Fixing EOD Imbalance created because of Year End Rollover

|

Please read carefully and fully understand the ramifications of this one time only feature before using it.

It will make a historical balancing entry and should only be used if your most recent Year End Rollover resulted in an End of Day imbalance. |

|

DO NOT use this process to correct and EOD imbalance in the middle of the year. It is only to be used if the EOD imbalance occurred directly after running Year End Rollover |

Why did I get an imbalance in the first place?

This issue should only arise if you:

- just ran your year end rollover -and-

- discovered that your first end of day after that was out of balance,

- The year end rollover process was redesigned in Mid 2018 to make it a much faster process. It now rebuilds annual GL totals from all past GL entries. The added benefit is that year-end-rollover to be rerun (please contact the support team to if you need this).

- Your venue has been using TM for a long time (most likely from version 6 era decades ago) -AND-

- A consolidated GL entry might not have been created properly - so this will address this missing data in the database

When NOT to use this process

DO NOT use this process if you just discovered and EOD imbalance in the middle of the year. Instead use the Troubleshooting End of Day imbalance checklist to find your issue.

Otherwise, we suggest to contact the support team to get assistance and to verify that the process should be used.

Who can do this process?

Only a master user or outlet administrator can make this entry. It is not visible for any other user.

What is the process and rules surrounding this feature

If you discover an EOD imbalance after your first end of day after year end:

- Try all troubleshootin processes as you would normally should end of day be out of balance.

- If you still cannot find the imbalance, contact the support team

If, after involving the support team and the End of Day Imbalance is still present, then:

- Force the EOD to balance by creating the adjusting entry under your normal user account.

- Do not post this force balanced GL entry.

If you posted it in TM, the next step you take depends on whether you passed this GL entry to your accounting system:

- If you just posted in Theatre Manager and have not created your end of day G/L report to pass to your accounting staff, please unpost this GL entry immediately.

- If you have already passed the Adjusting entry to your accounting staff, then:

- reverse the GL entry in TM.

- Create another force balance Adjusting Entry. The totals should be the same as the one you just reversed.

- Log in as the Master User or Outlet Administrator for your outlet. The feature is not available to anybody else

-

Find the EOD adjustment GL entry you just created. It must not be posted and it must be of type 'GL'

Find the EOD adjustment GL entry you just created. It must not be posted and it must be of type 'GL'

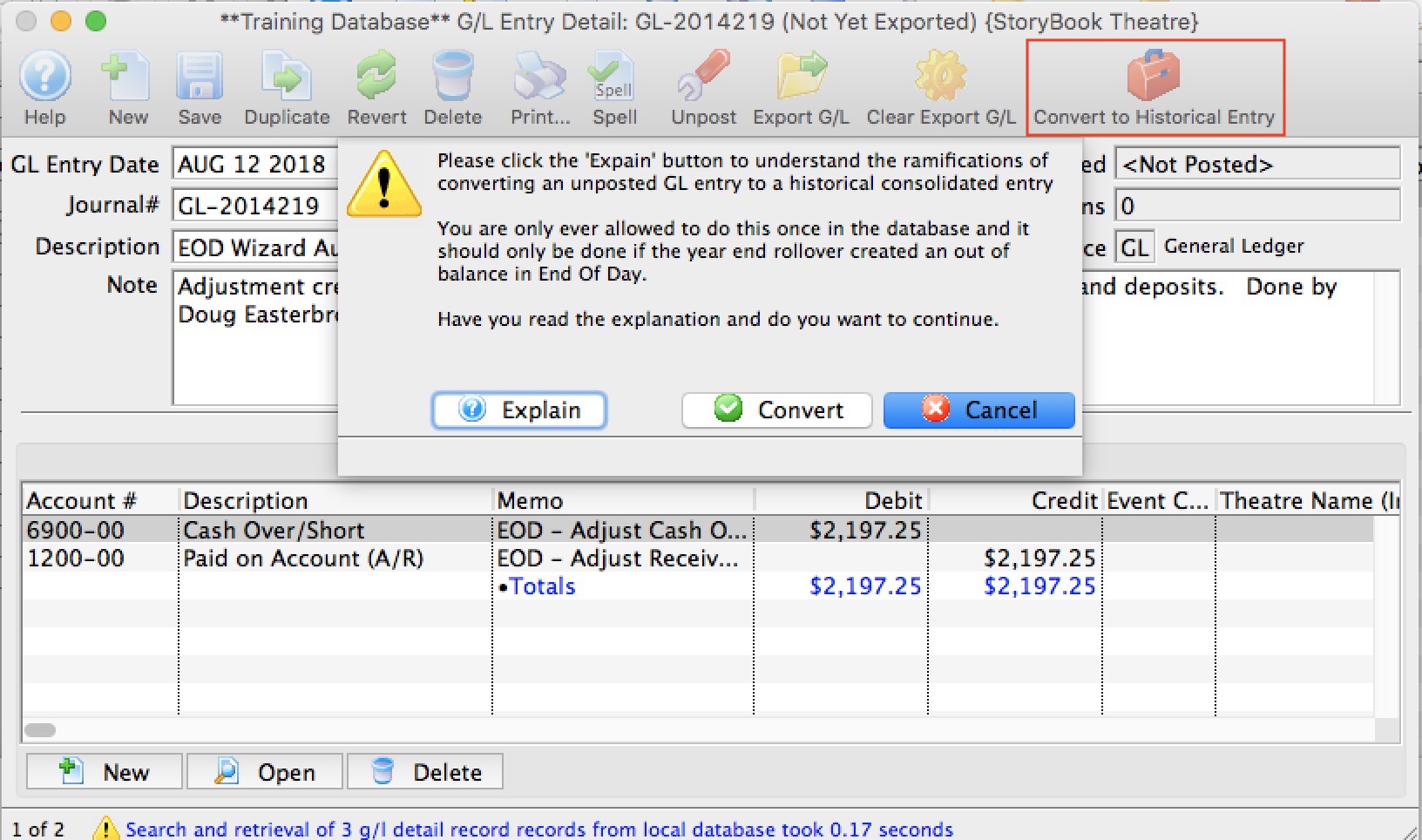

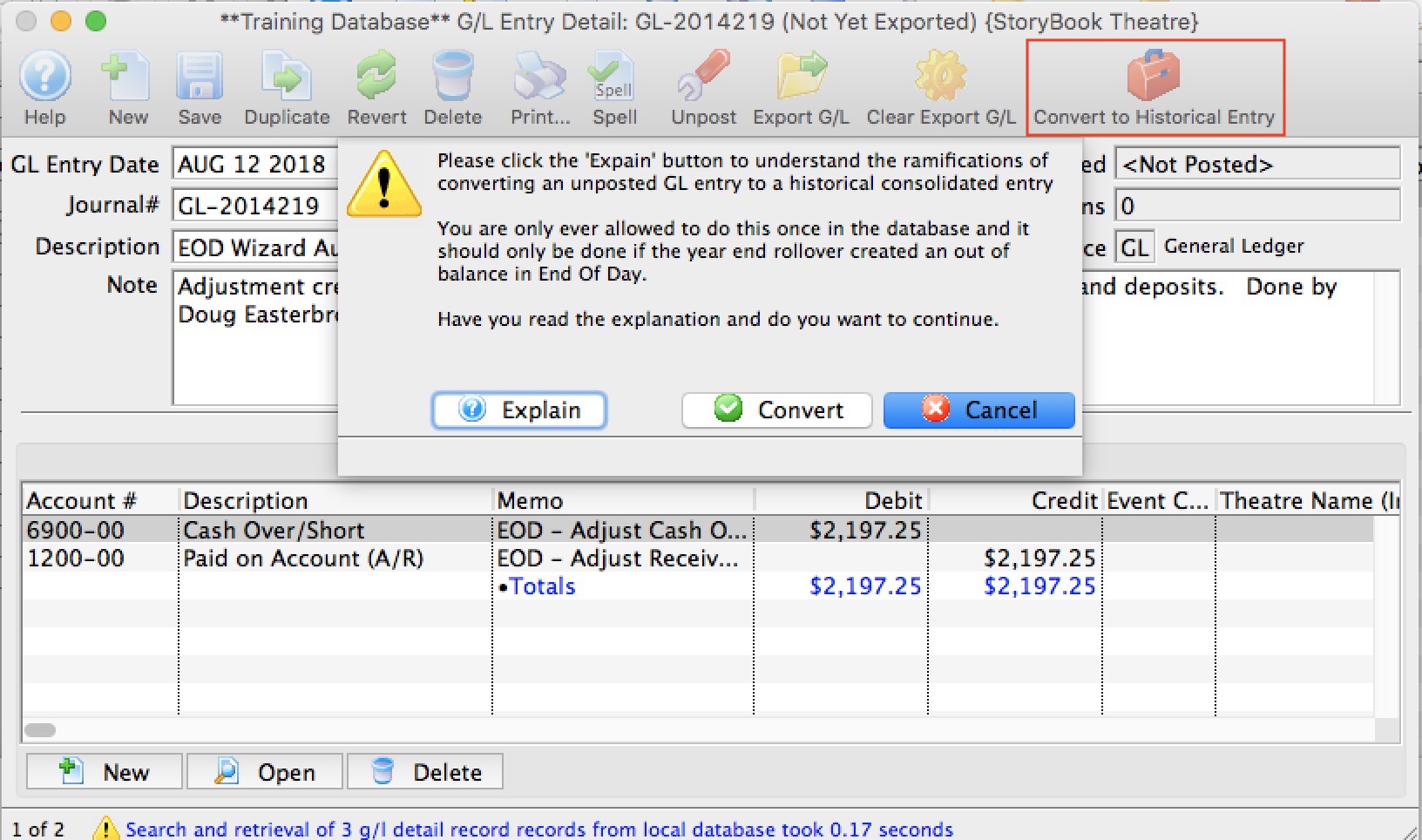

- Click the Convert to Historical Entry

- Confirm that you want to convert this GL entry to historical by clicking the Convert button.

What does this process do

Converting a GL Entry to historical will:

- Change the source of the GL entry from GL to CO, meaning that it is a historical consolidation accounting entry from years ago.

- Add text to the notes indicating that that it was a force balance after year end rollover

- Change the date on the GL entry to 10 years ago to the date

- Mark the entry as posted so that it will not be posted again

- It will back date the posting date to 10 years ago. This means it will not show up in today's end of day.

- Mark the GL entry as exported - meaning it cannot be exported and passed to your accounting system if you have automated that process

- Adds a flag to the GL entry to mark this a a special GL entry. Once you have created this one-time GL entry for a Year End Rollover problem, you will never be able to create another one.

- Theatre Manager will then rebuild the account balances as if it were ding year end rollover to bring TM's A/R account into balance. Since this GL entry is now 10 years old, it make it appear as if the force balance never occurred.