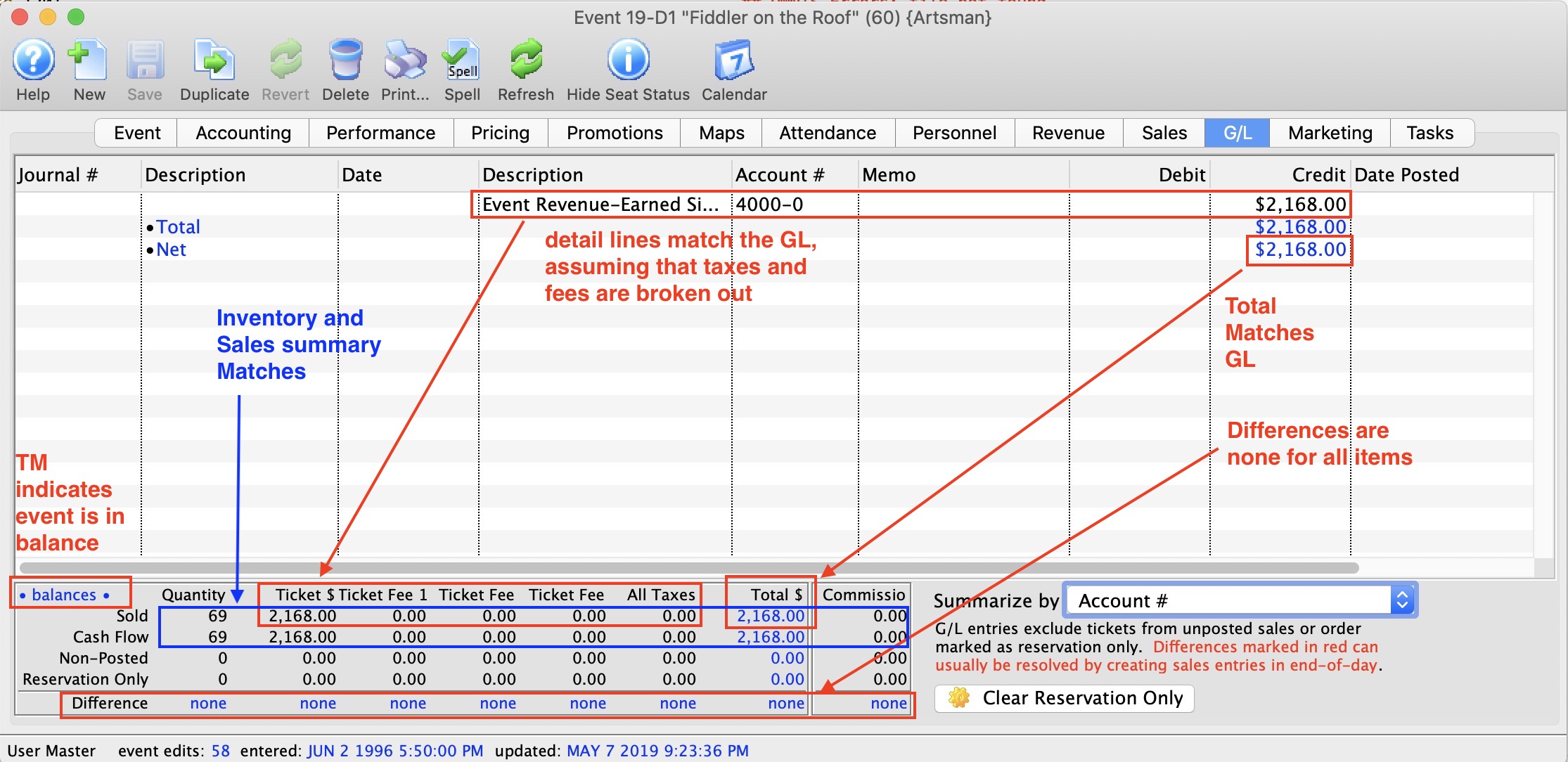

Balancing after event completed

We recommend doing a few things once an event is over:

- Making sure that all parts of the event balance (tickets, compared to daily sales, compared to the general ledger

- Verifying that all revenue is in the proper earned accounts (and nothing is left in the deferred accounts if you were doing deferred revenue accounting -and-

- If everything balances, then close the event to prevent further ticket sales, exchanges or refunds from occurring to the event. If you subsequently find that you want to refund a ticket, you can reopen the event, then close it again after the refund is done.

|

The best time to balance the event is after the last performance has occurred and after you have done end of day to move all deferred revenue into earned. |

Verifying that Ticket Inventory and Financials Transactions Balance

The quickest check is that the word • balances • appears at the top left of the lower part fo the screen. If it says this, it usually means that all the other aspects below balance.

The meaning of the various lines ay the bottom are:

- Sold Line is the number of sold tickets from inventory. This is the absolute revenue, most correct values for sales to the event:

- Quantity The number of tickets sold from inventory

- Ticket $ This is the values of tickets sold, less discounts - or the net sales

- Ticket Fee 1 The total amount of ticket fee 1 for all the sold tickets. If you have named ticket fee 1 something specific, it's name will appear here.

- Ticket Fee 2 The total amount of ticket fee 2 for all the sold tickets.

- Ticket Fee 3 The total amount of ticket fee 3 for all the sold tickets.

- All Taxes The value of all the taxes attached to the sold tickets (local, provincial/state, Federal

- Total $ The total amount of money taken in for all the tickets. it is the ticket$ + ticket fees + all taxes

- Commission If you set up paying commission for tickets, this will be the total commission associated with the sold tickets. it is NOT part of the Total sales, since it would be an expense payable.

- Cash Flow Line: is the summary of all ticket transactions created from tickets sales.. The values is each column should be exactly the same as the values from the Sold Line form Inventory. If it is not, then some transactions have not been created from end of day, or somebody was playing with transactions and may have duplcaited them. Contact Arts Management support if you find they do not match

- Non-Posted: Transactions may exist, but may not have been posited during end if day. If there are values in this row, it means you should complete end of day. before attenpting to balance.

- Reservation Only: Some tickets may have been marked as reservation only - which is an ancient practice of selling tickets before they were paid for and not telling accounting. if you see any number is this row and you are done with the event, then

- Click the Clear Reservation Only button to unmark the tickets and make then enter the accounting system

- Run your end of day. All data in the 'non-posted' and 'Reservation only' rows should move up into the sold and cash flow lines

- Run a report to find receivables for the event to see if some tickets should be returned because they were school or group sales that did not attend and wouldn't be paying

- Start your comparison again

|

If end of day has been run and the values at the bottom of this area all say the difference is 'none', then ticket inventory and transactions balance.

That reinforces the confidence in the GL entries discussed below. |

|

If some lines are not quite right, there are two things that might find the difference:

|

Verifying that Ticket Inventory and GL are in the right place

Once you haven 'none' in the difference row, we need to see what the make sure that the state of the accounts that post to the GL are correct.

-

If using deferred revenue accounting, you should see some of your deferred accounts in the upper list. However, they should all be zero. If they are not zero, then there are two possible problems:

- You might still have the last performance to roll over. If you roll over each performance on the day after, then you may need to wait till the day after the event and do end of day. That should fix it. if it does not, then its probably the next problem

- or, somebody changed the deferred accounts in the middle of the sales for this event. That's usually obvious one of your deferred accounts is negative and matches the amount in your other deferred accounts. That means you need to make a GL entry to put things in the right place (in theatre manager)

- The earned accounts should match up to the Sold inventory line. If you have separated out ticket revenue, taxes and fees into separate G/Ls, then the numbers will be obvious. if you didn't. you might have to add up a few numbers to see that they are right.

- Finally, the Net Credit should be the same as the 'Total $' in the 'Sold' column