Creating a Commission

You will need at least one commission table to allow for cross Outlet sales. The value of the commission table may be $0, if you are not charging a commission between Outlets, however you will still need the setup for Theatre Manager to function correctly.

To Create a new Commission Table, you perform the following steps:

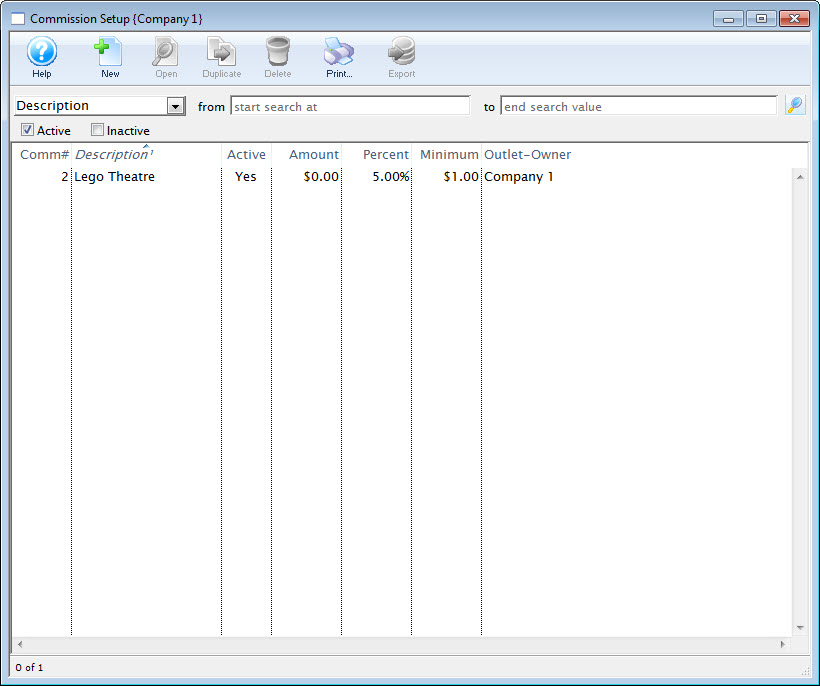

- Open the Commission Setup window.

Click here for more information on opening the Commission List.

- Click the New

button.

button.

The Commission Detail window Opens.

- Enter the Name of the commission.

- Enter data in the Commission Calculation tab.

Click here, for more information on the Coommission Calculation tab.

- Click the

tab.

tab.

- Enter data in the Edits and Accounting tab.

Click here, for more information on the Edits and Accounting tab.

- Click the Save

button.

button.

The new Commission is now created.

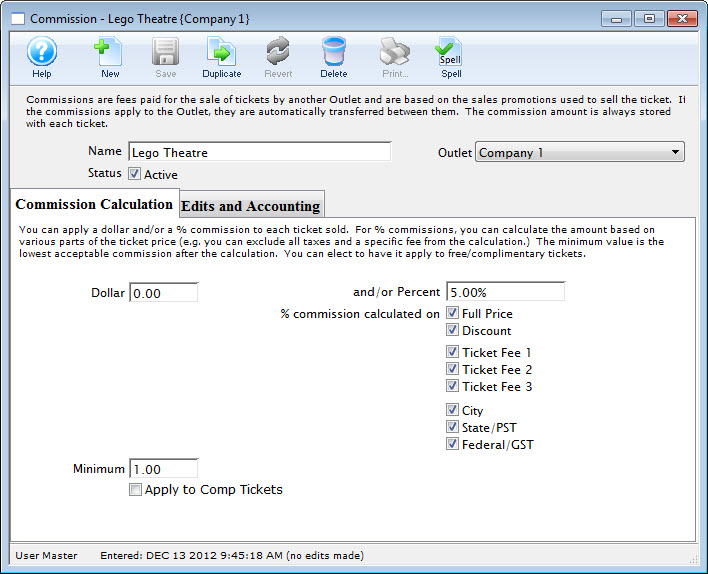

Commission Calculation Tab

The Commission Calculation tab is where you set the parameters of how the commission is charged, including dollar amounts and/or percentages of the ticket value, and if the commission is applied before or after discounts and markups (Sales Promotions) and fees.

Parts of the Commission Calculation Tab

| Dollar | Dollar value of the commission earned. Can be combined with a percentage. | ||

| Minimum | Minimum value of commission to be applied to any ticket sale. | ||

| Apply to Comp Tickets | Commission applies to issued comp tickets.

|

||

| And/or Percent | Percentage of the commission earned. Can be combined with the dollar value. | ||

% commission calculation on: | |||

| Full Price | Commission is charged on the base ticket price before discounts, markups or fees. | ||

| Discount | Commission is charged once the discount or markup has effected the base ticket price. | ||

| Ticket Fee 1 | Commission is charged on the ticket price including the value of ticket fee 1. | ||

| Ticket Fee 2 | Commission is charged on the ticket price including the value of ticket fee 2. | ||

| Ticket Fee 3 | Commission is charged on the ticket price including the value of ticket fee 3. | ||

| City | Commission is charged once the city tax is applied. | ||

| State/PST | Commission is charged once the state/PST is applied. | ||

| Federal/GST | Commission is charged once the Federal/GST is applied. | ||

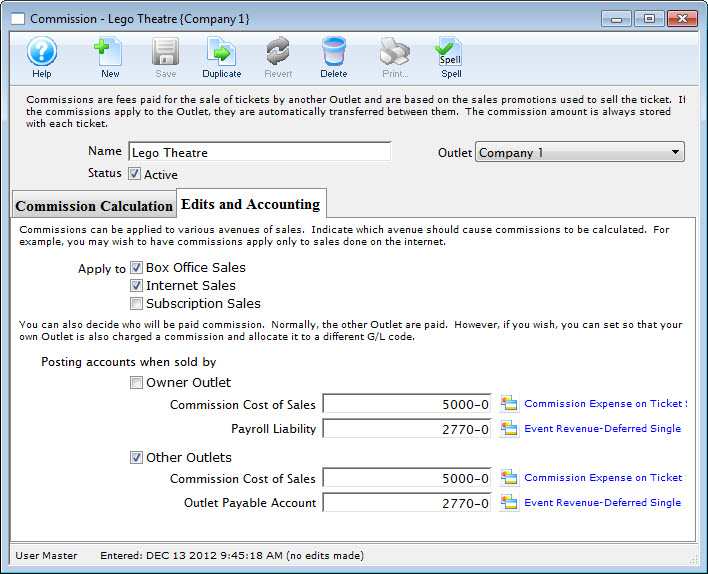

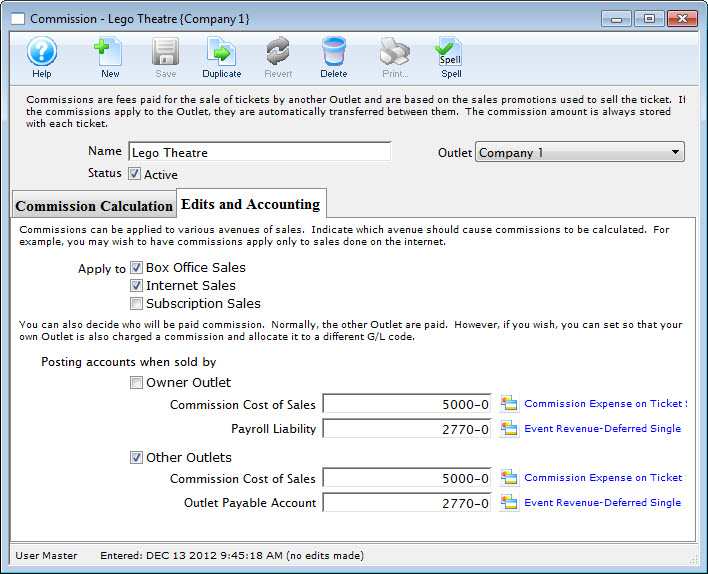

Edits and Accounting Tab

The Edits and Accounting tab allows you to set parameters regarding the avenue of sale (Box Office, Internet, Season Subscriptions), and the General Ledger (GL) accounts where commission funds will be placed for each Outlet. These GL accounts must be set up in Default Posting Accounts to be used here. Click here, for more information on Default Posting Accounts.

Parts of the Edits and Accounting Tab

Apply to: |

|||

| Box Office Sales | Commission is received when the Outlet sells tickets via the box office. | ||

| Internet Sales | Commission is received when tickets are sold through the Outlet's internet sales. | ||

| Subscription Sales | Commission is received when season tickets are purchased through the Outlet.

|

||

Posting accounts when sold by: |

|||

| Owner Outlet | When checked commission fees will be allocated to the designated general ledger accounts when sold by the Outlet responsible for the event. This allows you to assign commissions payable for internal telemarketing staff. | ||

| Commission Cost of Sales | General ledger account the value of commissions will be posted to when sold by the Outlet responsible for the event. | ||

| Payroll Liability | General ledger account the payroll fees are to be posted to when tickets are sold by the Outlet responsible for the event. | ||

| Other Outlets | When checked commission fees will be allocated to the general ledger accounts when sold by an Outlet other then the owner of the event. | ||

| Commission Cost of Sales | General ledger account the value of commissions will be posted to when sold by an Outlet other then the owner of the event. | ||

| Outlet Payable Account | General ledger account the payroll fees are to be posted to when tickets are sold by an Outlet other then the owner of the the event. | ||