Inserting a Tax Code

To add a Tax Code, you perform the following steps:;

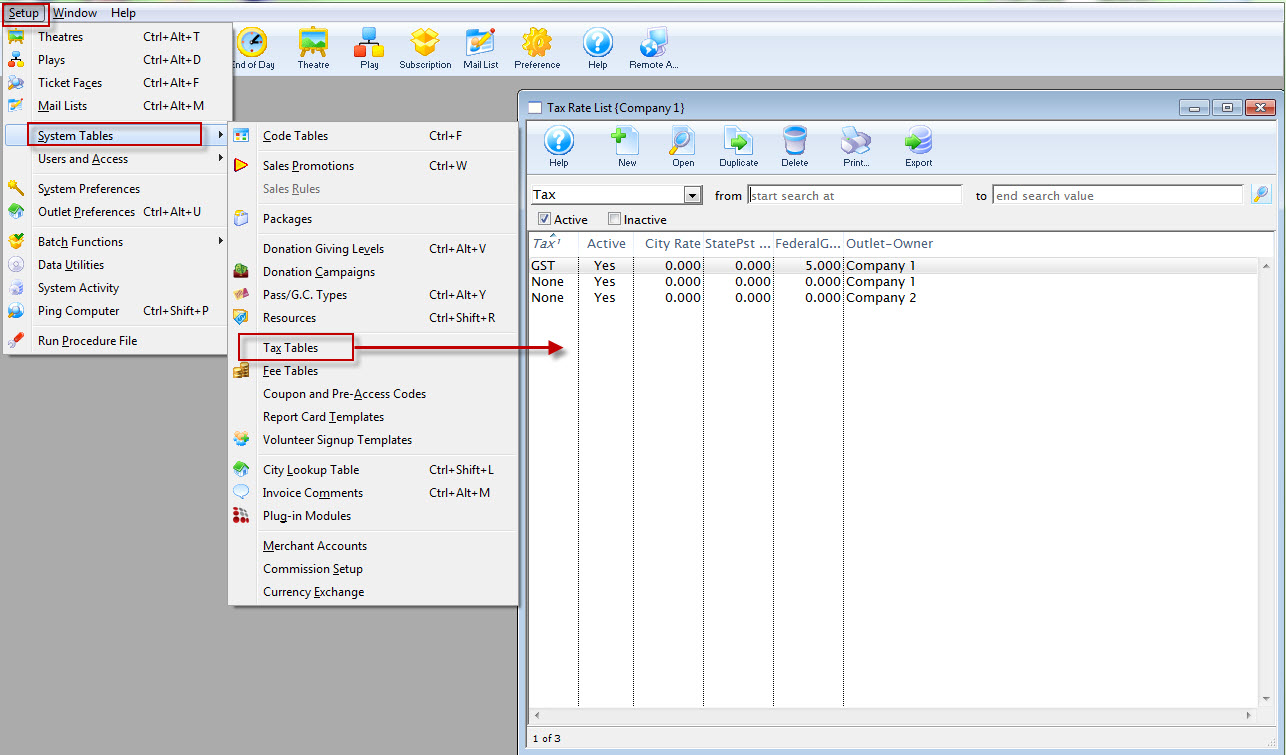

- Click Setup >> System Tables >> Tax Tables.

The Tax Rate List window opens.

Click here for a description of this window.

- Click the New

button.

button.

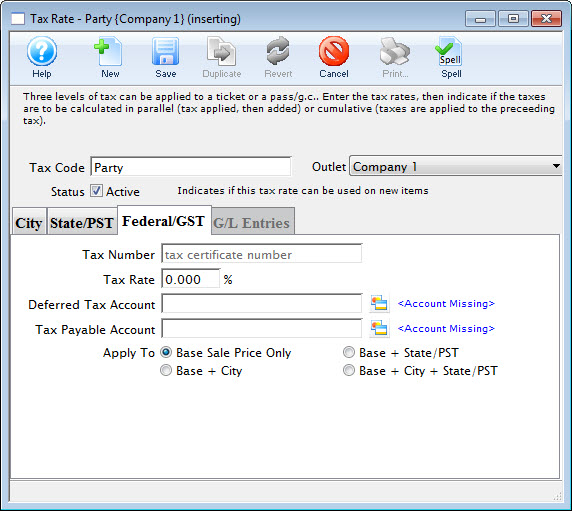

The Tax Rate Detail Window opens.

Click Here for a detailed description of this window.

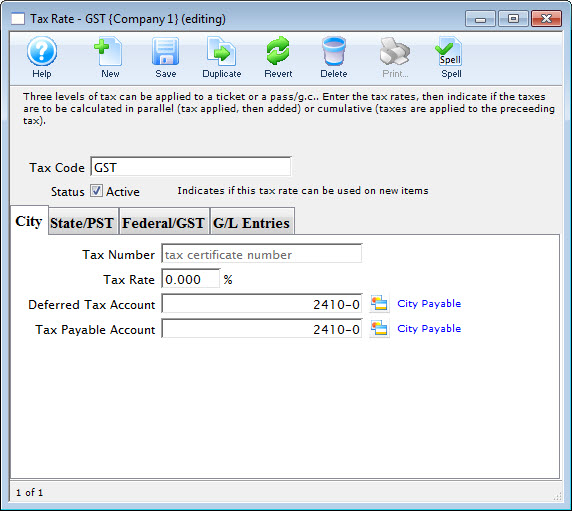

- Enter the Tax Code name.

This is the name that will be displayed anywhere the Tax Code can be selected.

- Enter the tax number in the City tab.

- Enter the Tax Rate percentage that applies to City taxes for the overall rate.

- Click the Lookup

button next to the Deferred Tax Account field.

button next to the Deferred Tax Account field.

The Chart of Accounts Lookup window opens.

- Select the G/L account the city tax should be applied to.

- Click the Lookup

button next to the Tax Payable Account field.

button next to the Tax Payable Account field.

The Chart of Accounts Lookup window opens.

- Select the G/L account the city tax should be applied to.

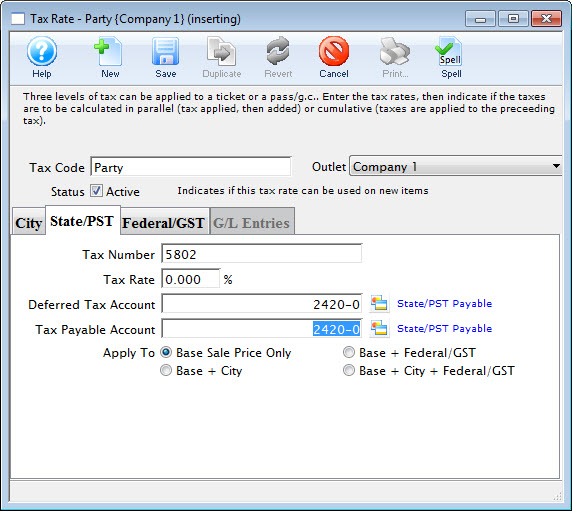

- Select the State/PST

tab.

tab.

Click here for more information on the State/PST Tax Tab.

- Enter the tax number in the State/PST tab.

- Enter the Tax Rate percentage.

- Click the Lookup

button next to the Deferred Tax Account field.

button next to the Deferred Tax Account field.

The Chart of Accounts Lookup window opens.

- Select the G/L account the State tax should be applied to.

- Click the Lookup

button next to the Tax Payable Account field.

button next to the Tax Payable Account field.

The Chart of Accounts Lookup window opens.

- Select the G/L account the State tax should be applied to.

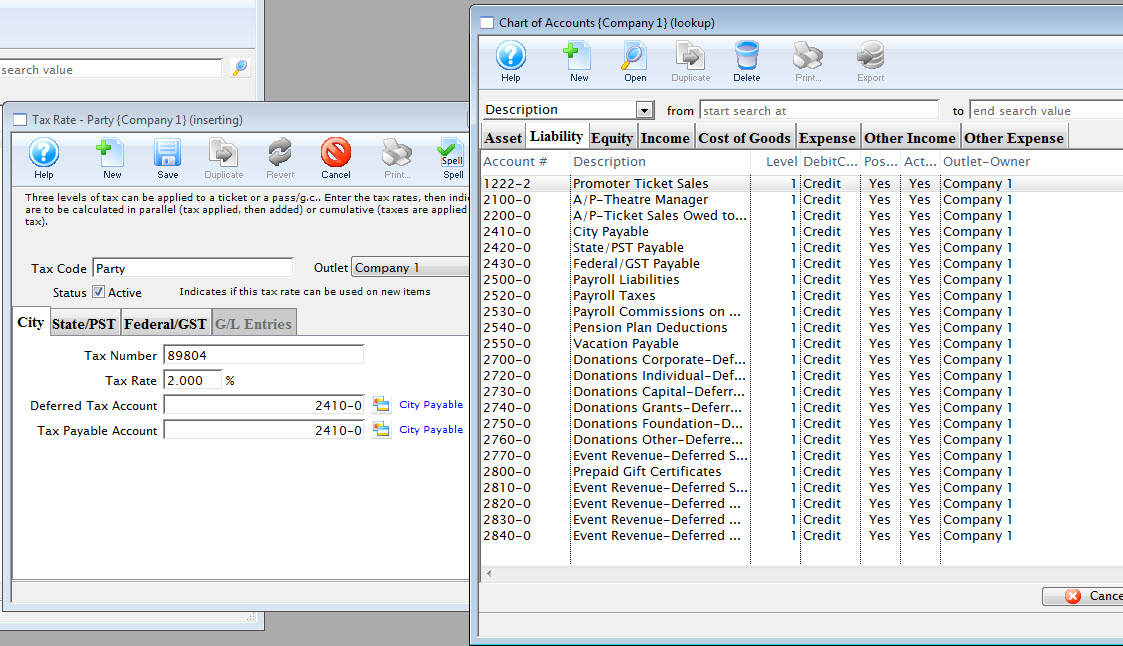

- Select the Federal/GST

tab.

tab.

Click here for more information on the Federal Tax Tab.

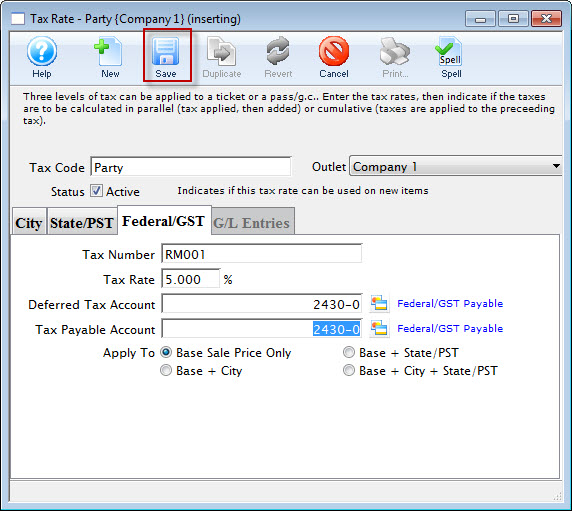

- Enter the tax number in the Federal/GST tab.

- Enter the Tax Rate percentage.

- Click the Lookup

button next to the Deferred Tax Account field.

button next to the Deferred Tax Account field.

The Chart of Accounts Lookup window opens.

- Select the G/L account the Federal tax should be applied to.

- Click the Lookup

button next to the Tax Payable Account field.

button next to the Tax Payable Account field.

The Chart of Accounts Lookup window opens.

- Select the G/L account the Federal tax should be applied to.

- Click the Save

button to save the tax.

button to save the tax.