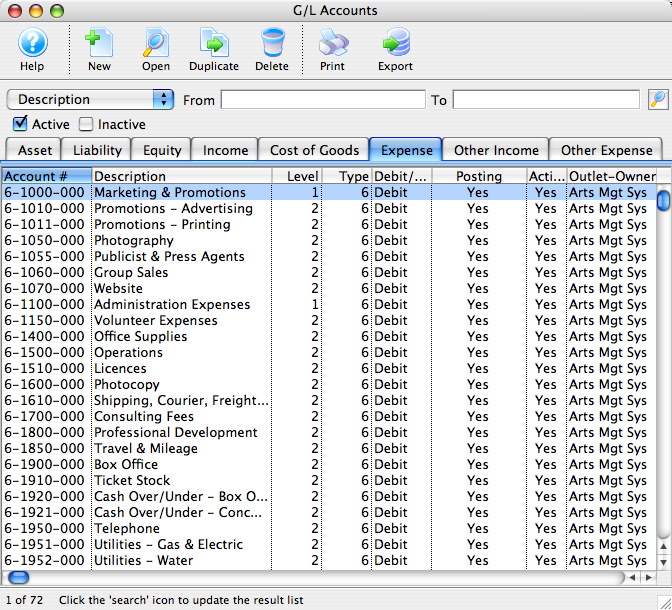

| Expense | Displays all the accounts which have been setup as Expense Accounts. Click here to view a sample of Expense accounts. |

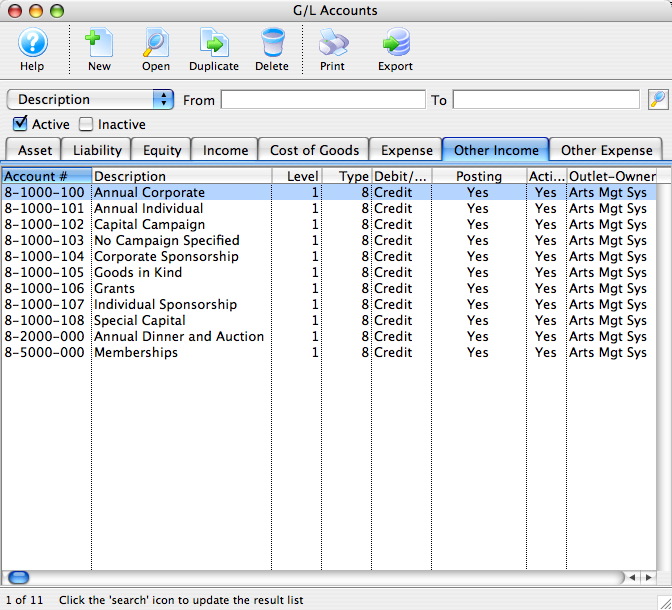

| Other Income | Displays all the accounts which have been setup as Other Income Accounts. Click here to view a sample of Other Income accounts. |

| Other Expense | Displays all the accounts which have been setup as Other Expense Accounts. |

| Account # | The eight digit account number of the account. |

| Description | The description of the account which is viewed on reports and any general journal entries which involve the account. |

| Level | The report level of the account. This feature is a future enhancement of Theatre Manager meant to represent indenting on the reporting and sub total levels. In other words, if something is at level 1, it is a grand total, Anything that is a 2 and under is accumulated into the grand total. |

| Type | The type of account either Detail or Posting. This is another future enhancement of Theatre Manager used to designate whether the account is a detail account or a posting account when printing summary level reports. |

| Debit/Credit | If the account is a Debit or Credit Account. |

| Posting | If the account is posted to the General Ledger |

| Active | If the account is set as active or inactive. |

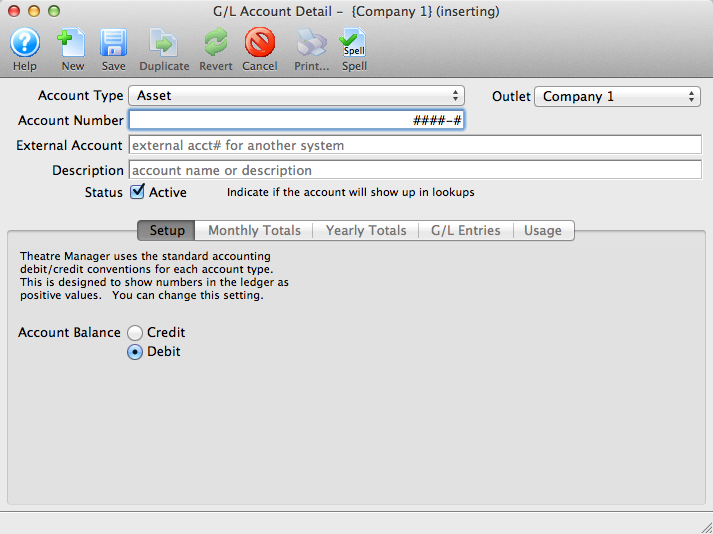

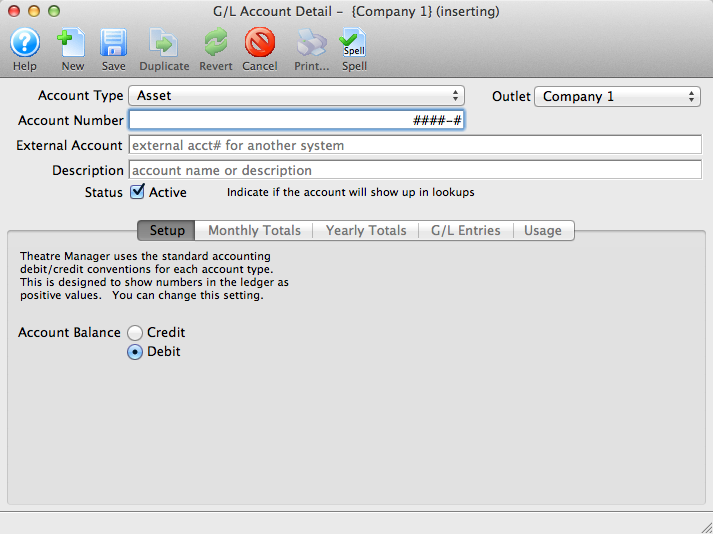

G/L Account Detail

The account detail window is accessed by opening the G/L Chart of Accounts and double clicking on an account or when inserting a new account.

Parts of the Account Detail Window

|

Saves the current general ledger account. |

|

Creates a duplicate of the current general ledger account. |

|

Reverts to the last saved version of the general ledger account. |

|

Deletes the general ledger account. If there are transactions associated with the account, it cannot be deleted. |

|

Prints the information in the general ledger account. |

|

Checks the spelling in all text entry fields in the window. |

| Account Type | Designates whether the account is a detail account or a posting account when printing summary level reports. Available for future enhancement. Not used at this time. |

| Account Number | An account consists of numbers and dashes. The dashes are typically a place holder (eg. 0-0000-000). The format of the numbers is controlled within the Accounting tab of Company Preferences. The first digit corresponding to the type of account. For more information on Account Types, see below. |

| External Account | External Account is a 50 character alpha-numeric field that will accommodate systems with longer account numbers or ones which include letters. When printing reports or exporting, the external account number will print or be visible. For use specifically with the Banner financial package and similar. Clients who do not need this longer field can simply duplicate the internal account number here. Information about the different export formats can be found here. |

| Description | Description allows the account to be named. The account number and descriptions are displayed on reports and on any general journal entries that affect the account. The more detail used to explain the account, the more easy reports will be to read. |

| Status | Used to indicate that the account is in use. If accounts are retired, or no longer required, it may be unchecked. |

|

The Setup tab deals with general information settings for the general ledger account. For more information on the Setup tab, click here. |

|

The Monthly Totals tab shows a breakdown of the monthly totals for the general ledger account. For more information on the Monthly Totals tab, click here. |

|

The Yearly Totals tab shows a breakdown of the yearly totals for the general ledger account. For more information on the Yearly Totals tab, click here. |

|

The G/L Entries tab shows transactions that are associated with the general ledger account. For more information on the G/L Entries tab, click here. |

Account Types

| Type of Account | First Number |

| Asset | 1 |

| Liability | 2 |

| Equity | 3 |

| Income | 4 |

| Cost of Sales | 5 |

| Expenses | 6 |

| Other Income | 8 |

| Other Expenses | 9 |

The next four numbers indicate the account number. The last three digits are for a feature of the account.

Play revenue accounts can be created so that the account number indicates the play and the feature indicates the type of revenue (sales, exchange, refunds, markup or discounts).

Try to harmonize the numbers to match the account numbers used in your existing accounting system.

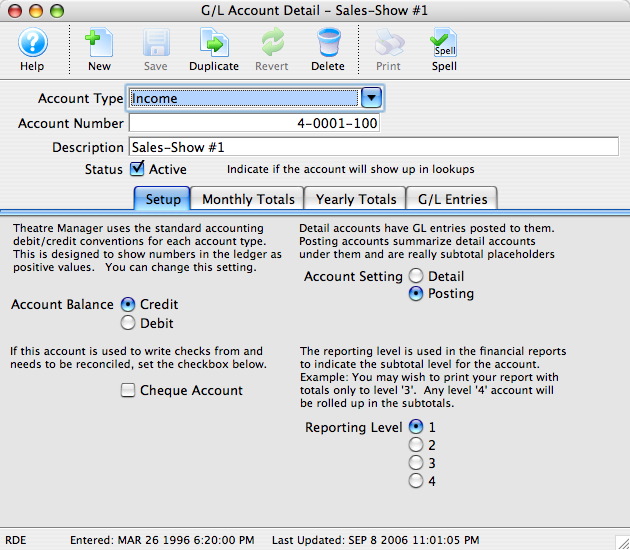

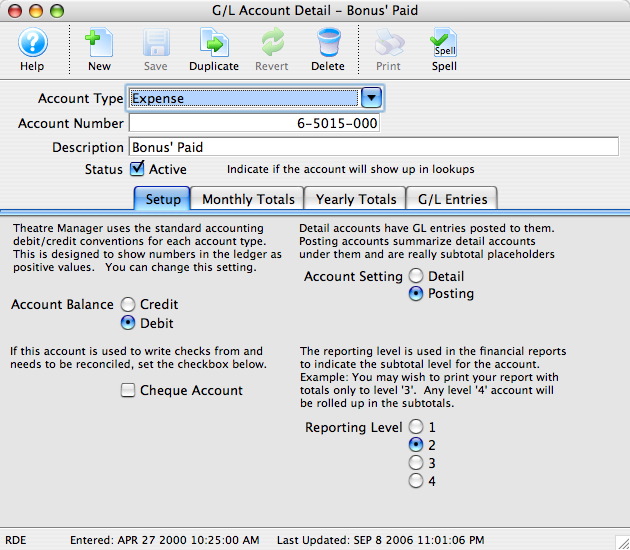

G/L Account Detail Setup Tab

The account detail window is accessed by opening the G/L Chart of Accounts and double clicking on an account or when inserting a new account.

Parts of the Account Detail Setup Tab

- Account Type indicates if the GL account is to be an Asset, Liability, Equity, Income, Cost of Goods Sold, Expense, or Other Income/Other Expense type.

- Account Number is the GL Account Number that will be assigned to this account.

- External Account gives you the opportunity to display a longer GL account number for reporting. This field is alpha-numeric.

- Description is the common name of the GL Account. This, in conjunction with the Account Number will appear on reports.

|

The Monthly Totals tab shows a breakdown of the monthly totals for the general ledger account. For more information on the Monthly Totals tab, click here. |

|

The Yearly Totals tab shows a breakdown of the yearly totals for the general ledger account. For more information on the Yearly Totals tab, click here. |

|

The G/L Entries tab shows transactions that are associated with the general ledger account. For more information on the G/L Entries tab, click here. |

| Account Balance | Depending on the account type selected, Theatre Manager will using standard accounting conventions to determine in the account should be a Credit or a Debit. |

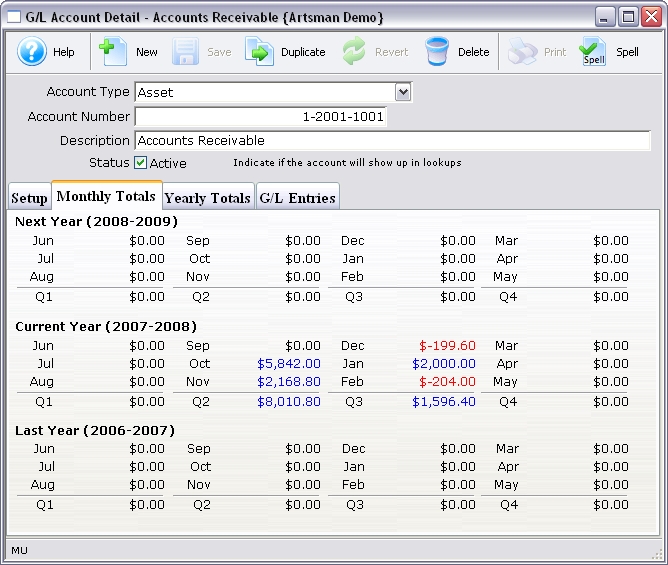

G/L Account Detail Monthly Totals Tab

The account detail window is accessed by opening the G/L Chart of Accounts and double clicking on an account or when inserting a new account.

Parts of the Account Detail Monthly Totals Tab

|

The Setup tab deals with general information settings for the general ledger account. For more information on the Setup tab, click here. |

|

The Yearly Totals tab shows a breakdown of the yearly totals for the general ledger account. For more information on the Yearly Totals tab, click here. |

|

The G/L Entries tab shows transactions that are associated with the general ledger account. For more information on the G/L Entries tab, click here. |

| Next Year | This area shows the account details for the Next Year prior to Year End Roll Over. |

| Current Year | This area shows the account detail for the current year divided into four quarters. |

| Prior Year | The same as the current year but the totals are for the prior year. |

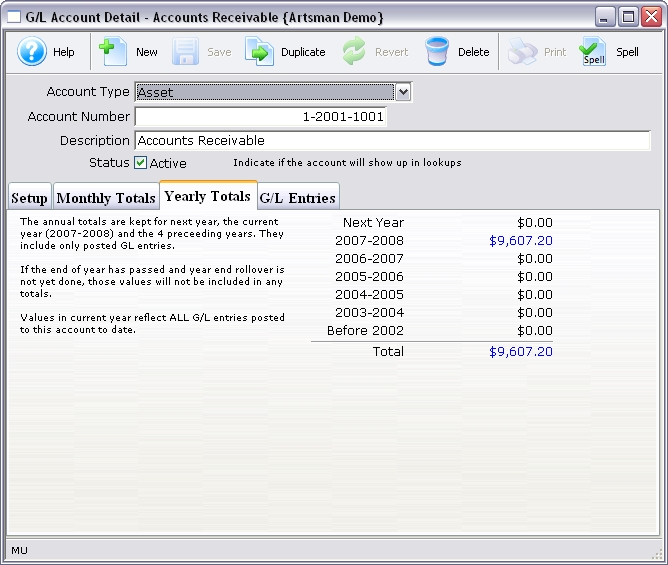

G/L Account Yearly Totals Tab

The account detail window is accessed by opening the G/L Chart of Accounts and double clicking on an account or when inserting a new account.

Parts of the Account Detail Yearly Totals Tab

|

The Setup tab deals with general information settings for the general ledger account. For more information on the Setup tab, click here. |

|

The Monthly Totals tab shows a breakdown of the monthly totals for the general ledger account. For more information on the Monthly Totals tab, click here. |

|

The G/L Entries tab shows transactions that are associated with the general ledger account. For more information on the G/L Entries tab, click here. |

|

A brief summary of the account details for the past five years and the total for those years. |

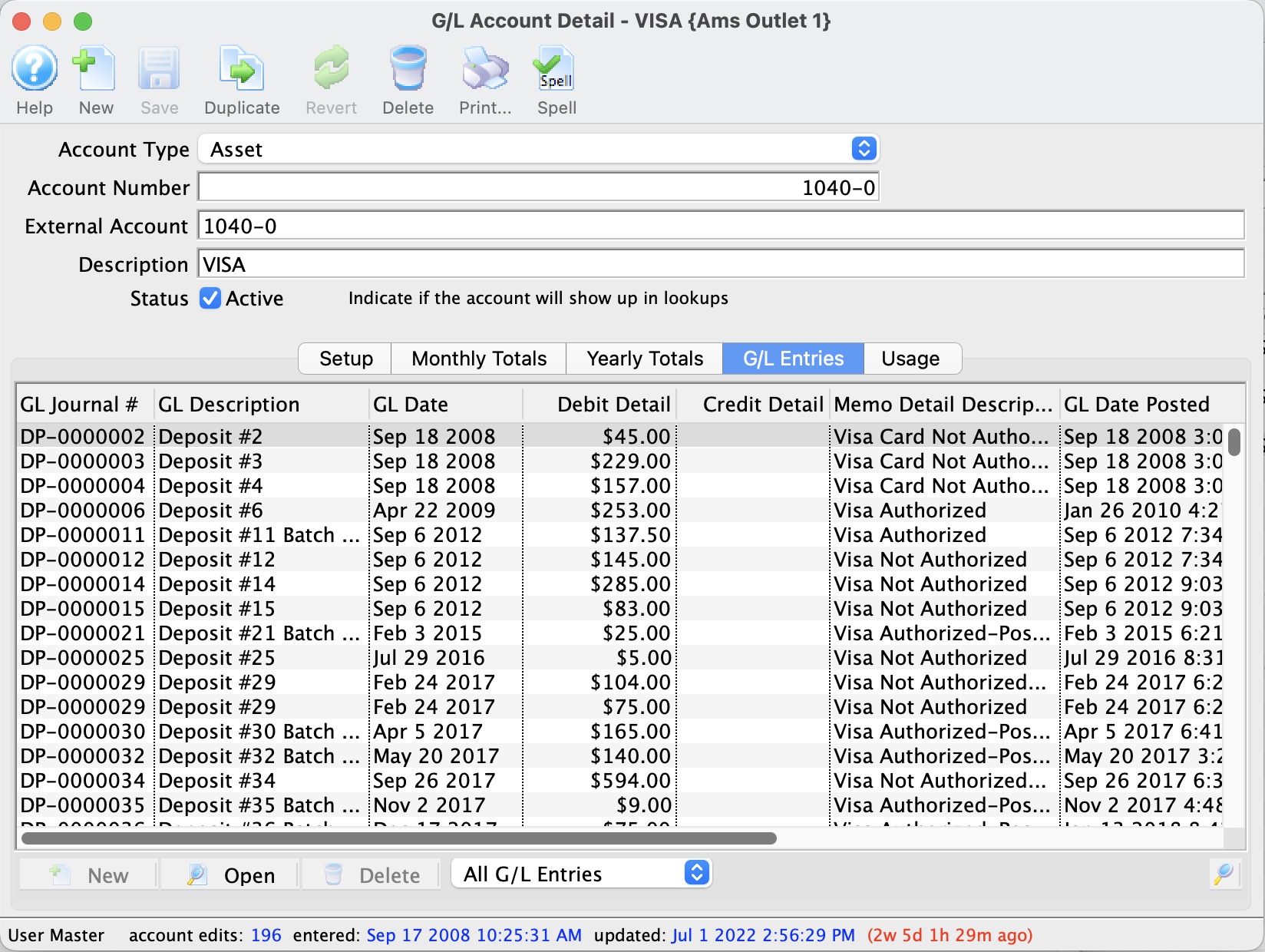

G/L Account Detail G/L Entries Tab

If you select a number of rows on the GL detail or transaction tabs, Theatre Manager will summarize the totals for you.

Parts of the Account Detail G/L Entries Tab

|

The Setup tab deals with general information settings for the general ledger account. For more information on the Setup tab, click here. |

|

The Monthly Totals tab shows a breakdown of the monthly totals for the general ledger account. For more information on the Monthly Totals tab, click here. |  |

The Yearly Totals tab shows a breakdown of the yearly totals for the general ledger account. For more information on the Yearly Totals tab, click here. |

|

Choose from the the drop down the type of entries for viewing |

| Journal # | The Journal number generated when the entry was created |

| Description | Brief description outlining the reason for the entry |

| Date | Date the entry was created |

| Debit | Amount debited to the G/L account |

| Credit | Amount credited to the G/L account |

| Memo | Details about the nature of the entry |

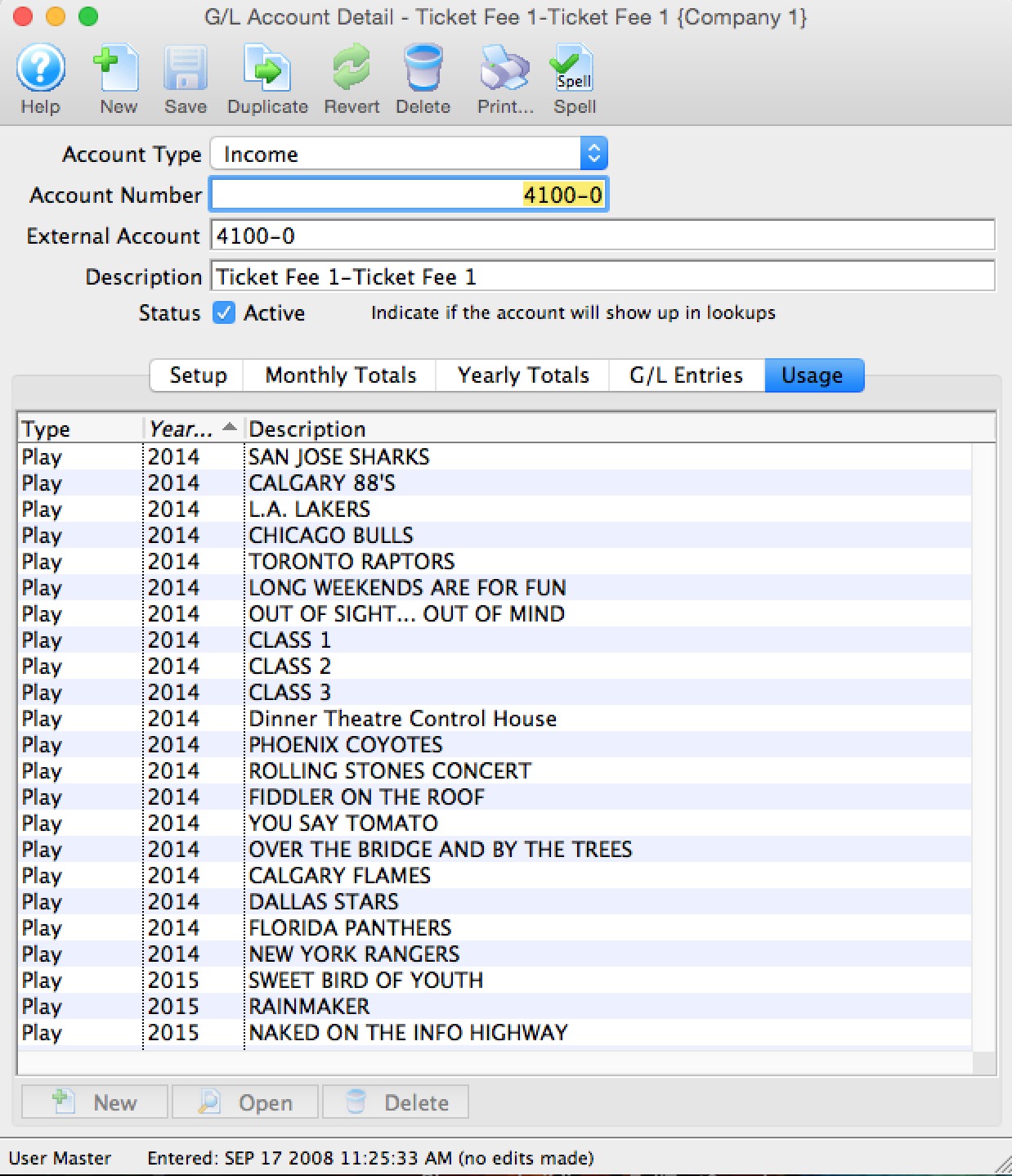

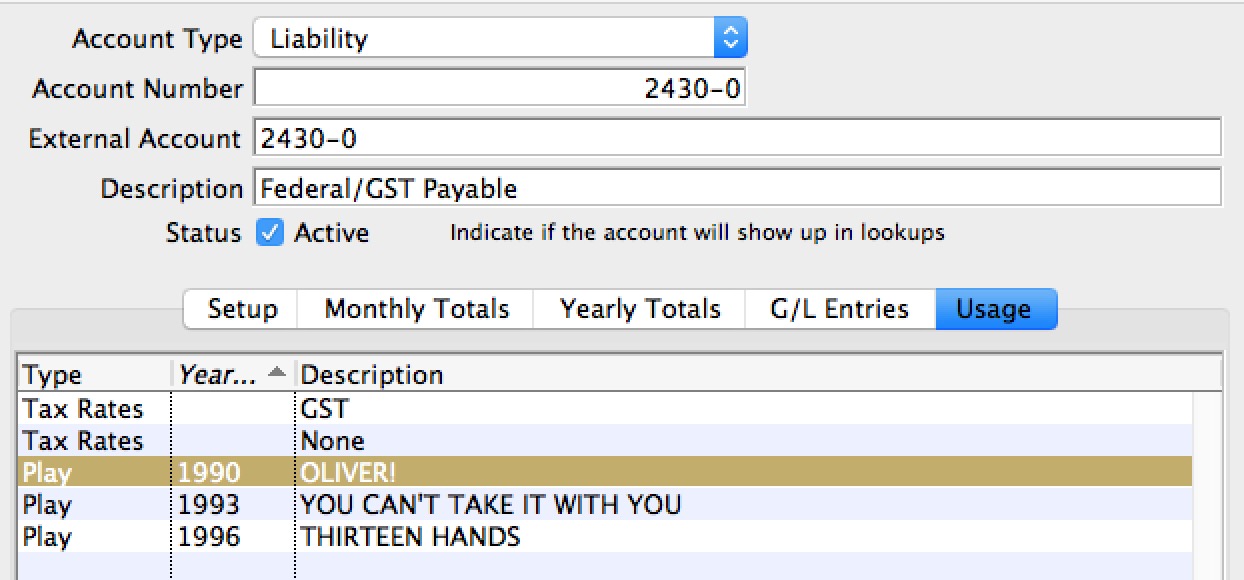

G/L Account Usage

- events

- fees

- donation campaigns

- resources

- taxes

- default posting accounts

Double click on any row to see the detail window containing the posting account. The first example shows what one might expect for a normal setup,

This second example shows that events are being posted to a tax account, which may assist showing why things are getting into an account that you didn't expect.

Setting up General Ledger Accounts

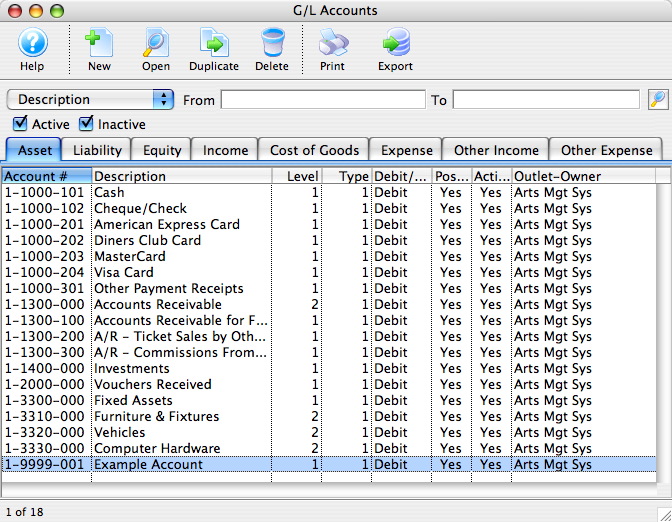

- Access to the Chart of Accounts is through the Accounting menu.

The G/L Accounts window opens.

Merging G/L Accounts

- change it to the first account

- Aggregate any totals into the new account

it could take a long time, especially if the account you are merging from has a lot of transactions (eg it was used for a play). Always try to merge into the most used account, and if you need to afterwards, rename/renumber the account you combined things into.

Accounts must be of the same type to merge them. Eg, you can only merge an asset account into an asset account, an income account into an income account, etc. Since is possible to change some account types (eg you can change liability to income). If you wish to merge disparate account types, then change the account type first.

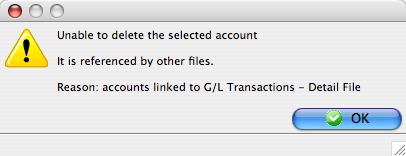

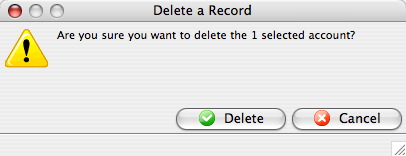

Deleting General Ledger Accounts

|

Only accounts which have not been used in a transaction may be deleted. |

For information on inactivating a G/L Account, click here.

- Find the account to be deleted.

For more information on finding a G/L Account, click here.

- Click the Delete

button.

button.

If the account has been used for a transaction the following message will appear.

If the account has not been used then the following message will appear.

- Click the

button to confirm.

button to confirm.

The account will be removed and a deletion confirmation will appear at the bottom of the window.

Determine the Chart of Accounts

Creating the Chart of Accounts requires understanding how the General Ledger will be used to generate information. For more information, refer to the sample Chart of Accounts by clicking here.

Minimum General Ledger Accounts

The suggested minimum number of General Ledger Account numbers are outlined in this table. The organization may choose to operate with fewer or more accounts.

|

Minimum General Ledger Accounts |

Type of Account |

|

Cash |

Asset |

|

Check |

Asset |

|

Accepted Credit Cards |

Asset |

|

Vouchers Received |

Asset |

|

Other Payments |

Asset |

|

Accounts Receivable |

Asset |

|

Accounts Receivable - Future Payment |

Asset |

|

Accounts Receivable - Outlet |

Asset |

|

Accounts Payable |

Liability |

|

City/Municipal Tax Payable - If this tax is collected |

Liability |

|

Provincial/State Tax Payable - If this tax is collected |

Liability |

|

Federal Tax Payable - If this tax is collected |

Liability |

|

Prepaid Gift Certificates |

Liability |

|

Deferred Donation |

Liability |

|

Commissions Payable |

Liability |

|

Order Fees |

Revenue |

|

Exchange Fees |

Revenue |

|

Reprint Fees |

Revenue |

|

Mail Fees |

Revenue |

|

Sales Account for Each Event |

Revenue |

|

Cash Over/Under |

Expense |

|

Donation Bank Transfer |

Expense |

|

Bank Service Charges |

Expense |

|

Donations |

Other Income |

Required General Ledger Accounts

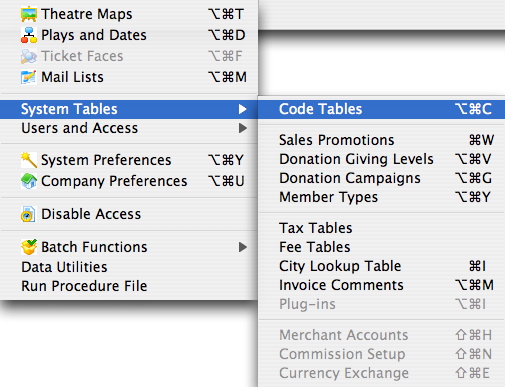

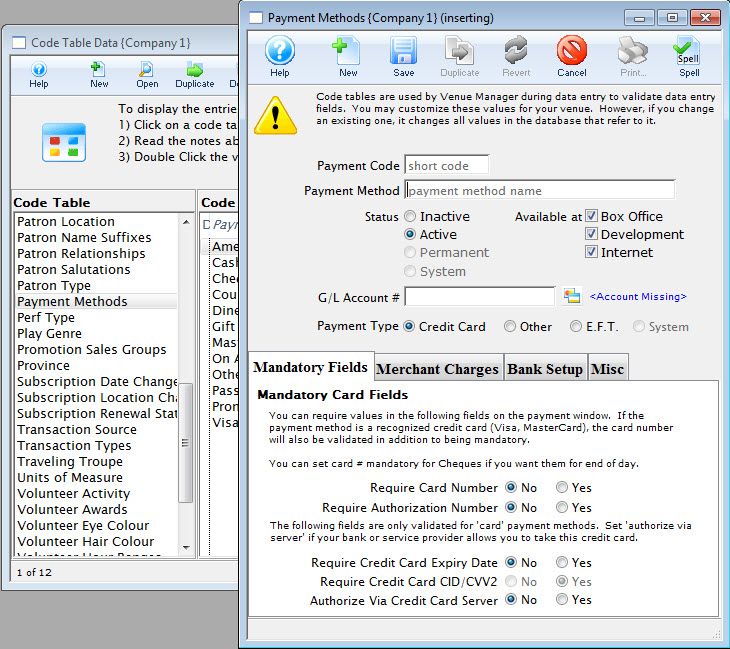

- Open the Code Table Window via the Setup >> System Tables >> Code Tables menu.

- Select Payments.

A list of required general ledger accounts is displayed.

- Select Default Posting Accounts.

The account names that appear in the list are the minimum number of accounts required for the General Ledger to operate and, except the credit card types, are determined by Theatre Manager. The credit card types that appear are determined by the credit card types entered in the Credit Card Category of the Code Table. All additional credit card types to the Code Table requires that Accounting Default Data be updated with a corresponding account number.

The actual general ledger account numbers used depends on the accounts set up in the General Ledger.

All required accounts must have a corresponding account number otherwise Theatre Manager we be unable to create deposits and revenue allocations.

Editing a General Ledger Account

To edit an account, you change some of the account details. Accounts can be changed to debit or credit accounts, active or inactive etc.

- Open the Chart of Accounts.

For more information on accessing the Chart of Accounts, click here.

For a detailed description of this window, click here.

- Find the account to be edited.

For information on finding a G/L account, click here.

- Double click the account to open the Account Detail window.

For a detailed description of this window, click here.

- Once the changes have been completed, click the Save

button.

button.

Setting an Account as Inactive

Over time, accounts in the GL may become obsolete. These accounts cannot be deleted because they still hold financial information. A user with the proper security clearance can set these accounts as inactive. Once an account is set as inactive it can no longer be used unless it it is reactivated.

- Open the Chart of Accounts window.

For more information on accessing the Chart of Accounts, click here.

- Find the account to be set as inactive.

For more information on finding a general ledger account, click here.

- Double click the account to open the Account Detail window.

- Uncheck the Status Active

box.

box.

The account will now be set as inactive and can no longer be used.

Finding General Ledger Accounts

- Open the Chart of Accounts window.

For more information on accessing the Chart of Accounts window, click here.

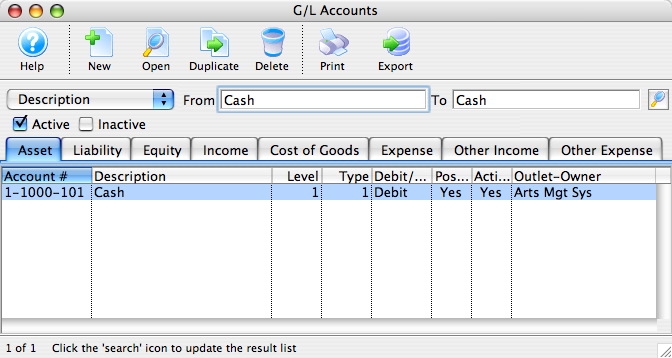

- Select the type of search to use to find the account.

- Enter the range of accounts to search for in the To and From fields.

- Click the Search

button.

button.

All matching entries will be displayed.

To view the details of an account double click the account.

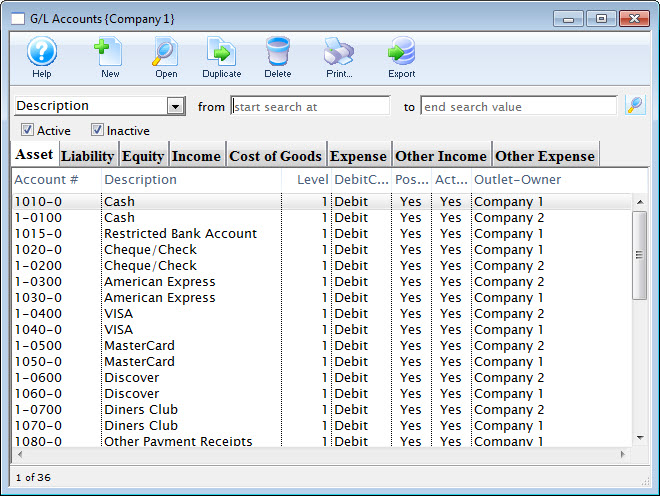

Sample Chart of Accounts

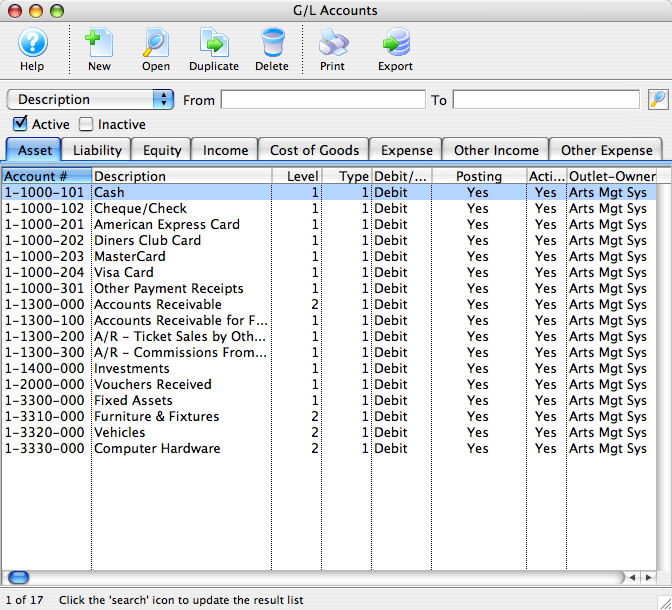

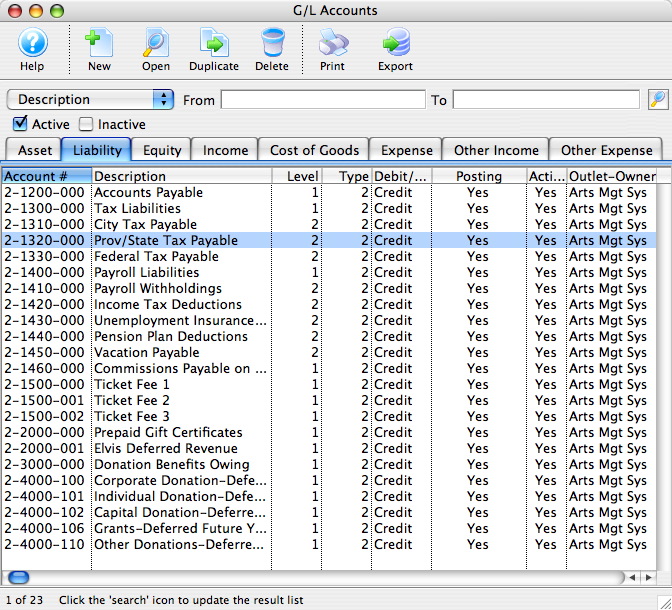

The number of General Ledger accounts setup depends on the detail required and should reflect the business practices for the organization. To view account details simply double click an account.

Assets

Liability

Equity

Income

The four digit account number has been used to indicate the play code and the three digit feature code has been used to indicate the type of revenue. However, the three digit feature code could be used to indicate the play code and the four digit account number could be used to indicate the type of revenue.

The refund accounts have a debit balance.

Cost of Goods

Expense

Other Income

Other Expense

Adding Accounts to the General Ledger

Using the chart of accounts you can edit and add accounts to the GL.

- Open the Chart of Accounts Window.

Click Here to Learn how to access this window.

Click Here for a detailed description of this window.

Clicking on the different tabs will show the accounts setup for corresponding type.

- Select the account type by clicking the corresponding tab.

- Either click the New

button or right click and select add.

button or right click and select add.

The GL Account Detail Window opens.

Click Here for a detailed description of this window.

- Enter the account number and description in the top fields.

- Choose the correct account attributes.

Set the account as active if you wish to use it immediately.

- Once you have entered all the information click the Save

button and close the G/L Account Detail window.

button and close the G/L Account Detail window.

The new account will be added to the Chart of Accounts.