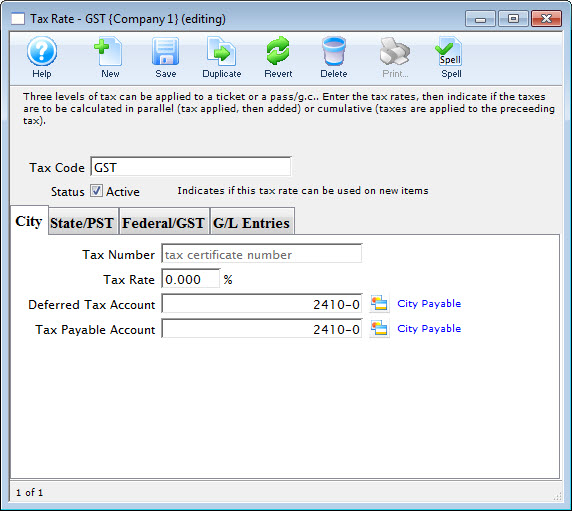

Tax Rate Detail Window

Parts of the Tax Rate Detail Window

Inserts new Tax Rate. For more information on inserting tax rates click here. |

|

Saves changes made to the selected Tax Rate. |

|

Duplicates the selected Tax Rate. |

|

Undoes changes to the last saved point. |

|

Deletes the selected Tax Rate. For more information on deleting tax rates click here. |

|

Tax Code |

Name of the tax rate. |

Setup for the City or Municipal portion of the tax code. For more information on this tab, click here. |

|

Setup for the State or Provincial portion of the tax code. For more information on this tab, click here. |

|

Setup for the Federal or GST portion of the tax code. For more information on this tab, click here. |

|

List of the G/L journal entries for each instance of the tax code's usage. For more information on this tab, click here. |

|

The names for the City, State/PST, and Federal/GST tabs can be set in Setup > System Preferences > Appearance Tab to reflect whichever is the suitable option. Our examples here show both names - but depending on your location, you may set them appropriately. More information can be found here. |

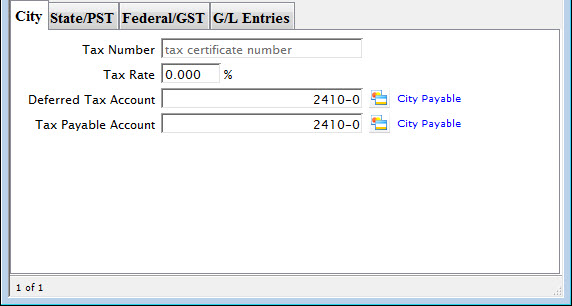

City Tax Tab

Parts of the City Tax Tab

Tax Number |

Your organization's tax ID number for City taxes. |

Tax Rate |

The percentage of the tax rate that applies to City taxes. |

Deferred Tax Account |

Deferral account number from your Chart of Accounts for the City tax. For more information about the Chart of Accounts in Theatre Manager, click here. |

Tax Payable Account |

Liability account from your Chart of Accounts for the City tax. |

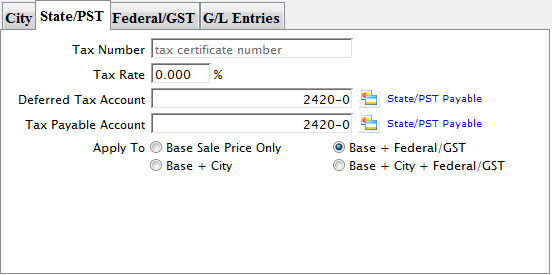

State/PST Tax Tab

Parts of the State/PST Tax Tab

Tax Number |

Your organization's tax ID number. |

Tax Rate |

The percentage of the tax rate that applies to State or PST taxes. |

Deferred Tax Account |

Deferral account number from your Chart of Accounts for the State/PST tax. For more information about the Chart of Accounts in Theatre Manager, click here. |

Tax Payable Account |

Liability account from your Chart of Accounts for the State/PST tax. |

Apply To Base Sale Price Only |

When selected, this option will apply the percentage set above to only the base price of the ticket or pass (parallel method). |

Apply To Base + City |

When selected, this option will apply the percentage set above to the base price plus the City price set in the City Tab(cumulative method). |

Apply To Base + Federal/GST |

When selected, this option will apply the percentage set above to the base price plus the Federal/GST tax set in the Federal/GST Tab(cumulative method). |

Apply To Base + City + Federal/GST |

When selected, this option will apply the percentage set above to the base price plus the City tax and plus the Federal/GST tax (cumulative method). |

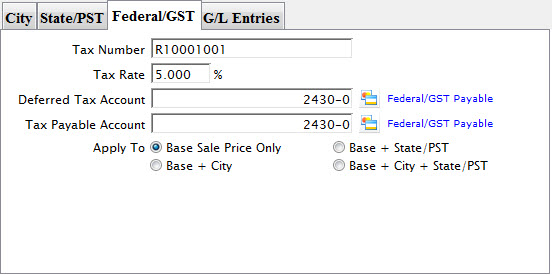

Federal/GST Tax Tab

Parts of the Federal/GST Tax Tab

Tax Number |

Your organization's tax ID number. |

Tax Rate |

The percentage of the tax rate that applies to Federal or GST taxes. |

Deferred Tax Account |

Deferral account number from your Chart of Accounts for the Federal/GST tax. For more information about the Chart of Accounts in Theatre Manager, click here. |

Tax Payable Account |

Liability account from your Chart of Accounts for the Federal/GST tax. |

Apply To Base Sale Price Only |

When selected, this option will apply the percentage set above to only the base price of the ticket or pass (parallel method). |

Apply To Base + City |

When selected, this option will apply the percentage set above to the base price plus the City price set in the City Tab(cumulative method). |

Apply To Base + State/PST |

When selected, this option will apply the percentage set above to the base price plus the State/PST tax set in the State/PST Tab(cumulative method). |

Apply To Base + City + State/PST |

When selected, this option will apply the percentage set above to the base price plus the City tax and plus the State/PST tax (cumulative method). |

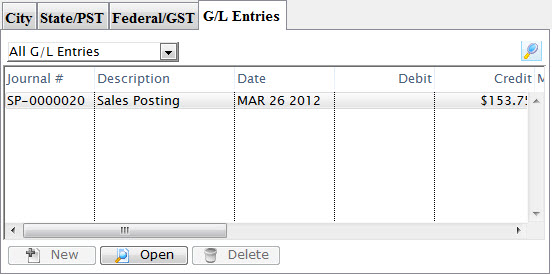

G/L Entries Tab

Parts of the G/L Entries Tab

View Selection Drop-down (set to All G/L Entries in the example) |

Choose which entries you want to see in the list and then click the |

Journal # |

The unique Journal # for the entry |

Description |

The type of journal entry it is (ie. Sales Posting) |

Date |

The posting date for the entry. |

Debit |

The Debit amount of the entry (if applicable) |

Credit |

The Credit amount for the entry. |

Not available. |

|

Opens the selected entry for viewing/editing. |

|

Not available. |

lookup button to view the list. The default is All G/L Entries.

lookup button to view the list. The default is All G/L Entries.