Sage 50 Accounting

Sage 50 Accounting Software

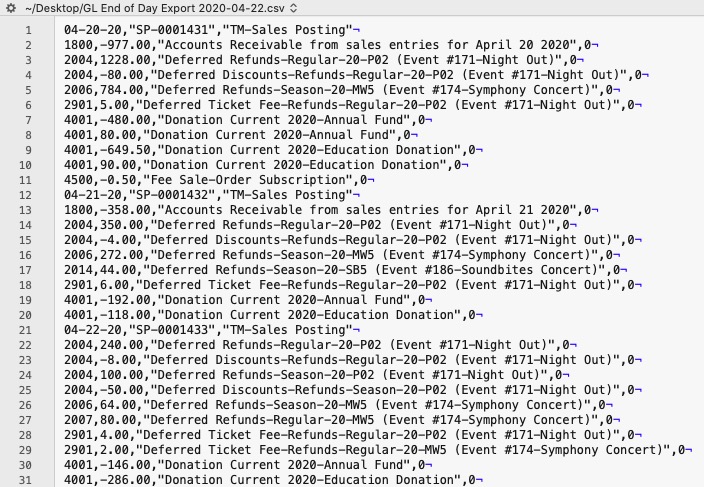

The Sage 50 Accounting Software exports each detail line within the G/L Entry. Each deposit and sales posting are exported as their own separate entry within the export file. This allows an exact match of each G/L Entry to crossover into Sage 50 Accounting (line for line).

Parts of the Sage 50 Export File - Header Record

| Date | The Journal Entry Date. The date is always in MM-DD-YY format. |

| Source | Journal Entry Reference Number. The Journal Number from the sales posting or deposit posting will be exported. The field is limited to 13 characters. |

| Comment | Journal Entry Description.

|

Parts of the Sage 50 Export File - Detail Record

| Account Number | Theatere Manager's External Account value (name or number) will be used to create the export file. |

| Amount | The debit amount (represented as a positive value) or the credit amount (represented as a negative value) of the transaction. |

| Comment | The memo text associated to this particular G/L transaction from Theatre Manager's journal entry. The field is limited to 160 characters. |

| Project Allocation | The number of project allocation lines that follow this GL Account transation. The value will default to "0" as Theatre Manager will not be allocating the Amount for each Account Number. |

Common Questions

|

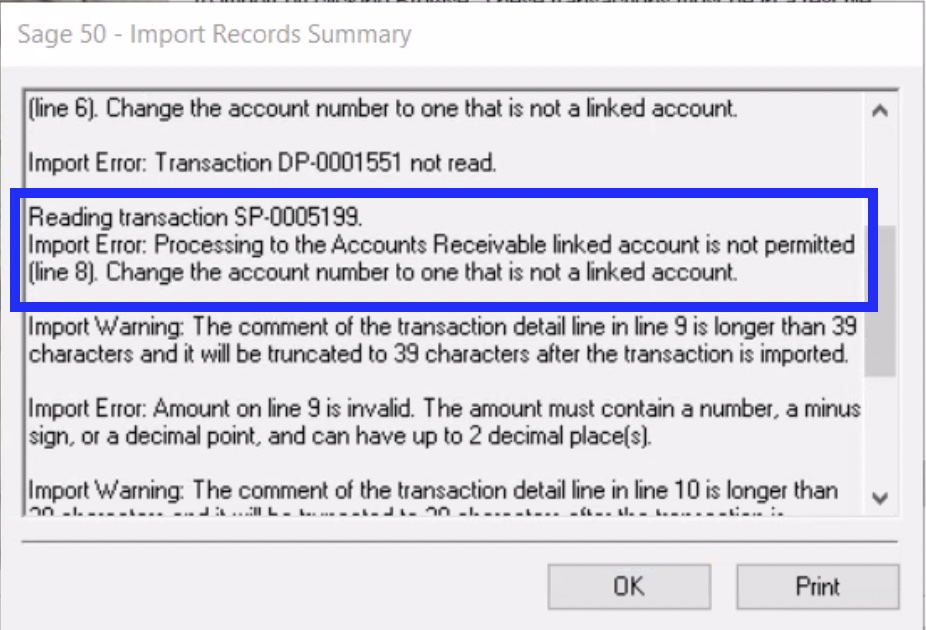

Sage 50 has a requirement its data import routines are unable to import transactions that affect the linked Accounts Receivable, Accounts Payable, Payroll Advances, Vacation Payable, or Inventory accounts if you have finished entering history.

The solution is as simple as avoiding any postings directly to the Sage 50 account types of Accounts Receivable and Accounts Payable. Rather, create a separate standard (non A/R) asset account and call it (for example) "A/R for Theatre Manager" and separate liability account and call it (for example) "A/P for Theatre Manager" and reference those account numbers in Theatre Manager's External Account value (name or number) used to create the export file. This way when you import the amount into Sage 50, it will go against the standard Asset / Liability account and not against the built-in accounts receivable account in Sage 50. When you want to see the details that make up the "A/R for Theatre Manager" or the "A/P for Theatre Manager" account, go directly to Theatre Manager for the details, rather than Sage 50. To recap, create a standard Asset and standard Liability account to use to post to in Sage 50. |