Managing or cleaning up your receivables

- there are multiple orders for same patron with offsetting balances (eg total debits minus total credits = zero), so the patron does not owe you anything

- the order is so old as to be uncollectible - and you need to write off the balance

- there is a small balance in the order (generally a fee charged or waived) that puts the order out of balance and just needs fixed without bothering the patron

- this is a true receivable - and the patron still owes you for product

- this is a true over charge and you should be refunding money to the patron or converting it to a donation

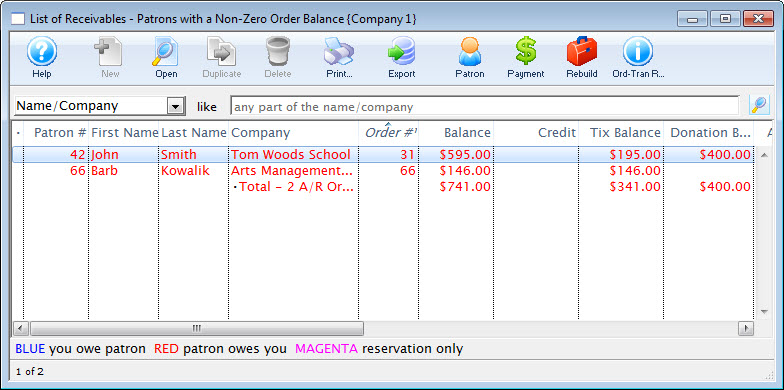

Identifying Receivables

All you need to do is:

- Look at the receivables listing using Accounting->Receivables->Receivables Listing -or-

- Look at the same data in the A/R Balance Tab in the end of day process, if that is more convenient.

- View the data on the Receviables - Based on Order Balances report which can be printed from the reports button under the Orders and Payments category , the Reports Tab on end of day, or right clicking on either of the two windows above and printing the A/R report.

Same patron with multiple offsetting orders

Offsetting orders are where the patron owes you money for an order and you owe them money for another order. This often occurs where the box office staff refunded the tickets (but not the payment) and then bought more tickets on a separate order instead of adding tickets to an existing order. In general, the patrons owes you $xx.xx and you owe them $xx.xx. Cleaning up these orders and removing them from the receivables list is as simple as:

- highlighting the appropriate orders from the list belonging to the same patron # -and-

- Applying one payment to multiple orders - using the cash payment method.

Orders that are so old as to be uncollectible

During followup training, we often see some orders that have been around for a decade or more with an unpaid balance. Unless it really is a long term receivable for a major donation, it should be written it off so that it does not clutter up the receivables listing. A messy receivables listing may lead you to ignore a true balance owing.

The steps to do this are:

- If you do not already have a payment method for write-off or uncollectible debt, you will need to make one in the Payment Methods code table. Once you have a write-off payment method set up with the correct account approved by finance -then-

- Select the order with the uncollectible amount (on any list that shows orders)

- Right click on the order from the list

- select Apply a payment to open the payment window

- use the write off payment method

Orders with a small balance

Order with a small balance generally have a recognizable amount in the order balance. For example, it might be $3.00 and that could represent an order or mailing fee that should have been charged -- or was possibly waived. If that is the case, then it is suggested to alter the order and fix the missing data by adding or removing the fee.

Use this approach when you want to ensure the correct money goes through to the appropriate order fee G/L.

To do this.

- Double click on the order.

- click on the fee button

- add or remove the fee to bring the order into balance

- Close the order window

This is a true receivable

Do nothing to the order - leave it as is.

Unless, it s for a receivable way in the future such as a group ticket sale or donation for months in the future. It is a good idea to set the expected payment date in the Contractual Notes tab in the payment.

Setting the order as a future receivable helps as it changes the age of the receivable so that it is always current, until the future date arrives. In effect, you are telling TM that you don't want to bother with this receivable for a while - and it clearly identifies it.

This is a true overcharge and you should be refunding money

If the balance indicates that you owe the patron money (and its large enough), there are three suggestions.

- If the patron wants to carry a balance, you could convert the balance to a dollar value gift certificate which you could call Store Credit. This could allow them to redeem their credit online (if it is set up that way).

- Double click on the order to open it

- Click on the gift certificate button

- Add a gift certificate to the order

- If the balance is larger, you could approach the patron and turn it into a donation

- Double click on the order to open it

- Click on the donation button

- Add a donation to the order

- You could leave the balance as is or add something to it like a fee as per above

- of, if you do need to refund the money, you can create a refund payment